Abengoa

Abengoa

Annual Report 2012

- Legal and Economic-Financial Information

- Consolidated management report

- Corporate governance

10.- Corporate governance

10.1 Shareholding structure of the company

Significant shareholdings

The share capital of Abengoa, S.A. is represented by book entries, managed by Iberclear (Sociedad de Gestión de los Sistemas de Registro, Compensación y Liquidación de Valores, S. A.) and totals 90,143,938.83 Euros represented by 538,062,690 shares fully subscribed and paid up, with two separate classes:

- 85,619,507 Class A shares with a nominal value of 1 Euro each, all in the same class and series, each of which grants the holder a total of 100 voting rights and which are the Class A shares of the company (“Class A Shares”).

- 452,443,183 Class B shares with a nominal value of 0.01 Euros each, all in the same class and series, each of which grants one (1) voting right (“Class B Shares” and, together with Class A shares, “Shares with Voting Rights”).

The shares will be represented by book entries and governed by the Stock Market Act and other applicable provisions.

Abengoa’s Class A and B shares are officially listed for trading on the Madrid and Barcelona Stock Exchanges and on the Spanish Stock Exchange Interconnection System (Continuous Market). Class A shares have been listed since 29 November 1996 and Class B shares since 25 October 2012. The company files mandatory financial information on a quarterly and half-yearly basis.

In December 2007, Abengoa was selected by the Technical Advisory Committee of Ibex35 to enter and form part of this index as of 2 January 2008, a listing which has been maintained throughout 2009. The inclusion was the result of the periodic review of listed companies carried out by the Committee takes into consideration the company’s capitalization as well as the volume of trading and the sector in which the company operates. At present the Class A shares are listed on the continuous market while the Class B shares are part of the Ibex 35. The Ibex 35 is the most followed index in Spain by national and international investors. The index groups together the 35 companies with the highest market capitalization and volume of trading.

The latest changes to the share capital were agreed by the Extraordinary General Shareholders' Meeting of Abengoa held at second call on 30 September 2012, which approved a capital increase against reserves via the issue of Class B shares with a par value of €4,304,501.52, issuing a total of 430,450,152 Class B shares, charged against voluntary reserves in a ratio of four (4) newly issued Class B shares for every one Class A or Class B share in circulation. For the purposes of this capital increase, four Class B shares were freely assigned to Abengoa’s shareholders that held at least one Class A or Class B share in circulation. At the same time, the company applied to list all the issued Class B shares for trading, which were officially listed on the Madrid and Barcelona stock exchanges and on the Spanish Stock Exchange Interconnection System (SIBE, continuous market) on 25 October 2012. This transaction ensured a minimum level of liquidity for Class A shares, while also guaranteeing sufficient liquidity for Class B shares as a means for obtaining capital at the lowest possible cost, which was the ultimate objective. The Extraordinary General Shareholders' Meeting therefore approved a voluntary conversion right of Class A shares into Class B shares, which will end on 31 December 2017.

As a result of the execution of the voluntary conversion right established in Article 8 of the bylaws, Abengoa carried out a capital reduction of six hundred and thirty thousand eight hundred and seventy nine euros and forty eight cents (€630,879.48) on 22 January 2013, by reducing the par value of six hundred and thirty seven thousand two hundred and fifty two (637,252) Class A shares from one (1) euro per share to one euro cent (€0.01) per share, by creating a restricted reserve in accordance with Article 335 c) of the Spanish Capital Companies Act (LSC).

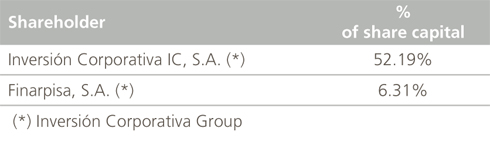

Since the capital is represented by book entry, there is no shareholder register other than the disclosures of significant shareholdings and the X-25 list, which was last requested for the Extraordinary Shareholders’ Meeting held on 30 September 2012. According to the information received, the situation is as follows:

The number of registered shareholders according to the list provided by Iberclear (Sociedad de Gestión de los Sistemas de Registro, Compensación y Liquidación de Valores, S.A.) on 26 September 2012 for the Extraordinary General Shareholders' Meeting held on 30 September 2012, is 15,375 shareholders.

With regards to shareholder agreements, Inversión Corporativa IC and Finarpisa, as shareholders of Abengoa, signed an agreement on 10 October 2011, within the framework of the investment agreement between Abengoa and First Reserve Corporation, effective from 7 November 2011, which governs the exercising of their respective rights to vote in Abengoa's general meetings in relation with the proposal, appointment, ratification, reelection or substitution of a director to represent First Reserve Corporation.

