Abengoa

Abengoa

Annual Report 2012

- Legal and Economic-Financial Information

- Consolidated financial statements

- Notes to the consolidated financial statements

-

Note 1.- General information

Abengoa, S.A. is the parent company of the Abengoa Group (referred to hereinafter as “Abengoa”, “the Group” or “the Company”), which at the end of 2012, was made up of 618 companies: the parent company itself, 568 subsidiaries, 16 associates and 33 joint ventures. Additionally, as of the end of 2012, certain subsidiaries were participating in 224 temporary joint ventures (UTE) and, furthermore, the Group held a number of interests, of less than 20%, in several other entities.

Abengoa, S.A. was incorporated in Seville, Spain on January 4, 1941 as a Limited Liability Company and was subsequently transformed into a Limited Liability Corporation (“S.A” in Spain) on March 20, 1952. Its registered office is Campus Palmas Altas, C/ Energía Solar nº 1, 41014 Seville.

The Group’s corporate purpose is set out in Article 3 of the Articles of Association. It covers a wide range of activities, although Abengoa is principally an applied engineering and equipment manufacturer, providing integrated project solutions to customers in the following sectors: energy, telecommunications, transport, water utilities, environmental, industrial and service.

Abengoa´s shares are represented by class A and B shares are listed on the Madrid and Barcelona Stock Exchange and on the Spanish Stock Exchange Electronic Trading System (Electronic Market). Class A shares have been listed since November 29, 1996 and class B shares since October 25, 2012. The Company presents mandatory financial information on a quarterly and semiannually basis.

Abengoa is an international company that applies innovative technology solutions for sustainability development in the energy and environment sectors, generating energy from the sun, producing biofuels, desalinating sea water and recycling industrial waste. The company supplies engineering projects under the “turnkey” contract modality and operates assets that generate renewable energy, produce biofuel, manage water resources, desalinate sea water, treat sewage and recycle industrial wastes.

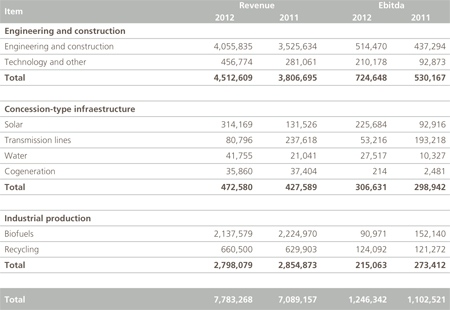

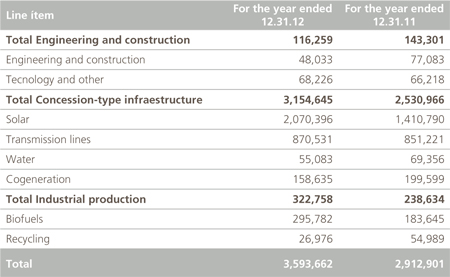

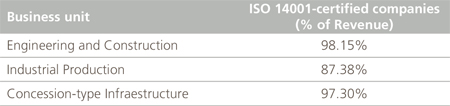

The Group has identified 3 main business activities (Engineering and Construction, Concession-type Infrastructures and Industrial Production).

Abengoa´s activities are focused on the energy and environmental sectors, and integrate operations throughout the value chain including R+D+i, project development, engineering and construction and operating and maintenance for its own the assets and third parties.

Abengoa’s activity and the internal and external management information are organized under the following three activities:

- Engineering and construction: includes our traditional engineering activities in the energy and water sectors, with more than 70 years of experience in the market and development of thermo-solar technology. Abengoa is specialized in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others.

- Concession-type infrastructures: groups together the company’s proprietary concession assets that generate revenues governed by long term sales agreements, such as take-or-pay contracts, tariff contracts or power purchase agreements. This activity includes the operation of electric (solar, cogeneration or wind) energy generation plants and transmission lines. These assets generate low demand risk and we focus on operating them as efficiently as possible.

- Industrial production: covers Abengoa’s businesses with a high technological component, such as biofuels and industrial waste recycling. The company holds an important leadership position in these activities in the geographical markets in which it operates.

These Consolidated Financial Statements were approved by the Board of Directors on February 21, 2013.

All public documents on Abengoa may be viewed at www.abengoa.com.

-

Note 2.- Significant accounting policies

The significant accounting policies adopted in the preparation of the accompanying Consolidated Financial Statements are set forth below:

2.1. Basis of presentation

The Consolidated Financial Statements as of December 31, 2012 have been prepared in accordance with International Financial Reporting Standards, as adopted for use within the European Union (herein, IFRS-EU).

Unless stated otherwise, the accounting policies as set out below have been applied consistently throughout all periods shown within these Consolidated Financial Statements.

The Consolidated Financial Statements have been prepared under the historical cost convention, modified by the revaluation of certain available-for-sale non-current financial assets under IFRS 1 and with the exception of those situations where IFRS-EU requires that financial assets and financial liabilities are valued at fair value.

The preparation of the Consolidated Financial Statements under IFRS-EU requires the use of certain critical accounting estimates. It also requires that Management exercises its judgment in the process of applying Abengoa’s accounting policies. Note 3 provides further information on those areas which involve a higher degree of judgment or areas of complexity for which the assumptions or estimates made are significant to the financial statements.

The amounts included within the documents comprising the Consolidated Financial Statements (Consolidated Statement of Financial Position, Consolidated Income Statement, Consolidated Statement of Comprehensive Income, Consolidated Statement of Changes in Equity, Consolidated Cash Flow Statement and notes herein) are, unless otherwise stated, all expressed in thousands of Euros (€).

Unless otherwise stated, any presented percentage of interest in subsidiaries, joint ventures (including temporary joint ventures) and associates includes both direct and indirect ownership.

Certain prior period amounts have been reclassified to conform to current year presentation.

2.1.1. Recently issued accounting standards

a) Standards, interpretations and amendments effective from January 1, 2012 applied by the Group:

- IFRS 7 (amendment), ´Financial Instruments: Disclosures´. This amendment modified the required disclosures about the risk exposures relating to transfers of financial assets. Among others, this amendment could affect the sale transactions of financial assets, factoring agreements, financial assets and the loan titles agreements.

This amendment did not have a significant impact on the Group’s Consolidated Financial Statements.

b) Standards, interpretations and amendments published by the IASB that are not yet in force and have been adopted by the European Union:

- IFRS 10, ´Consolidated Financial Statements´. IFRS 10 replaces current consolidation requirements of IAS 27 and establishes principles for the presentation and preparation of Consolidated Financial Statements when an entity controls one or more other entities. The standard defines the principle of control, and establishes control as the basis for consolidation. This Standard will be effective for periods beginning on or after January 1, 2014 under IFRS-EU (January 1, 2013 under IFRS approved by the International Accounting Standards Board , herein IFRSIASB).

- IFRS 11 ´Joint Arrangements´. This Standard will be effective for periods beginning on or after January 1, 2014 under IFRS-EU (January 1, 2013 under IFRS-IABS).

IFRS 11, replaces the actual IAS 31 about joint ventures and under this standard investments in joint arrangements are classified either as joint operations or joint ventures, depending on the contractual rights and obligations each investor has rather than just the legal structure of the joint arrangement. Joint operations arise where a joint operator has rights to the assets and obligations relating to the arrangement and hence accounts for its interest in assets, liabilities, revenue and expenses. Joint ventures arise where the joint operator has rights to the net assets of the arrangement and accounts for its interest under the equity method. Proportional consolidation of joint ventures is no longer allowed. - IFRS 12 ´Disclosures of interests in other entities´. This Standard will be effective for periods beginning on or after January 1, 2014 under IFRS-EU (January 1, 2013 under IFRS-IASB). Standard that defines the disclousures related to interests hold in subsidiaries, associates, joint arrangements and non-consolidated entities.

- IAS 27 (amendment) ´Separated financial statements´. IAS 27 amendment is mandatory for periods beginning on or after January 1, 2014 under IFRS-EU (January 1, 2013 under IFRS-IASB). After IFRS 10 has been published, IAS 27 covers only separate financial statements.

- IAS 28 (amendment) ´Associates and joint ventures´. IAS 28 has been amended to include the requirements for joint ventures to be accounted for under the equity method following the issuance of IFRS 11. IAS 28 is mandatory for periods beginning on or after January 1, 2014 under IFRS-EU (January 1, 2013 under IFRS-IASB).

