Abengoa

Abengoa

Annual Report 2011

- Corporate Social Responsibility

- Profile of Abengoa

- Contribution to society

The economic value distributed by Abengoa is boosted with the payment of taxes, employee benefits and also the voluntary contributions that the company makes to social and cultural projects.

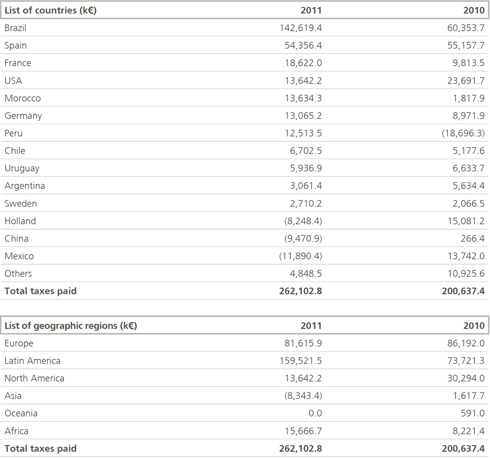

Taxes account for a large part of the economic contribution that Abengoa makes to society. This indicator is variable by nature and ultimately depends on the legal system in effect and how the company has performed.

Of the total amount of taxes paid in 2011, 36.67 % is attributed to Profit Tax. Likewise, 28.24 % corresponds to employee personal income and with holding tax applied and paid by the different group companies to the Tax Administration Agency, and 26.05 % is attributed to other taxes, fees and levies primarly involving taxes paid in Brazil.

Breakdown of taxes paid, by country:

© 2011 Abengoa. All rights reserved