Abengoa

Abengoa

Annual Report 2012

- Legal and Economic-Financial Information

- Consolidated analytical report

- Consolidated statements of financial position

Consolidated statements of financial position

Consolidated statements of financial position

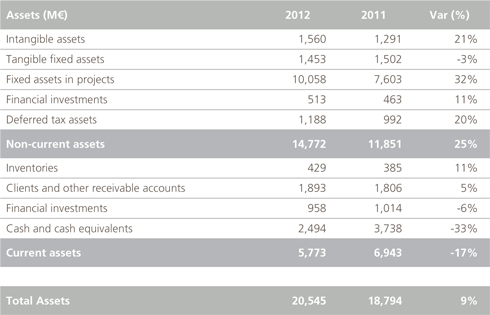

A summary of Abengoa’s consolidated balance sheet for 2012 and 2011 is given below, with the main variations:

- Non-current assets increased by 25% to €14,772 M primarily due to the increase in the fixed assets in projects for the solar business (solar plants in Spain, US and South Africa), electricity transmission line concessions in Brazil and Peru, the cogeneration plant in Mexico, the second generation bioenergy plant in Hugoton (US), and desalination plants in Algeria and China. These increases were partly offset by the sale of several transmission lines in Brazil.

- Current assets fell by -17% to €5,773 M, primarily driven by lower cash as a result of maturing financial debt and equity contributions to concession projects during the year.

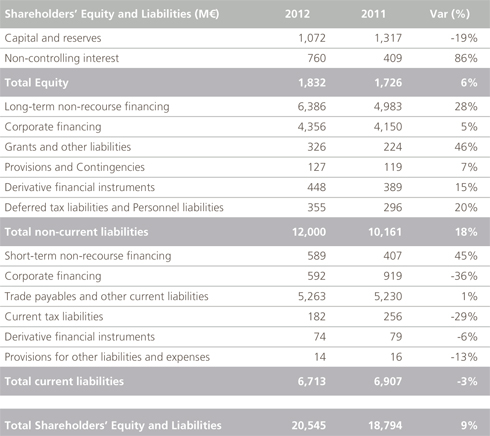

- Shareholders’ equity increased by 6% to €1,832 M, primarily due to the positive results for the year, and the increase of noncontrolling interest in various Electricity Transmission Lines companies in Brazil.

- Non-current liabilities increased by 18% to €12,000 M, mainly due to the increase in long term non-recourse financing, which rose from €4,983 M in 2011 to €6,386 M in 2012.

- Current liabilities decreased by -3% to €6,713 M, driven mainly by the reclassification of the syndicated financing as long term, following its refinancing during the year 2012.

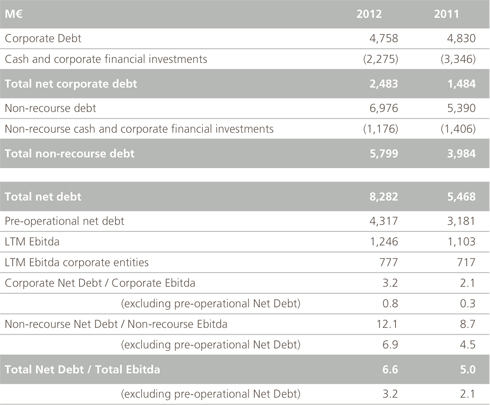

Net Debt Composition

© 2012 Abengoa. All rights reserved