- IFRS 13 ´Fair value measurement´. This Standard will be effective for periods beginning on or after January 1, 2013, both under IFRS-EU and IFRS-IASB.

- IAS 1 (amendment) ´Financial statements presentation´. The main change resulting from this amendment is a requirement to group items presented in ‘other comprehensive income’ (OCI) on the basis of whether they will be subsequently reclassified to profit or loss or not (reclassification adjustments). This Standard will be effective for annual periods beginning on or after July 1, 2012, both under IFRS-EU and IFRS-IASB. Earlier application is permitted.

- IAS 19 (amendment) ´Employee benefits´. IAS 19 amendment is mandatory for periods beginning on or after January 1, 2013.

- IAS 32 (amendment) and IFRS 7 (amendment) ‘Compensation of financial assets for financial liabilities’. IAS 32 amendment is mandatory for periods beginning on or after January 1, 2014 and is to be applied retroactively, both under IFRS-EU and IFRS-IASB. IFRS 7 amendment is mandatory for periods beginning on or after January 1, 2013 and is to be applied retroactively, both under IFRS-EU and IFRS-IASB.

The Group is currently in the process of evaluating the impact on the Consolidated Financial Statements derived from the application of these new standards and they will not have a significant impact on the Group’s Consolidated Financial Statements in opinion of the Directors.

c) Standards, interpretations and amendments that have not been adopted by the European Union:

- IFRS 9, ´Financial Instruments´. This Standard will be effective as from January 1, 2015 under IFRS-IASB.

- IFRS 10, IFRS 11 and IFRS 12 (amendments) ´Transition Guidance´. Effective from January 1, 2013 under IFRSIASB.

- Improvements to IFRS published by the IASB in May 2012 as part of the Annual Improvements 2009-2011 Cycle. The improvements affect IFRS 1 ´ First-time adoption of IFRS´, IAS 1´Presentation of Financial Statements´, IAS 16 ´Property, Plant and Equipment´, IAS 34 ´Interim financial reporting´, and IAS 32 ´Financial Instruments: Presentation’. These amendments are mandatory as from January 1, 2014 under IFRS-IASB.

The Group is currently in the process of evaluating the impact on the Consolidated Financial Statements derived from the application of these new standards and amendments.

2.2. Principles of consolidation

In order to provide information on a consistent basis, the same principles and standards applied to the parent company have been applied to all other consolidated entities.

All subsidiaries, associates and joint ventures included in the consolidated group for the years 2012, and 2011 that form the basis of these Consolidated Financial Statements are set out in Appendices I (XII), II (XIII ) and III (XIV), respectively.

Note 6 of these Consolidated Financial Statements reflects the information on the changes in the composition of the Group.

a) Subsidiaries

Subsidiaries are those entities over which Abengoa has the power to govern financial and operational policies to obtain profits from their operations.

It is assumed that a company has control if, directly or indirectly (through other subsidiaries), it holds more than half of the voting rights of another company, except in exceptional circumstances under which it may be clearly demonstrated that such possession does not entail control.

Control shall also be presumed to exist if a company holds half or less of the voting rights of another entity but holds certain participating rights:

- power over more than half of the voting rights under an agreement with other investors;

- power to manage the financial and operating policies of the company, by virtue of a legal provision, a bylaw or some kind of agreement with the aim of obtaining profits from its operations;

- power to appoint or dismiss the majority of the members of the Board of Directors or equivalent governing body that is actually in control of the company; or

- power to cast the majority of the votes in meetings of the Board of Directors or equivalent governing body that controls the company.

Subsidiaries are accounted for on a fully consolidated basis as of the date upon which control was transferred to the Group, and are excluded from the consolidation as of the date upon which control ceases to exist.

The group uses the acquisition method to account for business combinations. The consideration transferred for the acquisition of a subsidiary is the fair value of the assets transferred, the liabilities incurred and the equity interests issued by the group and includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Any contingent consideration is recognized at fair value at the acquisition date and subsequent changes to its fair value are recognized in accordance with IAS 39 either in profit or loss or as a change to other comprehensive income. Acquisition-related costs are expensed as incurred. Identifiable assets acquired, liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. On an acquisition-by-acquisition basis, the group recognizes any non-controlling interest in the acquiree either at fair value or at the non-controlling interest’s proportionate share of the acquireer’s net assets.

The value of non-controlling interest in equity and the consolidated results are shown, respectively, under 'Noncontrolling Interest' of the Consolidated Statement of Financial Position and “Profit attributable to non-controlling interest” in the Consolidated Income Statement.

Profit for the year and each component of Other comprehensive income is attributed to the parent company and non-controlling interest in accordance with their percentage of ownership. Total Comprehensive income is attributed to the parent company and non-controlling interest even if this results in a debit balance of the latter.

In the consolidation process, intercompany transactions and unrealized gains are eliminated and deferred until such gains are realized by the Group, usually through transactions with third parties. Intercompany balances between entities of the Group included in the consolidation are eliminated during the consolidation process.

In compliance with Article 155 of Spanish Corporate Law, the parent company has notified to all these companies that, either by itself or through another subsidiary, it owns more than 10 per 100 of their capital. Appendix VIII lists the Companies external to the Group which have a share equal to or greater than 10% of a subsidiary of the parent company under consolidation.

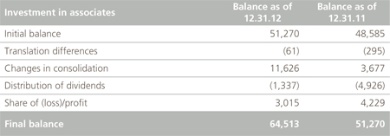

b) Associates

Associates are entities over which Abengoa has a significant influence but does not have control and, generally, involve an interest representing between 20% and 50% of the voting rights. Investments in associates are carried under the equity method and are initially recognized at cost. The Group’s investment in associates includes goodwill identified upon acquisition (net of any accumulated impairment loss).

The share in losses or gains after the acquisition of associates is recognized in the Consolidated Income Statement in “Share of (loss)/profit of Associates” and the share in movements in reserves subsequent to the acquisition is recognized in the reserves. Movements subsequent to the acquisition are adjusted against the carrying value of the investment. When the share in an associate’s losses is equal to or higher than the interest in the company, including any unsecured accounts receivable, additional losses are not recognized unless Abengoa has acquired obligations to make any payments in the associate’s name.

Gains between the Group and its associates not realized with third parties are eliminated according to the interest held by the Group in the associates. Unrealized losses are also eliminated, unless the transaction provides evidence of impairment to the asset being transferred.

In compliance with Article 155 of Spanish Corporate Law, the parent company has notified to all these companies that, either by itself or through another subsidiary, it owns more than 10 per 100 of their capital.

c) Joint ventures

Joint ventures exist when, by virtue of a contractual arrangement, an entity is jointly managed and owned by Abengoa and third parties outside the Group. These arrangements are based upon an agreement between all the parties that confer to those parties joint control over the financial and operating policies of the entity. Holdings in joint ventures are consolidated using the proportional consolidation method.

The Group consolidates the assets, liabilities, income and expenses, and cash flows of the joint ventures on a line-byline basis with similar lines in the Group’s financial statements.

The Group recognizes its share of gains and losses arising from the sale of Group assets to the joint venture for the portion that relates to other investors. Conversely, the Group does not recognize its share in any gains or losses of the joint venture that result from the purchase of assets from the joint venture by a Group company until those assets have been sold to third parties. Any loss on a transaction between the Group and the joint venture is recognized immediately if there is evidence of impairment.

As of December 31, 2012 and 2011 there are no significant contingent liabilities in the Group’s interests in joint ventures.

d) Temporary joint ventures

“Unión Temporal de Empresas” (UTE) are temporary joint ventures generally formed to execute specific commercial and/or industrial projects in a wide variety of areas and particularly in the fields of engineering and construction and infrastructure projects. They are normally used to combine the characteristics and qualifications of the UTE’s partners into a single proposal in order to obtain the most favorable technical assessment possible. UTE are normally limited as standalone entities with limited action, since, although they may enter into commitments in their own name, such commitments are generally undertaken by their investors, in proportion to each investor’s share in the UTE.