Under the terms of this agreement, Inversión Corporativa I.C., S.A. and Finarpisa, S.A. jointly and severally agree to:

(i) Vote in favor of the following, through their respective shareholder directors on Abengoa’s Board of Directors:

(a) to appoint as a member of the Board, the candidate proposed to be the investor's nominee pursuant to the co-optation procedure established under the Spanish Capital Companies Act; and

(b) the proposal to recommend to Abengoa's shareholders the election of any replacement director as the investor’snominee on the Board of Directors, at Abengoa's next general shareholders’ meeting;

(ii) Vote, at the corresponding general shareholders’ meeting of Abengoa, in favor of the appointment of the candidate proposed by the investor to be its nominee on the Board of Directors; and

(iii) while the investor or any of its related companies owns Abengoa Class B shares or any other instrument that is convertible or exchangeable into Abengoa Class B shares issued in accordance with the investment agreement or any other document of the transaction, they may not propose nor request the Board of Directors to recommend to shareholders any modification to the company’s bylaws that adversely affects the equality of rights of Class B shares and Class A shares in relation to the distribution of dividends or similar distributions as established in bylaws.

On 27 August 2012, Inversión Corporativa, I.C., S.A. and its subsidiary Finarpisa, S.A. modified the shareholder agreement with the Abengoa shareholder, First Reserve Corporation (which was subject to disclosure to the CNMV by means of the significant event filed on 9 November 2011).

The modification consisted of the following: To the current obligation that, ”while FRC or any of its related companies own Abengoa Class B shares or any other instrument that is convertible or exchangeable for Abengoa Class B shares issued in accordance with the investment agreement or any other document of the transaction, they may not propose nor request the Board of Directors to recommend to shareholders any modification to the company’s bylaws that adversely affects the equal rights of Class B and Class A shares in relation to the distribution of dividends or similar distributions as established in the bylaws", it was added that, “If this proposal were to be presented by another shareholder, or by the Board of Directors, they will vote against it”.

On 27 August 2012, Abengoa, S.A. signed a shareholder agreement with its significant shareholder, Inversión Corporativa, I.C., S.A., through which the latter agreed to the following, directly or indirectly through its subsidiary Finarpisa S.A.:

(i) To vote in favor of the resolutions relating to points 2, 3, 4, 5, 6 and 7 of the agenda of the General Shareholders' Meeting held on 30 September 2012, provided that it had previously verified that these resolutions were approved by the majority of Class A shareholders, excluding Inversión Corporativa;

(ii) Not to exercise its voting rights, except up to a maximum of 55.93% in cases in which, as a result of the exercising of the conversion right of Class A shares into Class B shares that is expected to be included in the company’s bylaws, the total percentage of voting rights that it holds of the total voting rights of the company is increased;

(iii) That the percentage represented at any given time by the number of shares with the right to vote that it owns (whether Class A or Class B shares) of the total shares of the company, will not at any time be less than one quarter of the percentage represented by the voting rights that these shares attribute to Inversión Corporativa, in relation to the total voting rights of the company (in other words, that its voting rights cannot exceed four times its financial rights); and that, should this occur, it shall dispose of sufficient Class A shares or shall convert them into Class B shares in order to maintain this ratio.

In accordance with Article 19 and following articles of the company’s bylaws, there are no limits on the voting rights of shareholders in relation to the number of shares which they hold. The right to attend the shareholders’ meeting is limited

however to those shareholders that hold 375 Class A or Class B shares. Meeting quorum: 25% of the share capital at first call. Any percentage at second call. These are the same percentages as the Capital Companies Act. In those cases stated in Article 194 of the Act (hereinafter the “LSC”), the quorum is as stated in the Act.

Resolution quorum: by a simple majority vote by those present or represented at the meeting. In those cases stated in Article 194 of the LSC, the quorum is as stated in the Act.

Shareholders’ rights: Shareholders have the right to information, in accordance with the applicable legislation; the right to receive the documentation related to the shareholders’ meeting, free of charge; the right to vote in proportion to their shareholding, with no maximum limit; the right to attend shareholders’ meetings if they hold a minimum of 375 shares; financial rights (to dividends, as and when paid, and their share of company’s reserves); the right to representation and delegation, grouping and the right to undertake legal actions attributable to shareholders. The Extraordinary General Shareholders' Meeting approved a series of amendments to the bylaws in order to ensure that the “rights of minority interests” are not infringed by the existence of two different share classes with different par values in which the lower nominal value of the Class B shares would make it more difficult to achieve the percentages of share capital required to exercise some of the voting and other non-financial rights. The General Meeting therefore agreed to amend Abengoa’s bylaws as explained below in order to ensure that all these rights can be exercised based on the number of shares and not the amount of share capital. These rights, such as the right to call a general meeting or to request a shareholder derivative action, require a certain percentage of the share capital to be held in nominal terms (in these cases, 5%).

