Abengoa

Abengoa

Annual Report 2011

- Legal and Economic-Financial Information

- 2011 consolidated financial statements

- Notes to the consolidated financial statements

-

Note 1.- General information and business overview

Abengoa, S.A. is the parent company of the Abengoa Group (referred to hereinafter as “Abengoa”, “the Group” or “the Company”), which at the end of 2011, was made up of 583 companies: the parent company itself, 529 subsidiaries, 18 associates and 35 joint ventures. Additionally, as of the end of 2011, certain group companies were participating in 241 temporary joint ventures (UTE) and, furthermore, the Group held a number of interests, of less than 20%, in several other entities.

Abengoa, S.A. was incorporated in Seville, Spain on January 4, 1941 as a Limited Partnership and was subsequently changed to a Limited Corporation (“S.A” in Spain) on March 20, 1952. Its registered office was at Avenida de la Buhaira, 2, Seville (Spain). On April 10, 2011, the Board of Directors agreed to move the registered office to Campus Palmas Altas, C/ Energía Solar nº 1, 41014 Seville, amending Article 2 of the Bylaws accordingly and recording the new address in the Companies Register.

The Group’s corporate purpose is set out in Article 3 of the Articles of Association. It covers a wide range of activities, although Abengoa is principally an applied engineering and equipment manufacturer, providing integrated project solutions to customers in the following sectors: Engineering, Telecommunications, Transport, Water Utilities, Environmental, Industrial and Service.

All the shares are represented by book entries, and have been listed on the Madrid and Barcelona Stock Exchange and on the Spanish Stock Exchange Electronic Trading System (Electronic Market) since November 29, 1996. The Company regularly facilitates financial information on a six month and quarterly basis.

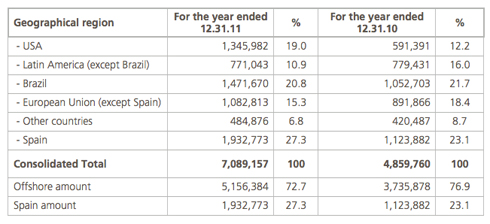

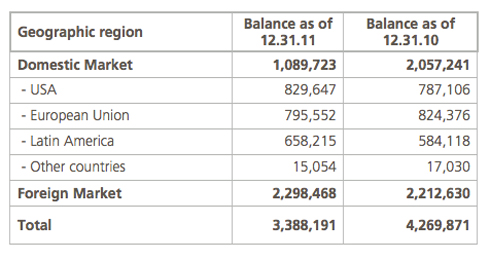

Abengoa is an international company that applies innovative technology solutions for sustainable development in the energy and environmental industries, generating energy from the sun, producing biofuels, desalinating sea water or recycling industrial waste.