The partners’ shares in the UTE normally depend on their contributions (quantitative or qualitative) to the project, are limited to their own tasks and are intended solely to generate their own specific results. Each partner is responsible for executing its own tasks and does so in its own interests.

The fact that one of the UTE’s partners acts as project manager does not affect its position or share in the UTE. The UTE’s partners are collectively responsible for technical issues, although there are strict pari passu clauses that assign the specific consequences of each investor’s correct or incorrect actions.

UTE are not variable-interest or special-purpose entities. UTE do not usually own assets or liabilities on a standalone basis. Their activity is conducted for a specific period of time that is normally limited to the execution of the project. The UTE may own certain fixed assets used in carrying out its activity, although in this case they are generally acquired and used jointly by all the UTE’s investors, for a period similar to the project’s duration, or prior agreements are signed by the partners on the assignment or disposal of the UTE’s assets upon completion of the project.

UTE in which the Company participates are operated through a management committee comprised of equal representation from each of the temporary joint venture partners, and such committee makes all the decisions about the temporary joint venture’s activities that have a significant effect on its success. All the decisions require consent of each of the parties sharing power, so that all the parties together have the power to direct the activities of the UTE. As a result, in these temporary joint ventures power is shared and UTE are consolidated proportionally.

The proportional part of the UTE’s Consolidated Statement of Financial Position and Consolidated Income Statement is integrated into the Consolidated Statement of Financial Position and the Consolidated Income Statement of the Company in proportion to its interest in the UTE on a line-by-line basis.

As of December 31, 2012 and 2011, there are no significant material liabilities in relation to the Group’s shareholdings in the UTE.

e) Transactions with non-controlling interests

Transactions with non-controlling interests are accounted for as transactions with equity owners of the group. When the Group acquires non-controlling interests, the difference between any consideration paid and the carrying value of the proportionate share of net assets acquired is recorded in equity. Gains or losses on disposals of non-controlling interests are also recorded in equity.

When the group ceases to have control or significant influence, any retained interest in the entity is remeasured to its fair value, and any difference between fair value and its carrying amount is recognized in profit or loss. In addition, any amount previously recognized in other comprehensive income in respect of that entity is accounted for as if the group had directly disposed of the related assets or liabilities.

Companies and entities which are third parties for the Group and which hold a share iqual to or larger than 10% in the share capital of any company included in the consolidation group are disclosed in Appendix VIII.

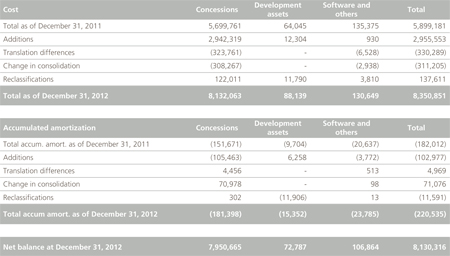

2.3. Intangible assets

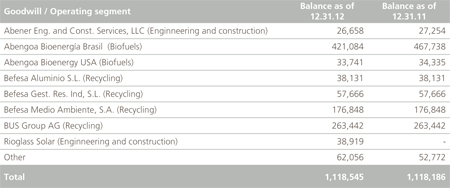

a) Goodwill

Goodwill is recognized as the excess between (A) and (B), where (A) is the sum of the considerations transferred, the amount of any non-controlling interest in the acquiree and in the case of a business combination achieved in stages, the fair value on the acquisition date of the previously held interest in the acquire and (B) the net value, at the acquisition date, of the identifiable assets acquired, the liabilities and contingent liabilities assumed, measured at fair value. If the resulting amount is negative, in the case of a bargain purchase, the difference is recognized as an income directly in the Consolidated Income Statement.

Goodwill relating to the acquisition of subsidiaries is included in intangible assets, while goodwill relating to associates is included in investments in associates.

Goodwill is carried at initial value less accumulated impairment losses (see Note 2.8). Goodwill is allocated to Cash Generating Units (CGU) for the purposes of impairment testing, these CGU’s being the units which are expected to benefit from the business combination that generated the goodwill.

b) Computer programs

Costs paid for licenses for computer programs are capitalized, including preparation and installation costs directly associated with the software. Such costs are amortized over their estimated useful life. Maintenance costs are expensed in the period in which they are incurred.

Costs directly related with the production of identifiable computer programs are recognized as intangible assets when they are likely to generate future economic benefit for a period of one or more years and they fulfill the following conditions:

- It is technically possible to complete the production of the intangible asset;

- Management intends to complete the intangible asset;

- The Company is able to use or sell the intangible asset;

- There are technical, financial and other resources available to complete the development of the intangible asset; and

- Disbursements attributed to the intangible asset during its development may be reliably measured.

Costs directly related to the production of computer programs recognized as intangible assets are amortized over their estimated useful lives which do not exceed 10 years.

Costs that do not meet the criteria above are recognized as expenses when incurred.

c) Research and development cost

Research costs are recognized as an expense when they are incurred.

Development costs (relating to the design and testing of new and improved products) are recognized as an intangible asset when all the following criteria are met:

- It is probable that the project will be successful, taking into account its technical and commercial feasibility, so that the project will be available for its use or sale;

- It is probable that the project will generate future economic benefits;

- Management intends to complete the project;

- The Company is able to use or sell the intangible asset;

- There are appropriate technical, financial or other resources available to complete the development of the intangible asset; and

- The costs of the project/product can be measured reliably.

Once the product is in the market, capitalized costs are amortized on a straight-line basis over the period for which the product is expected to generate economic benefits, which is normally 5 years, except for development assets related to the thermo-solar plant using tower technology which are amortized over 25 years.

Development costs that do not meet the criteria above are recognized as expenses when incurred.

Grants or subsidized loans obtained to finance research and development projects are recognized as income consistently with the expenses they are financing (following the rules described above).

d) Emission rights of greenhouse gases for own use

Under this head the Company records greenhouse gas emissions rights obtained through allocation by the competent national authority, which are used against the emissions discharged in the course of the Group’s production activities. These emission rights are measured at their acquisition cost and are derecognized from the Consolidated Statement of Financial Position when used, under the National Assignation Plan for Greenhouse Gas Permits or when they expire.

Emission rights are tested for impairment to establish whether their acquisition cost is greater than their fair value. If impairment is recognized and, subsequently, the market value of the rights recovers, the impairment loss is reversed through the Consolidated Income Statement, up to the limit of the original carrying value of the rights.

When greenhouse gases are released into the atmosphere, the releasing company provides for the tonnage of CO2 released at the average purchase price per ton of rights acquired. Any emissions in excess of the value of the rights purchased in a certain period will give rise to a provision for the cost of the rights at that date.

In the event that the emission rights are not for own use but intended to be traded in the market, the contents of Note 2.13 will be applicable.

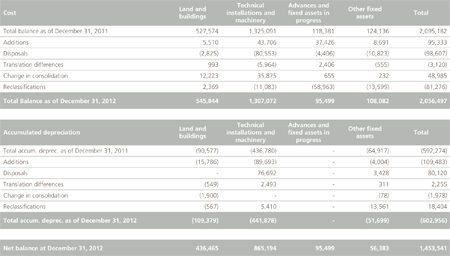

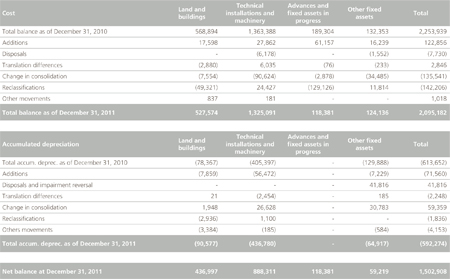

2.4. Property, plant and equipment

2.4.1. Presentation

For the purposes of preparing these Consolidated Financial Statements, property, plant and equipment has been divided into the following categories:

a) Property, plant and equipment

Includes property, plant and equipment of companies or project companies which have been self-financed or financed through external financing with recourse facilities.

b) Property, plant and equipment in Projects

Includes property, plant and equipment of companies or project companies which are financed through non-recourse project finance (for further details see Notes 2.5 and 10 on Fixed Assets in Projects).

2.4.2. Measurement

In general, property, plant and equipment is measured at historical cost, including all expenses directly attributable to the acquisition, less depreciation and impairment losses, with the exception of land, which is presented net of any impairment losses.

Subsequent costs are capitalized when it is probable that future economic benefits associated with that asset can be separately and reliably identified.

