Abengoa

Abengoa

Annual Report 2010

- Corporate Social Responsibility Report

- Transparency and Rigor in Management

- Corporate Governance

Transparency and Rigor in Management

In line with its commitment to transparency, managerial control and ethical conduct when engaging in business, Abengoa has opted for the following structure within its governing bodies1:

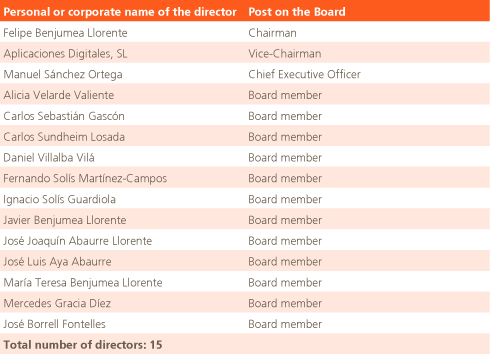

Board of Directors

Abengoa has devised its own Internal Regulations of the Board of Directors, which complement the provisions of the Spanish Public Limited Companies Act (“Ley de Sociedades Anónimas”) and the Regulations of the Companies House (“Reglamento del Registro Mercantil”) by subjecting the actions of directors to a raft of rules on accepted conduct, guided by the principles of business ethics and geared towards upholding the overriding priority of corporate interests, while ensuring the transparency of Board resolutions.

Membership of the Board of Directors is currently as follows:

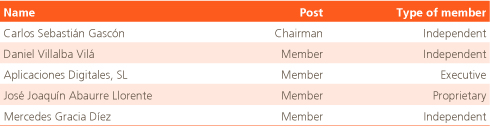

Audit Committee

As with the Board of Directors, and given the need for control mechanisms to function properly and efficiently, the Audit Committee is also subject to its own internal regulations.

Membership of the Audit Committee is currently as follows:

The Audit Committee primarily comprises non-executive members, thereby meeting the requirements prescribed by applicable law and regulations on good governance and, in particular, the Financial System Reform Act (Ley de Reforma del Sistema Financiero). Likewise, and in accordance with Article 2 of the Internal Regulations, the office of committee chairman must be vested in a non-executive member.

The duties and powers of the Audit Committee are as follows:

- Report on the annual accounts and half-yearly and quarterly financial statements that must be submitted to regulatory bodies and market watchdogs, with reference paid to the internal control systems, the control mechanisms to monitor implementation and compliance through internal audit procedures and, where appropriate, the accounting principles applied.

- Inform the Board of Directors of any changes in accounting principles, balance sheet risk and off-balance sheet risk.

- To report to the General Shareholders’ Meeting on those matters requested by shareholders that fall within its remit.

- To propose the appointment of the external financial auditors to the Board of Directors for subsequent referral on to the General Shareholders’ Meeting.

- To oversee the internal audit services. The Committee will have full access to the internal audit and will report during the process of selecting, appointing, renewing and removing the head auditor. It will likewise control the remuneration of the head auditor, and must provide information on the budget of the internal audit department.

- To be fully aware of the financial information reporting process and the company’s internal control systems.

- To liaise with the external audit firm in order to receive information on any matters that could jeopardize the latter’s independence and any others related to the financial auditing process.

- To summon those Board members it deems appropriate to its meetings, so that they may report to the extent that the Audit Committee deems fit.

- To prepare an annual report on the activities of the Audit Committee, which must be included as part of the annual accounts for the year in question.

- Supervise the preparation process and monitor the integrity of the financial information on the company and, if applicable, the group, and to verify compliance with regulatory requirements, the appropriate boundaries of the scope of consolidation and the correct application of accounting principles.

- Periodically review the internal control and risk management systems so that the principal risks are appropriately identified, managed and reported.