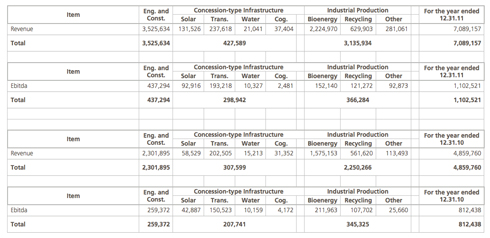

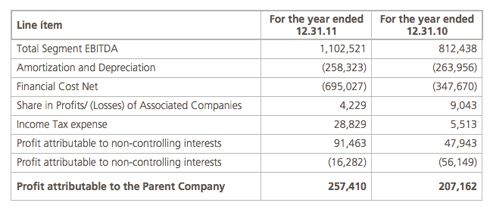

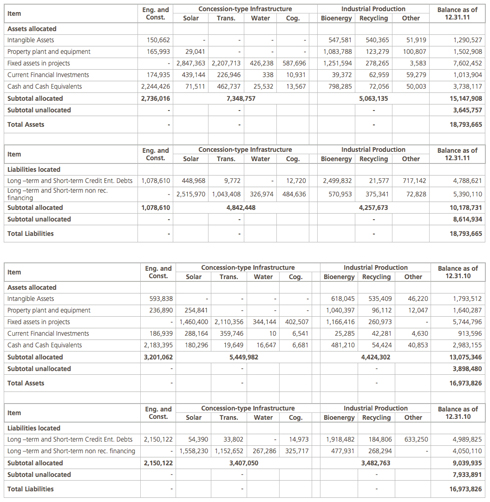

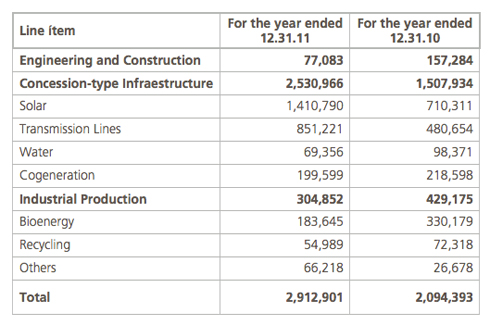

During the 2011 fiscal year, the changes that occurred in the organization of the Group entailed, among other things, the re-definition of the activities and segments considered by the Group and the re-definition of its Chief Operating Decision Maker in the figures of the Chairman and CEO of the Company in line with the applicable accounting standards. As a result of these charges, 8 operating segments have been identified, which are grouped into 3 main business activities (Engineering and Construction, Concession-type Infrastructures and Industrial Production).

These activities are focused in the energy and environmental industries and integrate operations in the value chain including R+D+i, projects development, engineering and construction, operating and maintaining the assets of the company and of third parties.

Abengoa’s activities are organized to take advantage of its presence worldwide and to use the experience in engineering and technology to strengthen its leadership position in the segments that it serves.

Based on the above, Abengoa’s activity and the internal and external management of financial information is grouped under the following three activities which are in turn composed of operating segments as defined by the IFRS 8:

- Engineering and construction; relates to the segment that incorporates all of the company’s traditional activities in engineering and construction in the energy and environmental sectors, with over 70 years of experience in the market, in which the Company specializes in executing complex turn-key projects for solar-thermal power stations; hybrid gas-solar power plants; conventional power plants and biofuel plants, hydraulic infrastructures, including complex desalination plants; electrical transmission lines, etc. This activity covers one operating segment.

- Concession-type infrastructures; relates to the activity that groups together the company’s proprietary concession assets, in which revenues are regulated via long term sale contracts, such as take-or-pay agreements, or power or water purchase agreements. This activity includes the operation of electricity generation plants (solar, co-generation or wind) and desalination plants, as well as transmission power lines. These assets generate no demand risk and our efforts can therefore focus on operating them as efficiently as possible.

This activity is currently composed of four operating segments:

-

Solar – Operation and maintenance of solar energy plants, mainly using solar-thermal technology;

-

Transmission – Operation and maintenance of high-voltage transmission power line infrastructures;

-

Water – Operation and maintenance of facilities for generating, transporting, treating and managing water, including desalination and water treatment and purification plants;

-

Cogeneration – Operation and maintenance of conventional electricity plants.

-

Industrial production; relates to the activity that groups Abengoa’s businesses with a high technological component, such as biofuels, industrial waste recycling or the development of solar-thermal technology. The company holds an important leadership position in these activities in the geographical markets in which it operates.

This activity is composed of three operating segments:

-

Biofuels – Production and development of biofuels, mainly bioethanol for transport, which uses cereals, sugar cane and oil seeds (soya, rape and palm) as raw materials.

-

Recycling – Industrial waste recycling, principally steel dust, aluminum and zinc.

-

Other – This segment includes those activities related to the development of solar-thermal technology, water management technology and innovative technology businesses such as hydrogen energy or the management of energy crops.

These Consolidated Financial Statements were approved by the Board of Directors on February 23, 2012.

All public documents on Abengoa may be viewed at www.abengoa.com.

- Engineering and construction; relates to the segment that incorporates all of the company’s traditional activities in engineering and construction in the energy and environmental sectors, with over 70 years of experience in the market, in which the Company specializes in executing complex turn-key projects for solar-thermal power stations; hybrid gas-solar power plants; conventional power plants and biofuel plants, hydraulic infrastructures, including complex desalination plants; electrical transmission lines, etc. This activity covers one operating segment.

-

Nota 02.- Resumen de las principales políticas contables

The significant accounting policies adopted in the preparation of the accompanying Consolidated Financial Statements are set forth below:

2.1. Basis of presentation

The Consolidated Financial Statements for the year ended December 31, 2011 have been prepared in accordance with International Financial Reporting Standards, as adopted for use within the European Union (herein, IFRS-EU).

Unless stated otherwise, the accounting policies as set forth below have been applied consistently throughout all periods shown within these Consolidated Financial Statements.

The Consolidated Financial Statements have been prepared under the historical cost convention, as modified by the revaluation of available-for-sale financial assets and financial assets and financial liabilities (including derivative instruments) at fair value through profit or loss.