Measures to promote shareholder participation: making the documentation related to the Shareholders’ Meeting available to shareholders free of charge, as well as publishing announcements of Shareholders’ Meetings on the company’s website. The option to grant a proxy vote or to vote on an absentee basis is possible by completing accredited attendance cards. In accordance with Article 539.2 of the Capital Companies Act, Abengoa has approved the Regulation on the Shareholders’ Electronic Forum in order to facilitate communication between shareholders regarding the calling and holding of each General Shareholders’ Meeting. Prior to each general meeting, shareholders may send:

- Proposals that they intend to submit as supplementary points to the agenda published in the notice of the general meeting.

- Requests to second these proposals.

- Initiatives to achieve the required percentage to exercise a minority right.

- Requests for voluntary representation.

The bylaws do not limit the maximum number of votes of an individual shareholder or include restrictions to make it more difficult to gain control of the company through the acquisition of shares.

Proposals of resolutions to be submitted to the Shareholders’ Meeting are published along with notice of the meeting on the websites of the company and the CNMV.

Points on the agenda that are significantly independent are voted upon separately by the Shareholders’ Meeting, so that voters may exercise their voting preferences separately especially when it concerns the appointment or ratification of directors or amendments to the bylaws.

The company allows votes cast by shareholders’ appointed financial representatives that are acting on behalf of more than one shareholder, to be split, so that they may vote in accordance with the instructions of each individual shareholder whom they represent.

There are currently no agreements in effect between the company and its directors, managers or employees that entitle them to severance pay or benefits if they resign or are wrongfully dismissed, or if the employment relationship comes to an end due to a public tender offer.

Treasury stock

At the Ordinary General Shareholders’ Meeting on 10 April 2011 it was agreed to authorize the Board of Directors to acquire the company’s treasury stock in the secondary market, directly or through subsidiaries or investee companies, up to the limit as stipulated in the current provisions, at a price of between six euros cents (0.06 Euros) and one hundred and sixty euros and 20 cents (120.60 Euros) per share, being able to do so during a period of 18 months as of the above date and subject to Article 134 and subsequent articles of the Capital Companies Act.

On 19 November 2007, the company entered into a liquidity agreement for Class A shares with Santander Investment Bolsa, S.V. On 8 January 2013, the company entered into a liquidity agreement for Class A shares with Santander Investment Bolsa, S.V., replacing the initial agreement, in compliance with the conditions established in CNMV Circular 3/2007 of 19 December. On 8 November 2012, the company entered into a liquidity agreement for Class B shares with Santander Investment Bolsa, S.V. in compliance with the conditions established in CNMV Circular 3/2007 of 19 December.

As of 31 December 2012, treasury stock totaled 14,681,667 shares, which represents 3.39% of the share capital of Abengoa, S.A. (2,913,435 shares in 2011), of which 2,939,135 are Class A shares and 11,742,532 are Class B shares. With regards to transactions carried out during the year, the amount of treasury stock purchased amounted to 8,201,391 Class A shares and 15,458,056 Class B shares, which represents 9.27% of the share capital of Abenoga, S.A. while treasury stock sold totaled 8,175,691 Class A shares and 3,715,524 Class B shares, equivalent to 4.66% of the share capital of Abengoa, S.A. with a net result of €961,000 recognized in equity of the parent company (decrease of €2,144,000 compared to 2011).

All the purchases and sales of the company’s treasury stock were carried out under the aforementioned liquidity agreements. In addition, the company bought back 30,700 Class A shares in relation to the management’s share purchase plan, in order to partially cancel it.

Details of the latest Shareholders’ Meetings

The Ordinary General Shareholders’ Meeting of Abengoa was held at second call on 1 April 2012, attended by shareholder representing 58,439,880 shares, equivalent to 64.474% of the share capital.

The following resolutions were passed:

One. Examine and, if applicable, approve the financial statements and the management report for 2011 of the company and of its consolidated group, as well as the management and remuneration of the Board of Directors during the same year. A total of 5,843,988,000 valid votes were cast in this resolution from 58,439,880 shares representing 64.474% of the share capital, of which 5,819,818,900 votes were in favor, 4,948,700 against and 19,220,400 abstentions.

Two. Examine and, if applicable, approve the proposal for the appropriation of earnings for 2011. A total of 5,843,988,000 valid votes were cast in this resolution from 58,439,880 shares representing 64.474% of the share capital, of which 5,681,303,400 votes were in favor, 2,625,600 against and 160,059,000 abstentions.