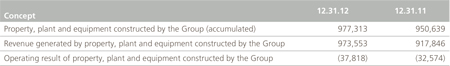

Work carried out by a company on its own property, plant and equipment is valued at production cost. In internal construction projects of our own assets carried out by our Engineering and Construction segment which are not under the scope of IFRIC 12 on Service Concession Agreements (see Note 2.25), internal margins are eliminated. The corresponding costs are recognized in the individual expense line item in the accompanying income statements. The recognition of an income for the sum of such costs through the line item "Other income- Income from capitalized costs and other" results in these costs having no impact in net operating profit. The corresponding assets are capitalized and included in property, plant and equipment in the accompanying balance sheets.

All other repair and maintenance costs are charged to the Consolidated Income Statement in the period in which they are incurred.

Costs incurred during the construction period may also include gains or losses from foreign-currency cash-flow hedging instruments for the acquisition of property, plant and equipment in foreign currency, transferred from equity.

With regard to investments in property, plant and equipment located on land belonging to third parties, an initial estimate of the costs of dismantling the asset and restoring the site to its original condition is also included in the carrying amount of the asset. Such costs are recorded at their net present value in accordance with IAS 37.

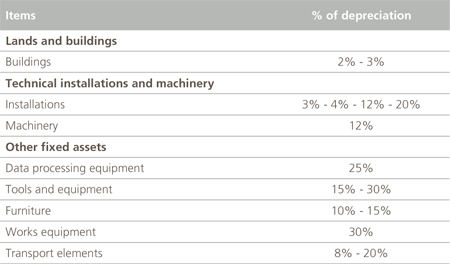

The annual depreciation rates of property, plant and equipment (including property, plant and equipment in projects) are as follows:

Waste ponds and similar assets are depreciated on the basis of the volume of waste in the ponds.

The assets’ residual values and useful economic lives are reviewed, and adjusted if necessary, at the end of the accounting period of the company which owns the asset.

When the carrying amount of an asset is higher than its recoverable amount, the carrying amount is reduced immediately to reflect the lower recoverable amount.

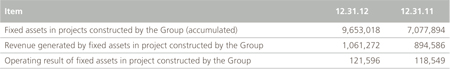

2.5. Fixed assets in projects (project finance)

This category includes property, plant and equipment and intangible assets of consolidated companies which are financed through Non-recourse Project Finance, that are raised specifically and solely to finance individual projects as detailed in the terms of the loan agreement.

These non-recourse Project Finance assets are generally the result of projects which consist of the design, construction, financing, application and maintenance of large- cale complex operational assets or infrastructures, which are owned by the company or are held under a concession agreement for a period of time. The projects are initially financed through non-recourse medium-term bridge loans and later by Non-recourse Project Finance.

In this respect, the basis of the financing agreement between the Company and the bank lies in the allocation of the cash flows generated by the project to the repayment of the principal amount and interest expenses, excluding or limiting the amount secured by other assets, in such a way that the bank recovers the investment solely through the cash flows generated by the project financed, any other debt being subordinated to the debt arising from the non-recourse financing applied to projects until the non-recourse debt has been fully repaid. For this reason, fixed assets in projects are separately reported on the face of the Consolidated Statement of Financial Position, as is the related non-recourse debt in the liability section of the same statement.

In addition, within the fixed assets in projects line item of the Consolidated Statement of Financial Position, assets are subclassified under the following two sub-headings, depending upon their nature and their accounting treatment:

- Intangible assets: includes fixed assets financed through non-recourse loans, mainly related to Service Concession Agreements, which are accounted for as intangible assets in accordance with IFRIC 12 (see Note 2.25). The rest of the assets shown under this heading are the intangible assets owned by the project company, the description and accounting treatment of which are set forth in Note 2.3.

- Property, plant and equipment: includes tangible fixed assets which are financed through a non-recourse loan and are not subject to a concession agreement as described below. Their accounting treatment is described in Note 2.4.

Non-recourse project finance typically includes the following guarantees:

- Shares of the project developers are pledged.

- Assignment of collection rights.

- Limitations on the availability of assets relating to the project.

- Compliance with debt coverage ratios.

- Subordination of the payment of interest and dividends to meeting inancial covenant ratios.

Once the project finance has been repaid and the non-recourse debt and related guarantees fully extinguished, any remaining net book value reported under this category is reclassified to the Property, Plant and Equipment or Intangible Assets line items, as applicable, in the Consolidated Statement of Financial Position.

2.6. Current and non-current classification

Assets are classified as current assets if they are expected to be realized in less than 12 months after the date of the Consolidated Statements of Financial Position. Otherwise, they are classified as non-current assets.

Liabilities are classified as current liabilities unless an unconditional right exists to defer their repayment by at least 12 months following the date of the Consolidated Statement of Financial Position.

2.7. Borrowing costs

Interest costs incurred in the construction of any qualifying asset are capitalized over the period required to complete and prepare the asset for its intended use. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its internal use or sale, which in Abengoa is considered to be more than one year.

Costs incurred relating to non-recourse factoring are expensed when the factoring transaction is completed with the financial institution.

Remaining borrowing costs are expensed in the period in which they are incurred.

2.8. Impairment of non-financial assets

Abengoa reviews its property, plant and equipment, intangible assets with finite and indefinite useful life and goodwill to identify any indicators of impairment quarterly. In addition, goodwill and intangible assets with indefinite useful life or that are not yet in operation are tested for impairment on an annual basis.

These assets are impaired when the carrying amount of the Cash Generating Unit to which it belongs is lower than its recoverable amount. The recoverable amount is the higher of the market value less related cost to sell and the value in use, which is the present value of estimated future cash flows.

The recoverable amount of an asset is the higher of its fair value less costs to sell and its value in use, defined as the present value of the estimated future cash flows to be generated by the asset. In the event that the asset does not generate cash flows independently of other assets, Abengoa calculates the recoverable amount of the Cash-Generating Unit to which the asset belongs.

Assumptions used to calculate value in use include a discount rate, growth rates and projected changes in both selling prices and costs. The discount rate is estimated by Management, pre-tax, to reflect both changes in the value of money over time and the risks associated with the specific Cash-Generating Unit. Growth rates and changes in prices and costs are projected based upon internal and industry projections and management experience respectively. Financial projections range between 5 and 10 years depending on the growth potential of each Cash Generating Unit.

To calculate the value in use of the major goodwill balances (Recycling, Biofuels), the following assumptions were made:

- 10-year financial projections were used for those Cash-Generating Units (CGUs) that have high growth potential based on cash flows taken into account in the strategic plans for each business unit, considering a residual value based on the flow in the final year of the projection.

The use of these 10-year financial projections was based on the assumption that it is the minimum period necessary for the discounted cash flow model to reflect all potential growth in the CGUs in each business segment showing significant investments.

The aforementioned estimated cash flows were considered to be reliable due to their capacity to adapt to the real market and/or business situation faced by the CGU in accordance with the business's margin and cash-flow experience and future expectations.

These cash flows are reviewed and approved every six months by Senior Management so that the estimates are continually updated to ensure consistency with the actual results obtained.

In these cases, given that the period used is reasonably long, the Group then applies a zero growth rate for the cash flows subsequent to the period covered by the strategic plan. - For concession assets with a defined useful life and with a specific financial structure, cash flow projections until the end of the project are considered and no terminal value is assumed.

Concession assets have a contractual structure that permits to estimate quite accurately the costs of the project (both in the construction and in the operations periods) and revenue during the life of the project.

Projections take into account real data based in the contract terms and fundamental assumptions based in specific reports prepared by experts, assumptions on demand and assumptions on production. Additionally, assumptions on macro-economic conditions are also taken into account, such as inflation rates, future interest rates, etc. and sensitivity analysis are performed over all major assumptions which can have a significant impact in the value of the asset. - 5-year cash flow projections are used for all other CGUs, considering the residual value to be the cash flow in the final year projected.

- Cash flow projections of CGUs located in other countries are calculated in the functional currency of those CGUs and are discounted using rates that take into consideration the risk corresponding to each specific country and currency. Present values obtained with this method are then converted to euros at the year-end exchange rate of each currency.