The preparation of the Consolidated Financial Statements under IFRS-EU requires the use of certain critical accounting estimates. It also requires that Management exercises its judgment in the process of applying Abengoa’s accounting policies. Note 3 provides further information on those areas which involved a greater degree of judgment or areas of complexity for which the assumptions or estimates made are significant to the financial statements.

The figures included within the components of the Consolidated Financial Statements (Consolidated Statement of Financial Position, Consolidated Income Statement, Consolidated Statement of Comprehensive Income, Consolidated Statement of Changes in Equity, Consolidated Cash Flow Statement and these notes herein) are, unless stated to the contrary, all expressed in thousands of Euros (€).Unless indicated otherwise, the percentage of the stake in the share capital of Group companies presented herein includes both direct and indirect stakes corresponding to the Group companies that are direct shareholders.

2.1.1. IFRIC12 - Service concession arrangements

As a result of IFRIC 12 on Service Concession Arrangements coming into effect on January 1, 2010, in accordance with IAS 8 as established in paragraph 29 of the aforementioned IFRIC 12, Abengoa began to apply this interpretation retrospectively with no significant impact on its Consolidated Financial Statements as at the end of 2010, since it had already been applying a similar accounting policy to the interpretation recurrently and in anticipation of the changes, for certain concession assets mainly related to the international concession business for electricity transmission, desalination and solar-thermal plants.

At the date of this application, the Company carried out an analysis of other agreements in the Group and identified further infrastructures, specifically solar-thermal plants in Spain included under the special arrangements of RD 661/2007 and recorded in the pre-assignment register in November 2009, which could potentially be classified as service concession arrangements.

Nevertheless, at the end of 2010, the company decided that it needed to carry out a more in-depth analysis of the issue since the reasons that justified the accounting application of the interpretation had not been sufficiently proven based on the information available at that date. The application of IFRIC 12 therefore had no significant impact on Abengoa’s Consolidated Financial Statements for 2010.

In 2011, Abengoa has continued to analyse the possible accounting application of IFRIC 12 to its solar-thermal plants in Spain, having obtained numerous legal, technical and accounting reports from independent third parties during the course of the year. In September 2011, when the latest reports from accounting experts were received, the Company concluded that it was required to apply IFRIC 12 to its solar-thermal plants in Spain included under the special scheme of Royal Decree 661/2007 and recorded in the pre-assignment register in November 2009, just as it does for its other concession assets, based on these reports and the newly acquired knowledge from the analysis performed. Therefore, in accordance with paragraph 52 of IAS 8 on Accounting Policies, Changes in Accounting Estimates and Errors, the Company began to apply IFRIC 12 prospectively to these plants from September 1, 2011.

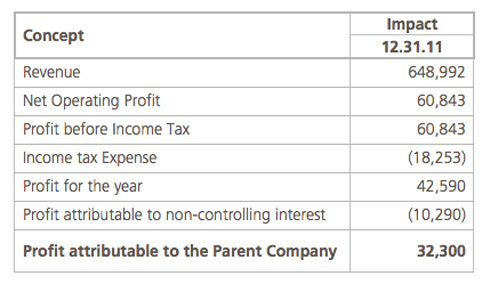

The application of IFRIC 12 to these assets produced an increase in revenues and in profits for the fiscal year 2011. The table below shows the impact of said application on the 2011 fiscal year’s Consolidated Income Statement:

See Note 10.1 for details on amounts subject to the application of IFRIC 12 on Service Concession Agreements.2.1.2. Recently issued accounting standards

The IASB recently approved and published certain Accounting Standards amending the existing standards, as well as IFRIC interpretations, from which the Group adopted the following measures:

a) Standards, interpretations and amendments thereto effective from January 1, 2011 applied by the Group:

- IAS 24 ‘Related party disclosures’

The revised standard clarifies and simplifies the definition of a related party and removes the requirement for government-related entities to disclose details of all transactions with the government and other government-related entities. Early adoption is permitted partial or totally in relation with reduced disclosures for governmental related entities.

- IAS 32 (amendment) ‘Classification of rights issues’.

The amendment addresses the accounting for rights issues (redeemable stocks, options, or warrants) that are denominated in a currency other than the functional currency of the issuer. Provided certain conditions are met, such rights issues are now classified as equity regardless of the currency in which the exercise price is denominated.