Three. Ratify, appoint and re-elect directors, as appropriate. In resolution three, paragraph 1, a total of 5,843,988,000 valid votes were cast from 58,439,880 shares representing 64.474% of the share capital, with 5,822,946,700 votes in favor, 20,930,000 against and 111,300 abstentions. In resolution three, paragraph 2, a total of 5,843,988,000 valid votes were cast from 58,439,880 shares representing 64.474% of the share capital, with 5,822,921,400 votes in favor, 20,955,300 against and 111,300 abstentions. In resolution three, paragraph 3, a total of 5,843,988,000 valid votes were cast from 58,439,880 shares representing 64.474% of the share capital, with 5,590,762,100 votes in favor, 253,114,600 against and 111,300 abstentions.

Four. Re-elect or appoint, as appropriate, the accounts auditor for the company and its consolidated group. A total of 5,843,988,000 valid votes were cast in this resolution from 58,439,880 shares representing 64.474% of the share capital, with 5,834,491,500 votes in favor, 9,412,000 against and 84,500 abstentions.

Five. Modification of the regulations of the General Shareholders’ Meeting (adaptation to Law 25/2011). A total of 5,843,988,000 valid votes were cast in resolution five from 58,439,880 shares representing 64.474% of the share capital, with 5,843,988,000 votes in favor, 0 against and 0 abstentions.

Six. Special report issued on the directors’ remuneration policy submitted for consultation purposes to the Shareholders’ General Meeting. A total of 5,843,988,000 valid votes were cast in resolution six from 58,439,880 shares representing 64.474% of the share capital, with 5,567,391,400 votes in favor, 276,596,600 against and 0 abstentions.

Seven. Grant the Board of Directors the authority to increase the share capital by issuing new shares of any of the A and/or B and/or C classes, pursuant to Article 297.1 b), within the limits of the law, with the specific power to impose the exclusion of pre-emptive right in accordance with Article 506 of the Capital Companies Act, voiding the amount that remained from previous authorizations granted by the General Shareholders’ Meeting. Granting the Board of Directors and each of its members the authority to establish the conditions of the capital increase, to take all the actions deemed necessary for the execution thereof, to re-write the relevant articles of the bylaws to adapt them to the new amount of the share capital and to execute those public or private documents that may be necessary to implement the increase. To apply to the competent national and foreign authorities to admit the new shares to trade on any stock market. A total of 5,843,988,000 valid votes were cast in resolution seven from 58,439,880 shares representing 64.474% of the share capital, with 5,560,571,000 votes in favor, 283,416,600 against and 400 abstentions.

Eight. Grant the Board of Directors the authority to issue debentures or other similar fixed income or equity securities that may be simple or guaranteed, convertible and non-convertible into shares, with the specific power to impose the exclusion of pre-emptive rights in accordance with Article 511 of the Capital Companies Act, directly or through Group companies, in accordance with the prevailing laws, and voiding the amounts that remained from previous empowerments granted by the General Shareholders’ Meeting. A total of 5,843,988,000 valid votes were cast in resolution eight from 58,439,880 shares representing 64.474% of the share capital, with 5,568,786,700 votes in favor, 244,132,600 against and 31,068,700 abstentions.

Nine. Grant the Board of Directors the authority to acquire treasury stock in the secondary market, directly or through group companies, pursuant to current legislation, voiding all previous authorizations granted by the General Shareholders’ Meeting for such purposes. A total of 5,843,988,000 valid votes were cast in resolution nine from 58,439,880 shares representing 64.474% of the share capital, with 5,596,874,600 votes in favor, 228,495,400 against and 18,618,000 abstentions.

Ten. Grant the Board of Directors the authority to interpret, rectify, execute, formalize and register the adopted resolutions. A total of 5,843,988,000 valid votes were issued in resolution ten from 58,439,880 shares representing 64.474% of the share capital, with 5,843,748,000 votes in favor, 240,000 against and 0 abstentions.

The meeting of the Extraordinary General Assembly of Shareholders of Abengoa was held at second call on 30 September 2012, attended by shareholder representing 89,090,315 shares, equivalent to 79.565% of the share capital.

Pursuant to the bylaws of Abengoa, S.A. and to Article 293 of the Capital Companies Act, the approval of the resolutions outlined in points Three to Seven of the agenda required, in addition to voting by all the shareholders present and represented at the Meeting, the separate voting of the Class A and the Class B shareholders. At the same time, Class A shareholders voted on points Five and Six of the agenda with the participation of the shareholders present and represented with the exception of the shareholders of Inversión Corporativa IC, S.A. and its subsidiary, Finarpisa S.A. who state that they would only vote in favor of the proposals of the Board of Directors in the separate voting of Class A shareholders once it had been verified that the majority of the rest of the attending shareholders voted in favor of the proposals submitted by the Board of Directors. The proposals of the resolutions under points Three to Seven on the agenda are closely interrelated so that these resolutions could only be approved and effective if the preceding resolutions were approved. This system of separate voting (which was disclosed to the CNMV on 1 October 2012) was used to approve all the proposed resolutions, which were the following:

One. Grant the Board of Directors the authority for a period of one (1) year, to issue debentures or other fixed income securities or warrants that may be converted into Class B shares, once or on several occasions, up to a maximum amount of one billion (€1,000M) Euros, notwithstanding the granting of powers approved by the General Meeting on 1 April 2012, in accordance with Article 319 of the regulation of the mercantile registry and the general guidelines on issuing debentures. Grant the authority to set the criteria for determining the bases and formats of the conversion, exchange or exercise of the power to increase the share capital in the amount deemed necessary to meet the corresponding requests for conversion or exercise, specifically granting the Board the power to exclude the pre-emptive subscription rights of shareholders, in accordance with Article 511 of the Capital Companies Act and all other applicable rules and regulations

Two. Ensure that the Class A and the Class B shares and the convertible debentures that the company issued or my issue are admitted for trading on the Stock Exchanges of Madrid and Barcelona, as well as on the Stock Exchanges in the USA. Grant the Board of Directors the authority to do everything necessary for that purpose, including any actions, declarations and procedures with the competent authorities to ensure that the shares or debentures, represented by ADS, if appropriate, are admitted for trading.

Three. Modifications of Articles 21, 23, 24, 28, 31 and 33 of the bylaws to enable certain shareholder rights to be exercised based on the number of shares that a shareholder may hold.

3.1. Modification of Article 21 of the bylaws to reflect that shareholders must possess three hundred and seventy-five (375) shares, whether Class A or Class B shares or a combination of both, to be permitted to attend General Shareholders’ Meetings.

3.2. Modification of Article 23 of the bylaws so that shareholders are entitled to request the publication of a supplement to the notice of a General Shareholders’ Meeting to include one or more points on the agenda and to submit proposals for resolutions on issues already included or that should be included in the agenda of the called Meeting on the basis of the number of shares held.

3.3. Modification of Article 24 of the bylaws so that the following may be permitted: (i) that based on the number of shares possessed, shareholders with one percent of the shares with voting rights may request the presence of a notary public to take the minutes of the General Meeting; (ii) that shareholders with five percent of the shares with voting rights may request that a General Meeting is called to decide on a shareholder derivative action to be brought against the directors or to take a shareholder derivative action without the agreement of the General Meeting or to take the action against it.

3.4. Modification of Article 28 of the bylaws so that the Board of Directors of the company may call General Shareholders’ Meeting at the request of shareholders representing five percent of the company's shares with voting rights.

3.5. Modification of Article 31 of the bylaws so that the Board of Directors of the company may decide to postpone the General Shareholders’ Meeting at the request of shareholders representing five percent of the company's shares with voting rights.

3.6. Modification of Article 33 of the bylaws so that the Board of Directors of the company may suspend the right to information as envisaged in Article 197 of the Capital Companies Act at the request of shareholders representing less than twenty-five percent of the company's shares with voting rights.

Four. Modification of Article 8 of the bylaws for the purpose of anticipating the possibility of increasing the share capital using reserves by issuing a single class of shares; and to establish a percentage limit on the redemption rights of Class B shares.

Five. Increase of the share capital by issuing Class B shares using the voluntary reserves. Approval of the balance that may serve as the basis for the increase.

Six. Establishment of a right to voluntarily convert Class A shares into Class B shares, for which the following resolutions shall be submitted to vote:

6.1. Addition of a new sub-section 3 to the first section, "Class A Shares", of Article 8 of the bylaws (such that the current sub-section 3, still with the same wording, unchanged, would now be sub-section 4) in order to introduce a right to voluntarily convert Class A Shares into Class B Shares.

6.2. Reduction of the share capital by reducing the nominal value of a given number of Class A shares, to be specified, by €0.99 per share, by establishing a non-distributable reserve in accordance with the provisions in Article 335 c) LSC, integrating the shares with a reduced nominal value due to their conversion into Class B shares, listing the Class B shares on the stock market and conferring the necessary powers for this process, all of the above for the purpose of permitting the exercise of the right to voluntarily convert Class A shares into Class B shares.

Seven. Modification of Articles 2, 4, 5, 9, 12 and 14 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt them to the new text of Articles 21, 23, 24, 28, 31 and 33 of the bylaws which shall be submitted for approval to the General Meeting as point three on the agenda.

7.1. Modification of Articles 2 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt it to the new text of Article 21 of the bylaws proposed to the General Assembly as point 3.1 on the Agenda.

7.2. Modification of Article 4 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt it to the new text of Articles 23 of the bylaws proposed to the General Assembly as point 3.2 on the Agenda.