- Taking into account that in most CGUs its specific financial structure is linked to the financial structure of the projects that are part of those CGUs, the discount rate used to calculate the present value of cash-flow projections is based in the weighted average cost of capital (WACC) for the type of asset, adjusted, if necessary, in accordance with the business of the specific activity and with the risk associated with the country where the project is performed.

- In any case, sensitivity analyses are performed, especially in relation with the discount rate used, residual value and fair value changes in the main business variables, in order to ensure that possible changes in the estimates of these items do not impact the possible recovery of recognized assets.

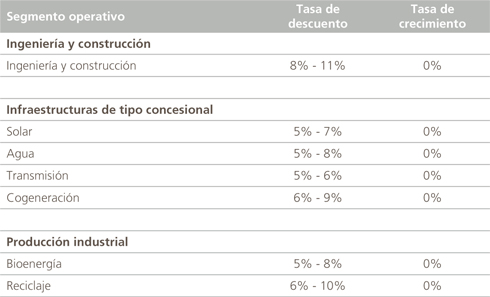

- Accordingly, the following table provides a summary of the discount rates used (WACC) and growth rates to calculate the recoverable amount for Cash-Generating Units with the operating segment to which it pertains:

In the event that the recoverable amount of an asset is lower than its carrying amount, an impairment charge for the difference recorded in the Consolidated Income Statement under the item “Depreciation, amortization and impairment charges”. With the exception of goodwill, impairment losses recognized in prior periods which are later deemed to have been recovered are credited to the same income statement heading.

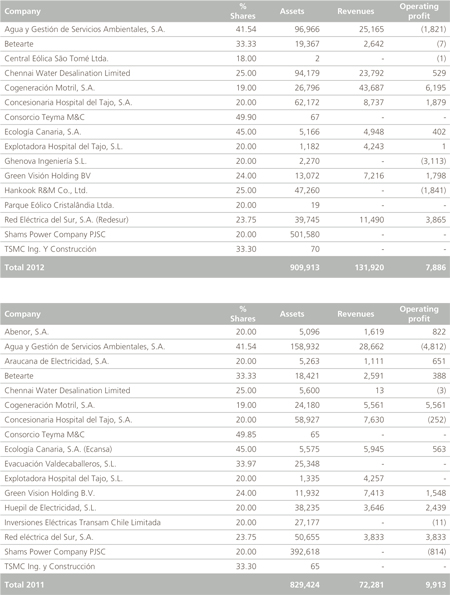

2.9. Financial Investments (current and non-current)

Financial investments are classified into the following categories, based primarily on the purpose for which they were acquired:

a) financial assets at fair value through profit and loss;

b) loans and accounts receivable;

c) financial assets held to maturity; and

d) available for sale financial assets.

Classification of each financial asset is determinated by management upon initial recognition, and is reviewed at each year end.

a) Financial assets at fair value through profit and loss

This category includes the financial assets acquired for trading and those initially designated at fair value through profit and loss. A financial asset is classified in this category if it is acquired mainly for the purpose of sale in the short term or if it is so designated by Management. Financial derivatives are also classified as acquired for trading unless they are designated as hedging instruments.

These financial assets are recognized initially at fair value, without including transaction costs. Subsequent changes in fair value are recognized under “Gains or losses from financial assets at fair value” within the “Finance income or expense” line of the Consolidated Income Statement for the period.

b) Loans and accounts receivables

Loans and accounts receivables are non-derivative financial assets with fixed or determinable payments, not listed on an active market.

Following the application of IFRIC 12, certain assets under concessions can qualify as financial receivables (see Note 2.25).

Loans and accounts receivables are initially recognized at fair value plus transaction costs and subsequently measured at amortized cost in accordance with the effective interest rate method. Interest calculated using the effective interest rate method is recognized under “Interest income from loans and debts” within the “Finance income” line of the Consolidated Income Statement.

c) Financial assets held to maturity

This category includes non-derivative financial assets expected to be held to maturity which have fixed or determinable payments.

These assets are initially recognized at fair value plus transaction costs and subsequently measured at their amortized cost under the effective interest rate method. Interest calculated under the effective interest rate method is recognized under “Other finance income” within the “Other net finance income/expense” line of the Consolidated Income Statement.

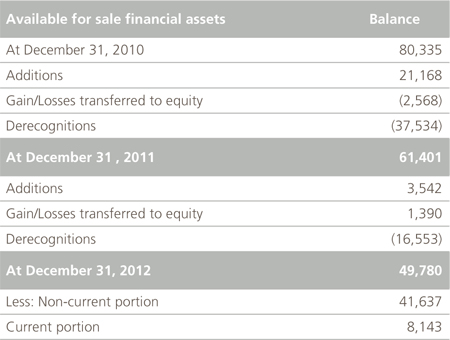

d) Available for sale financial assets

This category includes non-derivative financial assets which do not fall within any of the previously mentioned categories. For Abengoa, they primarily comprise interests in other companies that are not consolidated.

Financial assets available for sale are initially recognized at fair value plus transaction costs and subsequently measured at fair value, with changes in fair value recognized directly in equity, with the exception of translation differences of monetary assets, which are charged to the Consolidated Income Statement. Dividends from available-for-sale financial assets are recognized under “Other finance income” within the “Other net finance income/expense” line of the Consolidated Income Statement when the right to receive the dividend is established.

When available-for-sale financial assets are sold or impaired, the accumulated amount recorded in equity is transferred to the Consolidated Income Statement. To establish whether the assets have been impaired, it is necessary to consider whether the reduction in their fair value is significantly below cost and whether it will be for a prolonged period of time. The cumulative gain or loss reclassified from equity to profit or loss when the financial assets are impaired is the difference between their acquisition cost (net of any principal repayment and amortization) and current fair value, less any impairment loss on that financial asset previously recognized in profit or loss.Impairment losses recognized in the Consolidated Income Statement are not subsequently reversed through the Consolidated Income Statement.

Acquisitions and disposals of financial assets are recognized on the trading date, i.e. the date upon which there is a commitment to purchase or sell the asset. Available for sale financial assets are derecognized when the right to received cash flows from the investment has expired or has been transferred and all the risks and rewards derived from owning the asset have likewise been substantially transferred.

At the date of each Consolidated Statement of Financial Position, the Group evaluates if there is any objective evidence that the value of any financial asset or any group of financial assets has been impaired.

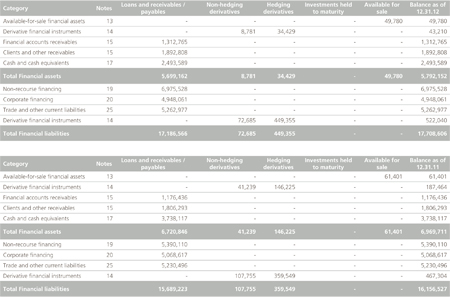

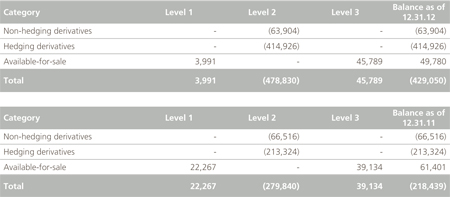

2.10. Derivative financial instruments and hedging activities

Derivatives are recorded at fair value. The Company applies hedge accounting to all hedging derivatives that qualify to be accounted for as hedges under IFRS.

When hedge accounting is applied, hedging strategy and risk management objectives are documented at inception, as well as the relationship between hedging instruments and hedged items. Effectiveness of the hedging relationship needs to be assessed on an ongoing basis. Effectiveness tests are performed prospectively and retrospectively at inception and at each reporting date, following the dollar offset method or the regression method, depending on the type of derivatives.

The Company has three types of hedges:

a) Fair value hedge for recognized assets and liabilities

Changes in fair value of the derivatives are recorded in the Consolidated Income Statement, together with any changes in the fair value of the asset or liability that is being hedged.

b) Cash flow hedge for forecasted transactions

The effective portion of changes in fair value of derivatives designated as cash flow hedges are recorded temporarily in equity and are subsequently reclassified from equity to profit or loss in the same period or periods during which the hedged item affects profit or loss. Any ineffective portion of the hedged transaction is recorded in the Consolidated Income Statement as it occurs.