- IFRIC 19, ‘Extinguishing financial liabilities with equity instruments’

The interpretation clarifies the accounting by an entity when the terms of a financial liability are renegotiated and result in the entity issuing equity instruments to a creditor of the entity to extinguish all or part of the financial liability (debt for equity swap). It requires a gain or loss to be recognized in profit or loss, which is measured as the difference between the carrying amount of the financial liability and the fair value of the equity instruments issued. If the fair value of the equity instruments issued cannot be reliably measured, the equity instruments should be measured to reflect the fair value of the financial liability extinguished the amendments should be applied retrospectively to the earliest comparative period presented.

- IFRS 1 (amendment), “Limited Exemption from Comparative IFRS 7 Disclosures for First-time Adopters”. (The amendments are effective for annual periods beginning July 1, 2010).

- IFRIC 14 (amendment), ‘Prepayments of a minimum funding requirement’.

- Improvements to IFRSs published by the IASB in May 2010 adapted by the EU as of February, 2011. The improvements affect IFRS 1 ´First-time adoption of IFRS´, IFRS 3 ´Business Combination´, IFRS 7 ´Financial Instruments: disclosures´, IAS 1´Presentation of Financial Statements´, IAS27 ´Consolidated and separated financial statements´, IAS 34 ´Interim financial reporting´, and IFRIC 13 ´Customer loyalty programs’. These amendments are mandatory as from January 1, 2011 except amendments to IFRS 3 and IAS 27 that apply to periods starting as from July 1, 2010.

These standards, interpretations and amendments did not have a significant impact on the Group’s Consolidated Financial Statements.

b) Standards, interpretations and amendments issued but not yet effective and not early adopted by the Group.

- IFRS 7 (amendment), ´Financial Instruments´. This amendment modified the required disclosures about the risk exposures relating to transfers of financial assets. Among others, these modifications could affect the sale transactions of financial assets, the factoring agreements, financial assets and the loan titles agreements

This amendment is mandatory as from January 1, 2011, even though early adoption is permitted.

The Company does not expect that the revised standard will have a material impact on the Group’s Consolidated Financial Statements.

c) Standards, interpretations and amendments that have not been adopted by the European Union:

- IFRS 9, ´Financial Instruments´. This Standard will be effective as from January 1, 2015.

- IFRS 10, ´Consolidated Financial Statements´. IFRS 10 establish principles for the presentation and preparation of Consolidated Financial Statements when an entity controls one or more other entity to present Consolidated Financial Statements. The standard defines the principle of control, and establishes controls as the basis for consolidation. This Standard will be effective as from January 1, 2013.

- IFRS 11 ´Joint Arrangements´. This Standard will be effective as from January 1, 2013.

- IFRS 12 ´Disclosures of interests in other entities´. This Standard will be effective as from January 1, 2013.

- IAS 27 (amendment) ´Consolidated and separated financial statements´. IAS 27 amendment is mandatory as from January 1, 2013.

- IAS 28 (amendment) ´Associates and joint ventures´. IAS 28 includes the requirements for joint ventures, as well as associates, to be equity accounted following the issue of IFRS 11. IAS 28 is mandatory as from January 1, 2013.

- IFRS 13 ´Fair value measurement´. This Standard will be effective as from January 1, 2013.

- IAS 1 (amendment) ´Financial statements presentation´. The main change resulting from these amendments is a requirement for entities to group items presented in ‘other comprehensive income’ (OCI) on the basis of whether they are potentially classifiable to profit or loss subsequently (reclassification adjustments). This Standard will be effective as from January 1, 2012.

- IAS 19 (amendment) ´Employee benefits´. IAS 19 amendment is mandatory as from January 1, 2013.

- IAS 32 (amendment) and IFRS 7 (amendment) ‘Compensation of financial assets for financial liabilities’. IAS 32 amendment is mandatory as from January 1, 2014 and is to be applied retroactively. IFRS 7 amendment is mandatory as from January 1, 2013 and is to be applied retroactively.

The Group is analyzing the impact that the new regulations, modifications and interpretations may bear on the Consolidated Financial Statements of the group in case they are adopted.2.2. Principles of consolidation

In order to provide information on a consistent basis, the same principles and standards as applied to the parent company have been applied to all other entities.All subsidiaries, associates and joint ventures included in the consolidation for the years 2011 and 2010 that form the basis of these Consolidated Financial Statements are set out in Appendixes I (XII), II (XIII) and III (XIV), respectively.

Note 6 of this Consolidated Report reflect the information on the changes in the Group composition.

a) Subsidiaries

Subsidiaries are those entities over which Abengoa has the power to govern financial and operational policies to obtain profits from their operations.