7.3. Modification of Article 5 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt it to the new text of Articles 24 of the bylaws proposed to the General Assembly as point 3.3 on the Agenda.

7.4. Modification of Article 9 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt it to the new text of Articles 28 of the bylaws proposed to the General Assembly as point 3.4 on the Agenda.

7.5. Modification of Article 12 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt it to the new text of Articles 31 of the bylaws proposed to the General Assembly as point 3.5 on the Agenda.

7.6. Modification of Article 14 of the Regulations on the functioning of the General Shareholders’ Meeting to adapt it to the new text of Articles 33 of the bylaws proposed to the General Assembly as point 3.6 on the Agenda.

Eight. Grant the Board of Directors the authority to interpret, rectify, execute, formalize and register the approved resolutions.

No directors are board members of other listed companies.

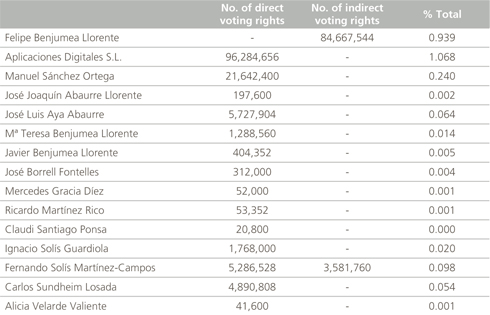

In accordance with the register of significant shareholdings that the company maintains, pursuant to the internal code of conduct in relation to the stock market, the percentage shareholdings of the directors in the capital of the company as at December 31, 2012 were as follows:

10.2. Company Management Structure

The Board of Directors

- Composition: number and identity

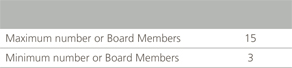

Following changes to Article 39 the company’s bylaws, as agreed by the Ordinary Shareholders’ Meeting held on 15 April 2007, the maximum number of members of the Board of Directors has been set at fifteen, compared to nine established until that time. This modification reinforced the structure of the Board with a number of directors that allows a more diversified composition as well as facilitating the delegation and adoption of resolutions with minimal attendance, thereby ensuring a multiple and plural presence in the Board of Directors.

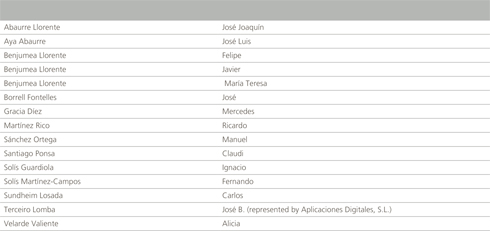

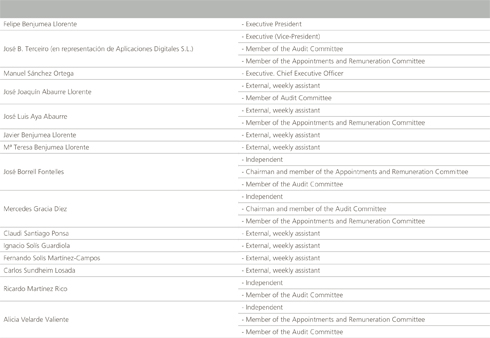

In accordance with the recommendations established in the Unified Code of Good Governance of Listed Companies, the composition of the Board reflects the capital structure. This enables the Board to represent the highest possible percentage of the capital in a stable way and ensures protection of the general interests of the company and its shareholders. The Board is provided, moreover, with a degree of independence in accordance with the practices and professional needs of any company. Its current composition is the following:

The total number of directors is considered to be appropriate to ensure the necessary representation and the effective functioning of the Board of Directors.

Notwithstanding the fact that independence is a condition that must be common to any director, irrespective of the director’s origin or appointment, based on the reliability, integrity and professionalism of his or her role, in accordance with the guidelines included under Law 26/2003, in Ministerial Order 3722/2003 and in the Unified Code of Good Governance of Listed Companies, the classification of current directors is as follows:

As may be seen in the table above, the Board is made up of a majority of external, non-executive directors.

- Organizational and functional rules

The Board of Directors is governed by the Regulations of the Board, the company’s bylaws and by the Internal Code of Conduct on Stock Exchange Matters. The Regulations of the Board were initially approved by the Board at a meeting on 18 January 1998, clearly in anticipation of the current rules of good governance and efficient internal control. The most recent update of note took place on 29 June 2003, in order to incorporate matters relating to the Audit Committee as established under the Financial System Reform Act.

