Abengoa

Abengoa

Annual Report 2011

- Corporate Social Responsibility

- Report preparation process

- Principles regarding quality of information disclosed under the GRI

In preparing this report, every effort was made to present the information in accordance with GRI principles pertaining to quality.

Balance

The report should reflect positive and negative aspects to enable a reasonable assessment of company performance.

The CSRR 2011 provides data on positive and improvable aspects of performance, as well as the objectives facing the company. The process of identifying material issues (see section on materiality) also contributes to compliance in this regard. In addition, the opinion of the IPESD, published in the report, allows the reader to gain an understanding of the perception of company performance held by society at large.

Comparability

The contents and data published in the report enable the reader to analyze evolution and change, and the report therefore includes a comparison with the previous year and also indicates any changes in calculation methods.

Accuracy

This report underwent a verification process to ensure the accuracy of quantitative data and confirm evidence and appropriate context for the qualitative information.

Timeliness

The report must be published on time according to a regular schedule so that stakeholders may make decisions based on the right information.

Abengoa has been publishing its Corporate Social Responsibility Report annually since 2003. These reports are available from the company’s website.

Clarity

Information should be presented in a way that is understandable and accessible. Abengoa prepares a digital edition of the report, which can be accessed by the public via the following address: annualreport.abengoa.com. The company also distributes the report to its shareholders, main customers, the media, responsible investment institutions, and other interested parties.

The CSRR was prepared by taking into account stakeholder recommendations on how the information should be presented. This report also includes a glossary of technical terms and terms with which readers may be less familiar.

Reliability

The information and procedures followed in preparing the report must be gathered, recorded, compiled, analyzed and presented in such a way as to hold up to examination and guarantee the quality and materiality of the information disclosed.

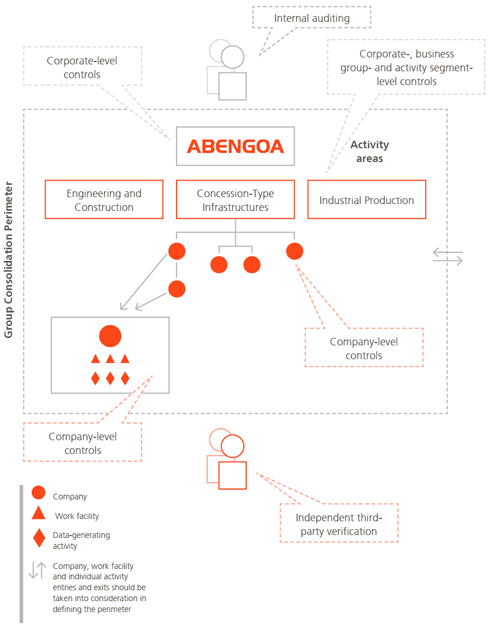

The procedure for consolidating information adhered to the following scheme:

© 2011 Abengoa. All rights reserved