It is assumed that a company has control if, directly or indirectly (through other subsidiaries),it holds more than half of the voting rights of another company, except in exceptional circumstances in which it may be clearly demonstrated that such possession does not entail control.

Control shall also be said to exist if a company holds half or less of the voting rights of another but holds certain participating rights:

-

power over more than half of the voting rights under an agreement with other investors;

-

power to manage the financial and operating policies of the company, by virtue of a legal provision, a bylaw or some kind of agreement with the aim of obtaining profits from its operations;

-

power to appoint or dismiss the majority of the members of the Board of Directors or equivalent governing body that is actually in control of the company; or

-

power to cast the majority of the votes in meetings of the Board of Directors or equivalent governing body that controls the company.

Subsidiaries are accounted for on a fully consolidated basis as of the date upon which control was transferred to the Group, and are excluded from the consolidation as of the date upon which control ceases to exist.

The group uses the acquisition method to account for business combinations. The consideration transferred for the acquisition of a subsidiary is the fair value of the assets transferred, the liabilities incurred and the equity interests issued by the group. The consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Acquisition-related costs are expensed as incurred. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the acquisition date. On an acquisition-by-acquisition basis, the group recognizes any non-controlling interest in the acquiree either at fair value or at the non-controlling interest’s proportionate share of the acquireer’s net assets.

Investments in subsidiaries are accounted for at cost less impairment, where applicable. Cost is adjusted to reflect changes in consideration arising from contingent consideration amendments. Cost also includes direct attributable costs of investment.

The value of non-controlling interest in equity and the consolidated results are shown, respectively, under 'Non-controlling Interest' of the Consolidated Statement of Financial Position and “Profit attributable to non-controlling interest” in the Consolidated Income Statement.

Profit for the year and each component of Other comprehensive income is attributed to the owners of the parent and non-controlling interest in accordance with their percentage of ownership. Total Comprehensive income is attributed to the owners of the parent and non-controlling interest even if this results in a debit balance of the latter.

Intercompany transactions and unrealized gains are eliminated and deferred until such gains are realized by the Group, usually through transactions with third parties.

Intercompany balances between entities of the Group included in the consolidation are eliminated during the consolidation process.

In compliance with Article 155 of Spanish Corporate Law, the parent company has notified to all these companies, either by itself or through another subsidiary, that it owns more than 10 per 100 of their capital.

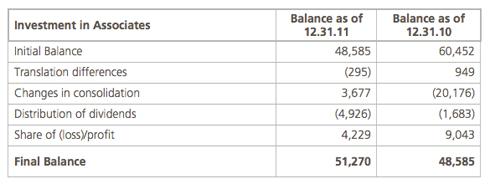

b) Associates

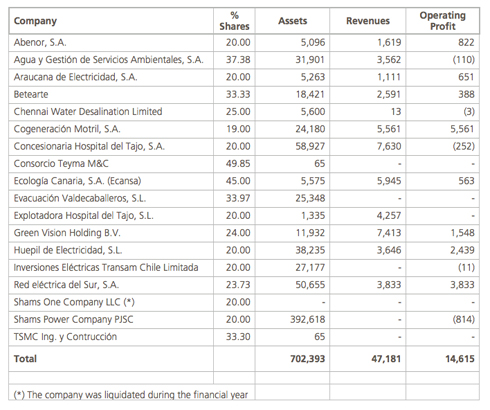

Associates are entities over which Abengoa has a significant influence but does not have control and, generally, involve an interest representing between 20% and 50% of the voting rights. Investments in associates are consolidated by the equity method and are initially recognized at cost. The Group’s investment in associates includes goodwill identified upon acquisition (net of any accumulated impairment loss).

The share in losses or gains after the acquisition of associates is recognized in the Consolidated Income Statement and the share in movements in reserves subsequent to the acquisition is recognized in the reserves. Movements subsequent to the acquisition are adjusted against the carrying value of the investment. When the share in an associate’s losses is equal to or higher than the interest in the company, including any unsecured accounts receivable, additional losses are not recognized unless Abengoa has acquired any obligations or make any payments in the associate’s name.

Results between the Group and its associates are eliminated to the extent of the Group’s holding in the associate. Additionally, unrealized gains are eliminated, unless the transaction provides evidence of impairment to the asset being transferred. The accounting policies of the associates have been changed where necessary to ensure consistency with the policies adopted by the Group.