When options are designated as hedging instruments (such as interest rate options described in Note 14), the intrinsic value and time value of the financial hedge instrument are separated. Changes in intrinsic value which are highly effective are recorded in equity and subsequently reclassified from equity to profit or loss in the same period or periods during which the hedged item affects profit or loss. Changes in time value are recorded in the Consolidated Income Statement, together with any ineffectiveness.

When the hedged forecasted transaction results in the recognition of a non-financial asset or liability, gains and losses previously recorded in equity are included in the initial cost of the asset or liability.

When the hedging instrument matures or is sold, or when it no longer meets the requirements to apply hedge accounting, accumulated gains and losses recorded in equity remain as such until the forecast transaction is ultimately recognized in the Consolidated Income Statement. However, if it becomes unlikely that the forecast transaction will actually take place, the accumulated gains and losses in equity are recognized immediately in the Consolidated Income Statement.

c) Net investment hedges in foreign operation

Hedges of a net investment in a foreign operation, including the hedging of a monetary item considered part of a net investment, are recognized in a similar way to cash flow hedges. The foreign currency transaction gain or loss on the non-derivative hedging instrument that is designated as, and is effective as, an economic hedge of the net investment in a foreign operation shall be reported in the same manner as a translation adjustment. That is, reported in the cumulative translation adjustment section of equity to the extent it is effective as a hedge, as long as the following conditions are met: the notional amount of the non-derivative instrument matches the portion of the net investment designated as being hedged and the non-derivative instrument is denominated in the functional currency of the hedged net investment. In that circumstance, no hedge ineffectiveness would be recognized in earnings.

Amounts recorded in equity will be reclassified to the Consolidated Income Statement when the foreign operation is sold or otherwise disposed of.

Contracts held for the purposes of receiving or making payment of non-financial elements in accordance with expected purchases, sales or use of goods (“own-use contracts”) of the Group are not recognized as derivative instruments, but as executory contracts. In the event that such contracts include embedded derivatives, they are recognized separately from the host contract, if the economic characteristics of the embedded derivative are not closely related to the economic characteristics of the host contract. The options contracted for the purchase or sale of non-financial elements which may be cancelled through cash outflows are not considered to be own-use contracts.

Changes in fair value of derivative instruments which do not qualify for hedge accounting are recognized immediately in the Consolidated Income Statement. Trading derivatives are classified as a current assets or liabilities.

2.11. Fair value estimates

The fair value of financial instruments traded on active markets (such as officially listed derivatives), is determined by the market value as of the date of the Consolidated Statement of Financial Position.

A market is considered active when quoted prices are readily and regularly available from stock markets or financial intermediaries, among others, and these prices reflect current market transactions that regularly occur between parties operating independently.

The fair value of financial instruments which are not listed or which do not have readily available market values is determined by applying various valuation techniques that use assumptions based upon market conditions as of the date of the Consolidated Statement of Financial Position. The fair value of interest rate swaps is calculated as the present value of estimated future cash flows. The fair value of forward exchange rate contracts is measured on the basis of market forward exchange rates as at the date of Consolidated Statement of Financial Position.

The nominal value of receivables and payables less estimated impairment adjustments is assumed to be similar to their fair value due to their short-term nature. The fair value of financial liabilities is estimated as the present value of contractual future cash outflows, using market interest rate available to the Group for similar financial instruments.

Detailed information on fair values is included in Note 12.

2.12. Inventories

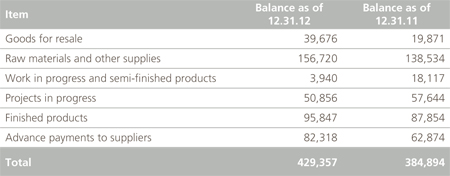

Inventories are valued at the lower of cost or net realizable value. In general, cost is determined by using the first-in-firstout (FIFO) method. The cost of finished goods and work in progress includes design costs, raw materials, direct labor, other direct costs and general manufacturing costs (assuming normal operating capacity). Borrowing costs are not included. The net realizable value is the estimated sales value in the normal course of business, less applicable variable selling costs.

Cost of inventories includes the transfer from equity of gains and losses on qualifying cash-flow hedging instruments related with the purchase of raw materials or with foreign exchange contracts.

2.13. Carbon emission credits (CERs)

Several Abengoa entities are involved in a number of external projects to reduce CO2 emissions through participation in Clean Development Mechanisms (CDM) and Joint Implementation (JI) programs with those countries/parties which are purchasing Carbon Emission Credits (CERs) and Emission Reduction Credits (ERUs), respectively. CDMs are projects in countries which are not required to reduce emission levels, whilst JIs are aimed at developing countries which are required to reduce emissions.

Both projects are developed in two phases:

1) Development phase, which, in turn, has the following stages:

- Signing an ERPA agreement (Emission Reduction Purchase Agreement), to which certain offer costs are associated.

- PDD (Project Design Document) development.

- Obtaining a certification from a qualified third party regarding the project being developed and submitting the certification to the United Nations, where it is registered in a database.

Thus, the Group currently holds various agreements for consultancy services within the framework of the execution of Clean Development Mechanisms (CDM). Costs incurred in connection with such consultancy services are recognized by the Group as non-current receivables.

2) Phase of annual verification of the reductions in CO2 emissions. After this verification, the company receives Carbon Emission Credits (CERs), which are registered in the National Register of Emission Rights. CERs are recorded as inventories and measured at market value.

Likewise, the company may hold Emission Allowances assigned by the competent EU Emission Allowance Authority (EUAs), which may also be measured at market price if held for sale. In case of the EUA are held for own use see Note 2.3.d. Furthermore, there are carbon fund holdings aimed at financing the acquisition of emissions from projects which contribute to a reduction in greenhouse gas emissions in developing countries through CDM’s and JI’s, as discussed above. Certain Abengoa companies have holdings in such carbon reduction funds which are managed by an external Fund Management team. The Fund directs the resources of the funds to purchasing Emission Reductions through CDM’s and JI’s projects.

The company with holdings in the fund incurs in a number of costs (ownership commissions, prepayments and purchases of CER’s). From the start, the holding is recorded on the balance sheet based upon the original Carbon Emission Credit (CER) allocation agreement; however this amount will be allocated over the life of the fund. The price of the CER is fixed for each ERPA. Based upon its percentage holding, and on the fixed price of the CER, it receives a number of CER’s as obtained by the Fund from each project.

These contributions are considered as long-term investments and are recognized in non-current assets in the Consolidated Statements of Financial Position under the heading of “Other receivables accounts”.

2.14. Biological assets

Abengoa recognizes sugar cane in production as biological assets. The production period of sugar cane covers the period from preparation of the land and sowing the seedlings until the plant is ready for first production and harvesting. Biological assets are classified as property, plant and equipment in the Consolidated Statement of Financial Position. Biological assets are recognized at fair value, calculated as the market value less estimated harvesting and transport costs.

Agricultural products harvested from biological assets, which in the case of Abengoa are cut sugar cane, are classified as inventories and measured at fair value less estimated sale costs at the point of sale or harvesting.

Fair value of biological assets is calculated using as a reference the forecasted market price of sugarcane, which is estimated using public information and estimates on future prices of sugar and ethanol. Fair value of agricultural products is calculated using as a the price of sugar cane made public on a monthly basis by the Cane, Sugar and Alcohol Producers Board (Consecana).

Gains or losses arising as a result of changes in the fair value of such assets are recorded, within “Other operating income” caption in the Consolidated Income Statement.

To obtain the fair value of the sugar cane while growing, a number of assumptions and estimates have been made in relation to the area of land sown, the estimated TRS (Total Recoverable Sugar contained within the cane) per ton to be harvested and the average degree of growth of the agricultural product in the different areas sown.

2.15. Clients and other receivables

Clients and other receivables relate to amounts due from customers for sales of goods and services rendered in the normal course of operation.

Clients and other receivables are recognized initially at fair value and are subsequently measured at amortized cost using the effective interest rate method, less provision for impairment. Trade receivables due in less than one year are carried at their face value at both initial recognition and subsequent measurement, provided that the effect of not discounting flows is not significant.