- Structure:

The Board of Directors is currently made up of 15 members. The Regulations of the Board cover the composition of the Board, the functions and its internal organization; additionally, there is the Internal Code of Conduct on Stock Exchange Matters, the scope of which covers the Board of Directors, senior management and all those employees who, due to their skills or roles, are also impacted by its content. The Regulations of the Functioning of Shareholders’ Meetings cover the formal aspects and other aspects of Shareholders’ Meetings. Finally, the Board is supported by the Audit Committee and the Appointments and Remuneration Committee, which in turn are subject to their own respective internal regulations. All these regulations, included within the revised Internal Regulations on Corporate Governance are available on the company’s website, www.abengoa.es/com.

Since its inception, the Appointments and Remuneration Committee has been analyzing the structure of the company’s governing bodies and has worked to align such bodies with regulations in force regarding governance, focusing in particular on the historical and current configuration of such ruling bodies within Abengoa. Consequently, in February 2007 the committee recommended the creation of a Coordination Director, as well as the dissolution of the Advisory Committee to the Board of Directors. The first recommendation was to align the company with the latest corporate governance recommendations in Spain in 2006; the second recommendation reflected that the advisory board had completed the role for which it was established in the first place, and that its coexistence with the remaining company bodies could create a potential conflict of roles. Both proposals were approved by the Board of Directors in February 2007 as well as by the shareholders at the Ordinary General Meeting on 15 April of the same year.

Finally, in October 2007 the Committee proposed to the Board to accept the resignation of Mr. Javier Benjumea Llorente as Vice-chairman, along with the revoking of any powers which had been granted in those entities or companies in which he held a position of responsibility, and the naming of a new representative of Abengoa and the Focus-Abengoa Foundation.

On the basis of the foregoing, the committee decided that it would be opportune to repeat the study on numbers and conditions of the Vice-chairman to the Board of Directors within the current structure of the company’s governing bodies.

As a result, the Committee considered it necessary that the Vice-chairman of Abengoa hold the powers as per the Spanish Public Limited Companies Act so that, on the one hand, he or she is granted full representation of the company and to counter-balance the functions of the chairman of the board. On this basis it was considered that the Coordination Director – in accordance with the responsibilities as assigned to the role by the Board of Directors (February 2007) and at the Shareholders’ Meeting (April 2007) – was ideal for the role, in addressing the corporate governance recommendations and the structure of the company, as well as the composition and diversity of the directors. The Coordination Director already has the duty to take into account the concerns and goals of the board members and, to achieve this, has the power to call Board meetings and to add items to the agenda. As this role was more in substance than in title, considering the interests of the directors, and conveyed a certain representation of the Board, it was considered appropriate to expand and recognize this representation making it institutional and organic.

For the reasons mentioned, the Committee deemed it appropriate to propose Aplicaciones Digitales, S.L. (Aplidig, represented by Mr. José B. Terceiro Lomba), the current Coordination Director, as the new Vice- Chairman of the Board. Additionally, within the representative duties, it was proposed that the Vice-chairman, in conjunction with the chairman, would represent Abengoa as chairman of the Focus-Abengoa Foundation, as well as for other foundations and institutions in which the company is or should be represented.

In light of the above, on 10 December 2007 the Board of Directors approved the appointment of Aplicaciones Digitales, S. L. (represented by Mr. José B. Terceiro Lomba), the current Coordination Director, as the new Vice-Chairman of the Board, with the unanimous agreement of the independent directors regarding the retention of his role as Coordination Director despite being promoted to an executive board member role. Additionally, within the representative duties, on 23 July 2007 the Board approved that the Vice-chairman, in conjunction with the Chairman, would also represent Abengoa as Chairman of the Focus-Abengoa Foundation Board, as well as for other foundations and institutions in which the company is or should be represented.

The Chairman of the Board, as the leading executive of the company is granted full powers excluding those which by law cannot be assigned by the Board of Directors, notwithstanding the powers and competences the Board itself. With regards to the Vice-chairman, also an executive role, he or she is granted the same powers as above.

At the proposal of the meeting of the Appointments and Remuneration Committee of 25 October 2010, and due to the resignation as a director of Mr Miguel Martín Fernández due to other professional commitments, the Committee agreed to appoint Mr Manuel Sánchez Ortega as CEO for a period of four years, by co-optation. Manuel Sánchez Ortega shares the executive functions of the company with Mr Felipe Benjumea Llorente.

- Functions:

The role of the Board of Directors is to undertake the necessary actions so as to achieve the corporate objectives of the company. It is empowered to determine the financial goals of the company, agree upon the strategies necessary as proposed by senior management so as to achieve such goals, assure the future viability of the company and its competitiveness, as well as adequate leadership and management, supervising the development of the company’s business.

- Appointments:

The Shareholders’ Meeting, or when applicable the Board of Directors, within the established rules and regulations, is the competent body for appointing members of the Board. Only those people that fulil the legally established requirements may be appointed, as well as being trustworthy and holding the knowledge, prestige and sufficient professional references to undertake the functions of director.

