Abengoa

Abengoa

Annual Report 2012

3.- Business trends

3.1. Recent trends

3.1.1.

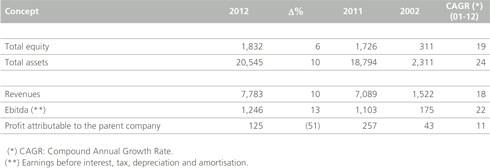

Movements in the main items on the Balance Sheet and the Income Statement are as follows:

3.1.2.

Balance sheet. An increase in “Project Fixed Assets”, which totaled €10,058 M in 2012, primarily comprised of intangible assets, reflects investments made in certain concessions in Brazil, and investments in water management projects, environmental projects and plants and production installations for bioethanol and solar power by the various project development companies owned by the various subsidiaries of Abengoa, S.A.

The investments made by these development companies are generally executed and financed through “project finance”; a specific financing formula through which funds are raised exclusively to finance that entity and the project, with debt

repayments being made directly from the future cash flows generated by that same project. This financing is ring-fenced, and is therefore without recourse to shareholders.

The opposite entry to these investments is recognized as a liability within the balance sheet, as “Non-recourse financing

applied to projects”, which at the close of 2012 totals €6,386 M in non-current liabilities and €589 M under the corresponding short-term heading.

Net equity increased 6% to €1,832 M, primarily due to results for the year and the increase in non-controlling interests in transmission line projects in Brazil.

Abengoa’s net debt in 2012 reached €1,409 M (net debt position) compared to €120 M (net corporate debt) for 2011.

The change in the size and structure of the Abengoa balance sheet over the last five years reflects certain events, of which the most significant are as follows:

a) During 2008 the contracting of four own projects continued, being four solar thermal plants (PS 20, Solnova 1, Solnova 3 and Solnova 4), and 3 ethanol plants (Rotterdam, Indiana and Illinois).

b) The 20 MW thermo-solar plant with PS 20 Tower Technology was commissioned in 2009.

c) Also in 2009, Abengoa accessed the capital markets through two bond issues for a total of €500 M.

d) Three new ethanol plants (Rotterdam, Indiana and Illinois) and three new solar-thermal plants (Solnova 1, Solnova 3 and Solnova 4) came into operation in 2010.

e) In addition, approximately €1,200 M of bonds were issued in 2010.

f) On 5 September 2011, Abengoa, S.A. closed an agreement with Schneider Electric, S.A. for the sale of 40% of its shares in Telvent GIT, S.A. The sale of these shares brought in cash flow of €391 M and income of €91 M recorded under the section “Income Statement of the Fiscal Year Originating from Interrupted Activities Net of Taxes” of the Consolidated Income Statement.

g) On 30 November 2011, Abengoa, S.A. closed an agreement with Compañía Energética Minas Gerais (CEMIG) through Transmissora Aliança de Energía Eléctrica, S.A. (TAESA) for the sale of 50% shares in the companies STE, ATE, ATE II and ATE III, and 100% in NTE. The sale of these shares generated cash of €479 M and profit of €45 M recorded in the section “Other Operating Income” in the Consolidated Income Statement (€43 M after tax).

h) On 4 October 2011, Abengoa, S.A. reached an investment agreement with First Reserve Corporation (through a specific affiliate) hereinafter, First Reserve or FRC, a US Investment Fund specialized in private equity and investment in the energy sector, by virtue of which it made a commitment to invest €300 M in Abengoa’s share capital under the terms and conditions set forth in an investment agreement.

i) On 16 March 2012, the company reached an agreement with Compañía Energética Minas Gerais (CEMIG) to sell the 50% stake that Abengoa S.A. still owned in four transmission line concessions in Brazil (STE, ATE, ATE II and ATE III). On July 2, we received €354 M in cash corresponding to the total price agreed for the shares. The gain from this sale totaled €4 M and is recorded in “Other operating income” in the Consolidated Income Statement.

3.1.3.

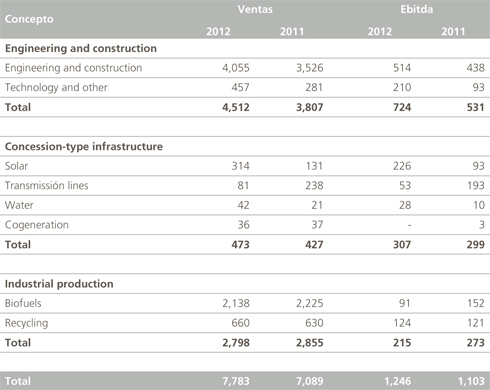

Consolidated sales as of December 31, 2012 totaled €7,783 M, representing an increase of 10% over the last period.

EBITDA (Earnings before interest, tax, depreciation and amortization) rose by €143 M (13%) to €1,246 M compared to 2011.

The profit attributable to Abengoa’s parent company decreased by 51% from €257 M in 2011 to €125 M in 2012. Excluding the results derived from the sale of transmission lines in Brazil, the impact of the sale of Telvent in 2011 and derivatives markto-market valuations, from both periods, the organic results would have increased by 9%.

3.1.4.

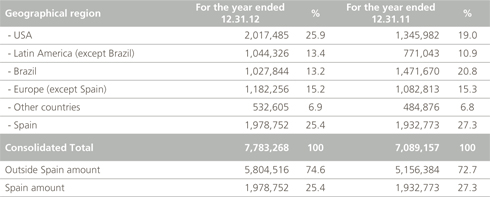

In 2012, Abengoa continued increasing its foreign activities in volume and in diversification. Of the €7,083 M consolidated sales for 2012, €5,805 M (75%) is from international or external sales. Activity in Spain amounts to €1,979 M (25%) compared to €1,932 M for 2011 (27%).

3.1.5.

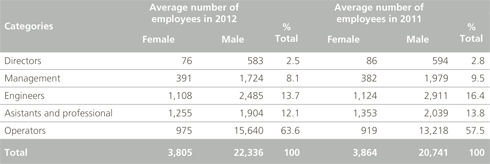

The following table shows the average number of employees for the various periods:

© 2012 Abengoa. All rights reserved