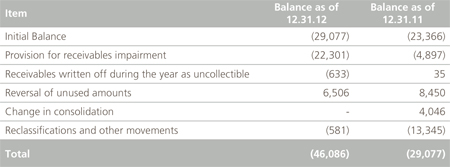

A provision for impairment of trade receivables is recorded when there is objective evidence that the Group will not be able to recover all amounts due as per the original terms of the receivables. The existence of significant financial difficulties, the probability that the debtor is in bankruptcy or financial reorganization and the lack or delay in payments are considered evidence that the receivable is impaired.

The amount of the provision is the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the effective interest rate. When a trade receivable is uncollectable, it is written off against the bad debt provision.

Clients and other receivables which have been factored with financial entities are derecognized and hence removed from assets on the Consolidated Statement of Financial Position only if all risks and rewards of ownership of the related financial assets have been transferred, comparing the Company’s exposure, before and after the transfer, to the variability in the amounts and the calendar of net cash flows from the transferred asset. Once the Company’s exposure to this variability has been eliminated or substantially reduced, the financial asset has been transferred, and is derecognized from the Consolidated Statement of Financial Position (See Note 4.b).

2.16. Cash and cash equivalents

Cash and cash equivalents include cash in hand, cash in bank and other highly-liquid current investments with an original maturity of three months or less which are held for the purpose of meeting short-term cash commitments.

In the Consolidated Statement of Financial Position, bank overdrafts are classified as borrowings within current liabilities.

2.17. Share capital

Parent company shares are classified as equity. Transaction costs directly attributable to new shares are presented in equity as a reduction, net of taxes, to the consideration received from the issue.

Treasury shares are classified in Equity-Parent company reserves. Any amounts received from the sale of treasury shares, net of transaction costs, are classified equity.

2.18. Government grants

Non-refundable capital grants are recognized at fair value when it is considered that there is a reasonable assurance that the grant will be received and that the necessary qualifying conditions, as agreed with the entity assigning the grant, will be adequately complied with.

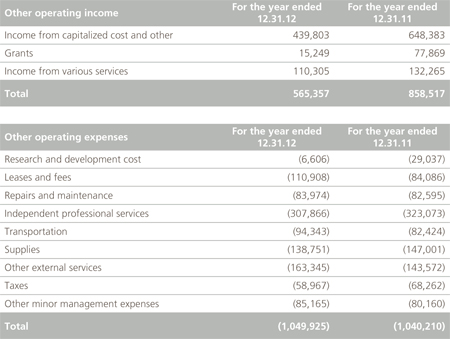

Grants related to income are recorded as liabilities in the Consolidated Statement of Financial Position and are recognized in “Other operating income” in the Consolidated Income Statement based on the period necessary to match them with the costs they intend to compensate.

Grants related to fixed assets are recorded as non-current liabilities in the Consolidated Statement of Financial Position and are recognized in “Other operating income” in the Consolidated Income Statement on a straight-line basis over the estimated useful economic life of the assets.

2.19. Loans and borrowings

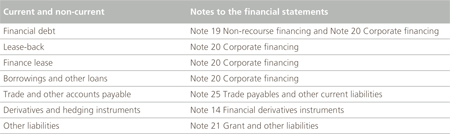

External resources are classified in the following categories:

a) Non-recourse financing applied to projects (project financing) (see note 19);

b) Corporate financing (see Note 20);

Loans and borrowings are initially recognized at fair value, net of transaction costs incurred. Borrowings are subsequently measured at amortized cost and any difference between the proceeds initially received (net of transaction costs incurred in obtaining such proceeds) and the repayment value is recognized in the Consolidated Income Statement over the duration of the borrowing using the effective interest rate method.

Interest free loans, mainly granted for research and development projects, are initially recognized at fair value in liabilities in the Consolidated Statement of Financial Position. The difference between proceeds received from the loan and its fair value is initially recorded within “Grants and Other liabilities” in the Consolidated Statement of Financial Position, and subsequently recorded in “Other operating income- Grants” in the Consolidated income statement when the costs financed with the loan are expensed. In the case of interest free loans received for development projects where we record an intangible asset, income from the grant will be recognized according to the useful life of the asset, at the same path as we record its amortization.

Commissions paid for obtaining credit lines are recognized as transaction costs if it is probable that part or all of the credit line will be drawn down. If this is the case, commissions are deferred until the credit line is drawn down. If it is not probable that all or part of the credit line will be drawn down, commission costs are expensed in the period.

2.19.1. Convertible notes

Pursuant to the Terms and Conditions of each of the convertible notes issued, when investors exercise their conversion right, the Company may decide whether to deliver shares of the company, cash, or a combination of cash and shares (see Note 20.3 for further information).

In accordance with IAS 32 and 39, since Abengoa has a contractual right to choose the type of payment and one of these possibilities is paying through a variable number of shares and cash, the conversion option qualifies as an embedded derivative. Thus, the convertible bond is considered a hybrid instrument, which includes a component of debt and an embedded derivative for the conversion option held by the bondholder.

The Company initially measures the embedded derivative at fair value and classifies it under the derivative financial instruments liability heading. At the end of each period, the embedded derivative is re-measured and changes in fair value are recognized under “Other net finance income or expense” within the “Finance expense net” line of the Consolidated Income Statement. The debt component of the bond is initially recorded as the difference between the proceeds received for the notes and the fair value of the aforementioned embedded derivative. Subsequently, the debt component is measured at amortized cost until it is settled upon conversion or maturity. In general, debt issuance costs are recognized as a deduction in the value of the debt in the Consolidated Statement of Financial Position and included as part of its amortized cost.

2.19.2.Ordinary notes

The company initially recognizes ordinary notes at fair value, net of issuance costs incurred. Subsequently, notes are measured at amortized cost until settlement upon maturity. Any other difference between the proceeds obtained (net of transaction costs) and the redemption value is recognized in the Consolidated Income Statement over the term of the debt using the effective interest rate method.

2.20. Current and deferred income taxes

Income tax expense for the period comprises current and deferred income tax. Income tax is recognized in the Consolidated Income Statement, except to the extent that it relates to items recognized directly in equity. In these cases, income tax is also recognized directly in equity.

Current income tax expense is calculated on the basis of the tax laws in force or about to enter into force as of the date of the Consolidated Statement of Financial Position in the countries in which the subsidiaries and associates operate and generate taxable income.

Deferred income tax is calculated in accordance with the Consolidated Statement of Financial Position liability method, based upon the temporary differences arising between the carrying amount of assets and liabilities and their tax base. However, deferred income tax is not recognized if it arises from initial recognition of an asset or liability in a transaction other than a business combination that, at the time of the transaction, affects neither the accounting nor the taxable profit or loss. Deferred income tax is determined using tax rates and regulations which are enacted or substantially enacted at the date of the Consolidated Statement of Financial Position and are expected to apply and/or be in force at the time when the deferred income tax asset is realized or the deferred income tax liability is settled.

Deferred tax assets are recognized only when it is probable that sufficient future taxable profit will be available to use deferred tax assets.

Deferred taxes are recognized on temporary differences arising on investments in subsidiaries and associates, except where the timing of the reversal of the temporary differences is controlled by the Group and it is not probable that temporary differences will reverse in the foreseeable future.

2.21. Employee benefits

a) Share plans

Certain Group companies have obligations in connection with certain share-based incentive plans for managers and employees. These plans are linked to the achievement of certain management objectives during the upcoming years. When the shares have an active market (which is the case for plans linked to Abengoa shares), personnel expense is recognized during the vesting period based on their fair value at grant date. In either case, the impact of these share plans on Abengoa’s Consolidated Financial Statements is not significant. When there is no active market for the shares granted by the plan, personnel expense is recognized on the basis of the repurchase price identified in the plan during the vesting period.

Share plans are considered a cash-settled share-based payment plans in accordance with IFRS 2, since the company compensates the participants for their services in exchange for the assumption of the market risk on the shares. By use of the guarantee on the loan, Abengoa guarantees participants, up to the end of the plan period, no personal losses in conjunction with a change in the price of the shares purchased. As such, Abengoa measures and recognizes at the end of each reporting period, a liability based on the value of the shares. Upon expiration of the Plan, employees may sell the shares to repay the individual loan or may otherwise repay the loan as they wish.

b) Bonus schemes

The Group records the amount annually accrued in accordance with the percentage of compliance with the plan’s established objectives as personnel expense in the Consolidated Income Statement Expenses incurred from employee benefits are disclosed in Note 29.