- Supervise the internal audit function, through full access to it, and monitor and supervise its independence and effectiveness; propose the selection, appointment, re-election and removal of the manager of the internal audit service; propose the budget for this service and set the remuneration for its manager; receive periodic information on its activities and the budget for the service; and verify that senior management takes into account the conclusions and recommendations of its reports.

- Establish and oversee a mechanism whereby employees may confidentially and anonymously, if deemed necessary, communicate potential irregularities, especially financial and accounting, which they may detect within the company, proposing the appropriate corrective measures and approvals to the Board of Directors.

- Submit proposals regarding the selection, appointment, re-appointment and replacement of the external auditor to the Board of Directors, including the terms of engagement.

- Receive regular information on the audit plan and the results of its implementation from the external auditor, and verify that the senior management takes the recommendations thereof into account.

- Safeguard the independence of the external auditor.

- Ensure that the group auditor is tasked with conducting the audits for the individual group companies.

- Oversee and resolve conflicts of interest. Pursuant to the Regulations of the Board of Directors, Board members are under the obligation to inform the Board of any situation of potential conflict, in advance, and to abstain until the committee has reached a decision.

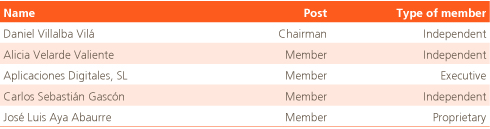

Appointments and Remuneration Committee

The structure and members of the Appointments and Remuneration Committee are as follows:

The Appointments and Remuneration Committee comprises a majority of non-executive directors, thereby fulfilling the requirements prescribed by the Spanish Financial System Reform Law (Ley de Reforma del Sistema Financiero). Likewise, the position of committee chairman must be vested in a non-executive director, in accordance with that envisaged in Article 2 of the company’s Internal Regulations.

The Appointments and Remuneration Committee is entrusted with the following functions and responsibilities:

- To report to the Board of Directors on appointments, reappointments, removals and the remuneration of the Board and its component posts, as well as on the general policy of remunerations and incentives for positions on the Board and within the senior management.

- To report, in advance, on all proposals that the Board of Directors presents to the General Shareholders’ Meeting regarding the appointment or removal of directors, even in cases of co-optation by the Board itself; to verify, on an annual basis, continuing compliance with the requirements governing appointments of directors and the nature or type thereof, all of this being information to be included in the Annual Report. The Appointments Committee will ensure that, when vacancies are filled, the selection procedures do not suffer from implicit bias that hinders the selection of female directors and that women who meet the required profile are included among the potential candidates.

- To prepare an annual report on the activities of the Appointments and Remuneration Committee, which must be included in the Management Report.

Strategy Committee

This committee comprises the Executive Chairman, the Executive Vice-Chairman, the heads of the various business units, the Head of Organization, Quality and Budgets, the Technical Secretary, the General Secretary for Sustainability, the Head of Human Resources, the Financial Director, the Head of Investor Relations, the Head of Institutional Relations, the Head of Corporate Strategy and Development and the General Secretary.

This particular committee, which meets monthly, is governed by the Internal Code of Conduct in Stock Markets, which contains a raft of obligations to protect information and uphold the duty of secrecy, while addressing preliminary decision-making and publication aspects of relevant corporate actions, establishing for such purpose the pertinent procedures for ensuring internal and external confidentiality, recording ownership of shares and dealing with transactions involving securities and conflicts of interest.

Good Governance Practices

Following a favorable report from the committee, the Board of Directors sitting in plenary session will approve the following company policies and strategies:

- Investment and financing policy.

- Defining how the business units are structured.

- Corporate governance policy.

- Corporate social responsibility policy.

- Strategic or Business Plan, as well as the budget and management targets.

- Remuneration and performance assessment policy for senior executives.

- Risk control and management policy, as well as the periodic monitoring of internal information and control systems.

- Dividends and treasury stock policy and, in particular, limits thereto.

1 For further information on the structure and categories of director and governing bodies, please consult the Annual Corporate Governance Report