Directors are appointed for a maximum of 4 years, although they may be re-elected.

- Dismissals:

Directors will be removed from their position at the end of their tenure or under any other circumstances in accordance with the appropriate laws. Furthermore, they should relinquish their role as directors in the event of any incompatibility, prohibition, serious sanctions or failure to fulfill their obligations as directors.

- Meetings:

In accordance with Article 42 of the company bylaws, the Board of Directors will meet as deemed necessary given the demands of the company or, as a minimum requirement, three times annually, with the first meeting during the first quarter of the year. During 2012, the Board met a total of 15 times, of which five meetings took place via a meeting by circular resolution, in addition to one meeting between the Board of Directors and senior management.

- Duties of the Directors:

The function of the director is to participate in the direction and control of management of the company for the purposes of and with the aim of maximizing its value for shareholders. Each director operates with the diligence and care of a loyal and dedicated professional, guided by the company’s interests, as a representative with complete independence to defend and protect the interests of the shareholders.

By virtue of their appointment, the directors are required to:

- Prepare and be sufficiently and properly informed for each meeting.

- Actively assist and participate in meetings and decisions.

- Avoid conflicts of interest and, in the event that they arise, to report such conflicts to the company

through the Board of Directors’ Secretary.

- Not to undertake duties for competing entities.

- Not to use company information for personal purposes.

- Not to use the company’s business opportunities for their own interest.

- Maintain full confidentiality regarding information received within their role as Director of the company.

- Abstain from voting on proposals that may have an effect on them.

- The Chairman:

The Chairman, in addition to the company bylaws and legal requirements, is the senior-most executive of the company, and as such is effectively responsible for the management of the company, always in accordance with the criteria and decisions of the Board of Directors and the General Shareholders’ Meeting. The Chairman is responsible for implementing the decisions made by the company’s management bodies, through application of the powers as permanently granted to him by the Board of Directors, which he represents in all aspects. The Chairman also casts the deciding vote in the Board of Directors.

The Chairman is also the Chief Executive Officer. The following measures are in place to prevent an accumulation of power.

Under Article 44 bis of the company bylaws, on 2 December 2002 and 24 February 2003 the Board of Directors agreed to appoint the Audit Committee and the Appointments and Remuneration Committee.

These committees have the powers, which may not be delegated, as per the Law, the company bylaws and internal regulations, acting as regulatory body and supervisory body associate with the matters over which they chair.

Both are chaired by a non-executive independent director and are comprised of a majority of non-executive directors.

- The Secretary:

The Secretary to the Board of Directors undertakes those responsibilities as required by law. Currently the role of Secretary and that of Legal Counsel to the Board is undertaken by the same person, being responsible for the correct calling of meetings and that resolutions are properly implemented by the Board. In particular, he will advise the Board as to the legality of proposed deliberations and decisions and upon compliance with the company’s internal corporate governance regulations, making him responsible as guarantor of the legality, both in law and in substance, of the actions of the Board.

The Secretary, as a specialized role, guarantees the legality in law and in substance of the actions of the Board, with the full support of the board to perform their duties with independent judgment and substance. He or she is also responsible for safeguarding the internal rules of corporate governance.

- Resolutions:

Decisions are made by a simple majority of those directors present at the meeting (present of represented) in each meeting, with the exception of legal matters as previously set out.

- Structure:

- Remuneration and other benefits

- Remuneration:

Directors are remunerated in accordance with Article 39 of the company bylaws. Directors’ remuneration may consist of a fixed amount as agreed by the General Shareholders’ Meeting, and need not be equal for all directors. Additionally they may receive a proportion of retained earnings of the company, of between a maximum of 5 and 10 percent of profits after dividends in the year to which the remuneration relates. Additionally, travel costs are paid for actions related to the Board.

The total remuneration paid during 2012 to the whole of the Board of Directors was €13,887,000 for fixed and variable remuneration concepts (€13,237,000 in 2011) and €169,000 for other concepts (€156,000 in 2011).

Detail of individual remuneration and benefits in 2012 paid to the Board of Directors (in thousands of Euros):

- Remuneration:

Additionally, in 2012 overall remuneration for key management of the company (Senior Management which are not executive directors), including both fixed and variable components, amounted to €13,574,000 (€7,822,000 in 2011).

For more information on the Corporate Governance Report, the appendix of this Management Report contains the complete version which has been subjected to independent verification by our auditors who have issued opinion of reasonable assurance based on the ISAE 3000 standard “Assurance Engagements other than Audits or Reviews of Historical Financial Information” issued by the International Auditing and Assurance Standard Board (IAASB) of the International Federation of Accountants (IFAC).

© 2012 Abengoa. All rights reserved