Abengoa

Abengoa

Annual Report 2011

- Legal and Economic-Financial Information

- Consolidated analytical report

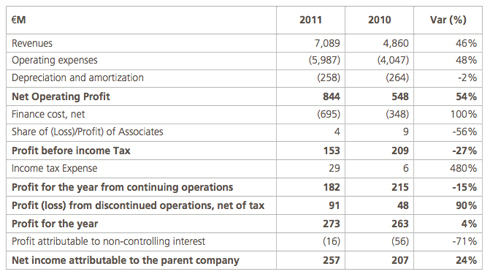

- Consolidated income statement

Revenues

Abengoa’s consolidated revenues to December, 31 2011 reached €7,089 M, a 46% increase from the previous year, mainly due to:

- Revenues increase in Engineering and Construction due to the construction on thermosolar plants in Spain and the 280 MW Solana concentrating solar power plant in Arizona, the significant progress in the construction of the Tabasco Cogeneration Plant (Mexico) and high voltage lines and current transmission substations in Madeira (Brazil), as well as in the construction of Manaus high voltage line (Brazil).

- Increase in prices of commodities and contribution for the full year of new bioethanol plants in Indiana and Illinois (which became operational during the first half of 2010), as well as Netherlands (which came into operations during the second half of 2010), as well as the beginning of operations of two cogeneration plants in the state of São Paulo.

- Higher industrial waste volume treated, and higher commodities prices.

Ebitda

Abengoa’s EBITDA figure to December, 31 2011 reached €1,103 M, a 36% increase from the previous year, mainly due to:

- Contribution for the full year of new Solar Power plants in Spain (Solnova 1, Solnova 3 and Solnova 4), which came into operation at different times during 2010 as well as the beginning of operation of SPP1, the hybrid solar/gas plant in Algeria during the first half of 2011, and Helioenergy 1, a 50 MW thermosolar plant in Spain during third quarter of 2011.

- Contribution for the full year of new high voltage Transmissions Lines in Brazil (ATE IV-VII), which came into production at different times during 2010, as well as the beginning of operation of the ATN transmission line, in Peru.

- Excluding the effect of the capital gains recorded in 2010 and 2011 derived from the sale of transmission lines in Brazil (+€45 M in 2011 and +€69 M in 2010), EBITDA would have increased by 45%.

Finance cost, net

Net financial expenses increased from -€348 M in 2010 to -€695 M in 2011 primarily due to new solar plants, ethanol plants and transmission lines, coming online in the year with financial cost being taken to P&L; increase in interests accrued by bonds of Abengoa and interest expenses on the bonds that were issued in the last quarter of 2010, as well as the negative valuation of the embedded derivatives in Abengoa’s convertible bonds and the time value of the interest rate caps.

Income tax expense

Corporate income tax benefit increased from €6 M in 2010 to €29 M in 2011. This figure was affected by various incentives for exporting goods and services from Spain, for investment and commitments to R&D+i activities, the contribution to Abengoa’s profit from results from other countries, as well as prevailing tax legislation.

Profit for the year from continuing operations

Given the above, Abengoa’s income from continuing operations decreased by -15% in 2011 from €215 M in 2010 to €182 M in 2011.

Excluding the after-tax effect of the capital gains recorded in 2010 and 2011 derived from the sale of transmission lines in Brazil (€+43 M in 2011 and €+46 M in 2010), the negative valuation of the embedded derivative of the convertible bonds (€-21 M in 2011 and €+30 M in 2010), as well as the time value of the interest rate hedging caps (€-47 M in 2011), profit for the year from continuing operations for the year ended December 31, 2011 would amount to €207 M in comparison to €140 M for the year ended December 31, 2010, resulting in a 48% increase.

Profit from discontinued operations, net of tax

This heading includes the net impact of €91 M (including gain) from the sale of the remaining stake in Telvent GIT. Likewise, 2010 Telvent figures have been reclassified and are now considered as discontinued operations for comparative purposes.

Profit for the year attributable to the parent company

The profit attributable to Abengoa’s parent company increased by 24% from €207 M achieved in 2010 to €207 M in 2011. Excluding the same impacts outlined above, as well as discontinued operations, it would have increased by 75%.

© 2011 Abengoa. All rights reserved