2.22. Provisions and contingencies

Provisions are recognized when:

- There is a present obligation, either legal or constructive, as a result of past events;

- It is more likely than not that there will be a future outflow of resources to settle the obligation; and

- The amount has been reliably estimated.

Provisions are initially measured at the present value of the expected outflows required to settle the obligation and subsequently valued at amortized cost following the effective interest method. The balance of Provisions disclosed in the Notes reflects management’s best estimate of the potential exposure as of the date of preparation of the Consolidated Financial Statements.

Contingent liabilities are possible obligations, existing obligations with low probability of a future outflow of economic resources and existing obligations where the future outflow cannot be reliably estimated. Contingences are not recognized in the Consolidated Statements of Financial Position unless they have been acquired in a business combination.

2.23. Trade payables and other liabilities

Trade payables and other liabilities are obligations arising from the purchase of goods or services in the ordinary course of business and are recognized initially at fair value and are subsequently measured at their amortized cost using the effective interest method.

Other liabilities are obligations not arising from the purchase of goods or services in the normal course of business and which are not treated as financing transactions.

Advances received from customers are recognized as “Trade payables and other current liabilities”.

2.24. Foreign currency transactions

a) Functional currency

Financial statements of each subsidiary within the Group are measured and reported in the currency of the principal economic environment in which the subsidiary operates (subsidiary’s functional currency). The Consolidated Financial Statements are presented in euro, which is Abengoa’s functional and reporting currency.

b) Transactions and balances

Transactions denominated in a currency different from the subsidiary’s functional currency are translated into the subsidiary’s functional currency applying the exchange rates in force at the time of the transactions. Foreign currency gains and losses that result from the settlement of these transactions and the translation of monetary assets and liabilities denominated in foreign currency at the year-end rates are recognized in the Consolidated Income Statement, unless they are deferred in equity, as occurs with cash-flow hedges and net investment in foreign operations hedges.

c) Translation of the financial statements of foreign companies within the Group

Income Statements and Statements of Financial Position of all Group companies with a functional currency different from the group’s reporting currency (Euro) are translated to Euros as follows:

1) All assets and liabilities are translated to Euros using the exchange rate in force at the closing date of the Financial Statements.

2) Items in the Income Statement are translated into Euros using the average annual exchange rate, calculated as the arithmetical average of the average exchange rates for each of the twelve months of the year, which does not differ significantly from using the exchange rates of the dates of each transaction.

3) The difference between equity, including profit or loss calculated as described in (2) above, translated at the historical exchange rate, and the net financial position that results from translating the assets, and liabilities in accordance with (1) above, is recorded in equity in the Consolidated Statement of Financial Position under the heading “Accumulated currency translation differences”.

Results of companies carried under the equity method are translated at the average annual exchange rate calculated described in (2) above.

Adjustments to the goodwill and the fair value that arise on the acquisition of a foreign company are treated as assets and liabilities of the foreign company and are translated at the year-end exchange rate.

2.25. Service concession agreements

As established in IFRIC 12, Service Concession Agreements are public-to-private arrangements in which the public sector controls or regulates the service provided with the infrastructure and their prices, and it is contractually guaranteed to gain, at a future time, ownership of the infrastructure through which the service is provided. The infrastructures accounted for by the Group as concessions are mainly related to the activities concerning power transmission lines, desalination plants, cogeneration plants and certain thermo-solar electricity generation plants. The infrastructure used in a concession can be classified as a financial asset or an intangible asset, depending on the nature of the payment entitlements established in the agreement.

The Group recognizes an intangible asset within “Fixed assets in projects” to the extent that it has a right to charge final customers for the use of the infrastructure. This intangible asset is subject to the provisions of IAS 38 and is amortizable, taking into account the estimated period of commercial operation of infrastructure. The Group recognizes and measures revenue, costs and margin for providing construction services during the period of construction of the infrastructure in accordance with IAS 11 “Construction Contracts” and revenue for other services in accordance with IAS 18 “Revenue”.

Service Concession Agreements are accounted for in accordance with the following criteria:

1) Total construction costs, including associated financing costs, are recorded as intangible assets within “Fixed assets in projects”. Profits attributable to the construction phase of the infrastructure are recognized using the percentage of completion method, based on the fair value assigned to the construction phase and the concession phase.

2) The intangible asset is usually amortized on a straight-line basis over the period of the concession.

3) The amounts recognized in the Consolidated Income Statement during the period of the concession are as follows:

- Ordinary income: the annual updated concession fee income is recognized in each period.

- Operating costs: operating and maintenance costs and general overheads and administrative costs are charged to the Consolidated Income Statement in accordance with the nature of the cost incurred (amount due) in each period. Fixed assets are amortized as per point 2) above.

- Financial costs: financing costs and exchange rate differences arising from repayable debt denominated in foreign currencies are charged to the Consolidated Income Statement.

4) At the end of each period, each project is tested for impairment if the invested costs are considered not recoverable.

In those concession agreements where the grantor of the concession is responsible for the payment of the operator’s expenses and retains substantially all the legal risks associated with the concession, the asset arising from the construction phase of the project is reported as a non-current receivable within the line item Loans (non-current portion) under the noncurrent Financial accounts receivable caption of the Consolidated Statement of Financial Position, provided that it is possible to calculate the amount. The non-current receivable is measured at amortized cost in accordance with the effective interest rate method and gradually reduced during the term of the contract against the annual fees received (see also note 2.26.c). Interest calculated using the effective interest rate method is recognized within the line item “Interest income from loans and debt”, under the “Finance income” caption of the Consolidated Income Statement.2.26. Revenue recognition

a) Ordinary income

Ordinary income comprises the fair value of sales of goods or services, excluding VAT or similar taxes, any discounts or returns and excluding sales between Group entities.

Ordinary income is recognized as follows:

- Income from the sale of goods is recognized when the Group delivers the goods to the client, the client accepts them and it is reasonably certain that the related receivables will be collectible.

- Income from the sale of services is recognized in the period in which the service is provided.

- Interest income is recognized using the effective interest rate method. When a receivable is considered impaired, the carrying amount is reduced to its recoverable amount, discounting the estimated future cash flows at the original effective interest rate of the instrument and recording the discount as a reduction in interest income.

- Income from interest on loans that have been impaired is recognized when the cash is collected or on the basis of the recovery of the cost when the conditions are guaranteed.

- Dividend income is recognized when the right to receive payment is established.

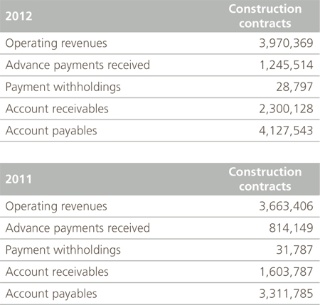

b) Construction contracts

Costs incurred in relation to construction contracts are recognized when incurred. When the outcome of a construction contract cannot be reliably estimated, revenues are only recognized up to the amount of the costs incurred to date that are likely to be recovered.

When the outcome of a construction contract can be reliably estimated and it is probable that it will be profitable, revenue from the contract is recognized over the term of the contract. When it is probable that the costs of the project will be greater than its revenue, expected loss is recognized immediately as an expense. To determine the appropriate amount of revenue to be recognized in any period, the percentage of completion method is applied. The percentage of completion method considers, at the date of the Statement of Financial Position, the actual costs incurred as a percentage of total estimated costs for the entire contract. Costs incurred in the period which relate to future project activities are not included when determining the percentage of completion. Prepayments and certain other assets are recognized as inventories, depending upon their specific nature.

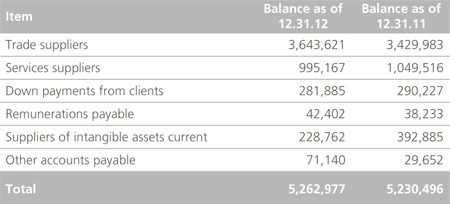

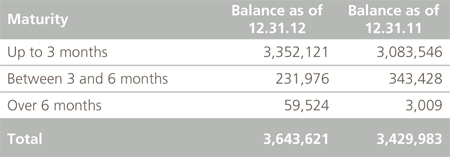

Partial billing that has not yet been settled by the clients and withholdings are included under the Trade and other receivables heading.