Abengoa

Abengoa

Annual Report 2012

- Legal and Economic-Financial Information

- Consolidated analytical report

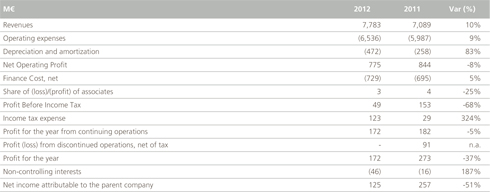

- Consolidated income statement

Revenues

Abengoa’s consolidated revenues to December, 31 2012 reached €7,783 M, a 10% increase from the previous year. The increase is mainly due to the revenues increase in Engineering and Construction, being of note: the construction of thermosolar plants in Spain and US, the significant progress in the construction of the 640 MW electricity power plant in Mexico, as well as in the construction of transmission lines and current transmission substations in Madeira (Brazil).

Ebitda

Abengoa’s EBITDA figure for the year ended December, 31 2012, reached €1,246 M, a 13% increase from the previous year in spite of the sale of part of the Brazilian transmission lines. It was mainly due to contribution of new concessions assets in operation (Solar Power plants in Spain, and desalination and hybrid solar/gas plants in Algeria), as well as the Ebitda contributed by the aforementioned revenues increase in Engineering and Construction.

Finance cost, net

Net financial expenses increased from €-695 M in 2011 to €-729 M in 2012, mainly due to lower interest income from loans and credits in Brazil due to the sale of transmission lines.

Income Tax Expense

Corporate income tax benefit reached €123 M, from €29 M previous year. This figure was affected by various incentives for exporting goods and services from Spain, for investment and commitments to R&D+i activities, the contribution to Abengoa’s profit from results from other countries, as well as prevailing tax legislation.

Profit for the year from continuing operations

Given the above, Abengoa’s income from continuing operations decreased by 5% from the previous year figure of €182 M to €172 M in 2012.

Profit from discontinued operations, net of tax

In December 2011 Telvent figures have been reclassified and are considered as discontinued operations for comparative purposes, as Telvent GIT was effectively sold in 2011.

Profit for the year attributable to the parent company

As a result of the above, the profit attributable to Abengoa’s parent company decreased by 51% from €257 M achieved in 2011, to €125 M in 2012.

© 2012 Abengoa. All rights reserved