In compliance with Article 155 of Spanish Corporate Law, the parent company has notified to all these companies, either by itself or through another subsidiary, that it owns more than 10 per 100 of their capital.

c) Joint ventures

Joint ventures exist when, by virtue of a contractual arrangement, an entity is jointly managed and owned by Abengoa and third parties outside the Group. These arrangements are based upon an agreement between all the parties that confer to those parties joint control over the financial and operating policies of the entity. Holdings in joint ventures are consolidated using the proportional consolidation method.

The Group consolidates the assets, liabilities, income and expenses, and cash flows of the joint ventures on a line-by-line basis with similar lines in the Group’s accounts.

The Group recognizes its share of gains and losses arising from the sale of Group assets to the joint venture for the portion that relates to other investors. Conversely, the Group does not recognize its share in any gains or losses of the joint venture that result from the purchase of assets from the joint venture by a Group company until those assets have been sold to third parties. Any loss on the transaction is recognized immediately if there is evidence of a reduction in the net realizable value of current assets or an impairment loss. Where necessary, the accounting policies of the joint ventures are adapted so as to ensure consistency with those adopted by the Group.

A business combination involving entities or businesses under common control is a business combination in which all entities or businesses that are combined are controlled, ultimately, by the same party or parties, before and after combination takes place, and this control is not transitory.

When the group experienced a business combination under common control, the assets and liabilities acquired are recorded at the same book amount that were registered previously, and they are not valued at fair value. No goodwill related to the transaction is recognised. Any difference between the purchase price and the net book value of net assets acquired is recognized in equity.

There are no contingents liabilities in the Group’s own shares in joint ventures, neither are there contingent liabilities in the joint ventures themselves.

d) Temporary joint ventures

“Unión Temporal de Empresas” (UTE) are temporary joint ventures generally formed to execute specific commercial and/or industrial projects in a wide variety of areas and particularly in the fields of engineering and construction and infrastructure projects.

They are normally used to combine the characteristics and qualifications of the UTE’s investors into a single proposal in order to obtain the most favorable technical assessment possible.

UTEs are normally limited as standalone entities with limited action, since, although they may enter into commitments in their own name, such commitments are generally undertaken by their investors, in proportion to each investor’s share in the UTE.

The investors’ shares in the UTE normally depend on their contributions (quantitative or qualitative) to the project, are limited to their own tasks and are intended solely to generate their own specific results. Each investor is responsible for executing its own tasks and does so in its own interests, following specific organizational guidelines that comply with the general guidelines coordinated by all the participants in the project.

Overall project management and coordination does not generally extend beyond execution and preparation or presentation of all the technical and financial information and documentation required to carry out the project as a whole. The fact that one of the UTE’s investors acts as project manager does not affect its position or share in the UTE.

The UTE’s investors are collectively responsible for technical issues, although there are strict pari passu clauses that assign the specific consequences of each investor’s correct or incorrect actions.

UTEs are not variable-interest or special-purpose entities. UTEs do not usually own assets or liabilities on a standalone basis. Their activity is conducted for a specific period of time that is normally limited to the execution of the project. The UTE may own certain fixed assets used in carrying out its activity, although in this case they are generally acquired and used jointly by all the UTE’s investors, for a period similar to the project’s duration, or prior agreements are reached by the investors regarding the manner and amounts of the assignment or disposal of the UTE’s assets on completion of the project.

The proportional part of the UTE’s Statement of Financial Position and Income Statement is integrated into the Statement of Financial Position and the Income Statement of the participating company in proportion to its interest in the UTE.

There are no contingent liabilities in relation to the Group’s shareholdings in the UTE, nor contingent liabilities in the UTE themselves.

e) Transactions with non-controlling interests

The group treats transactions with non-controlling interests as transactions with equity owners of the group. When the Group acquires non-controlling interests, the difference between any consideration paid and the carrying value of the proportionate share of net assets acquired is recorded in equity. Gains or losses on disposals of non-controlling interests are also recorded in equity.

When the group ceases to have control or significant influence, any retained interest in the entity is remeasured to its fair value, with the change in carrying amount recognized in profit or loss. The fair value is the initial carrying amount for the purposes of subsequently accounting for the retained interest as an associate, joint venture or financial asset. In addition, any amounts previously recognized in other comprehensive income in respect of that entity are accounted for as if the group had directly disposed of the related assets or liabilities. This may mean that amounts previously recognized in Statement of Comprehensive Income are reclassified to profit or loss.

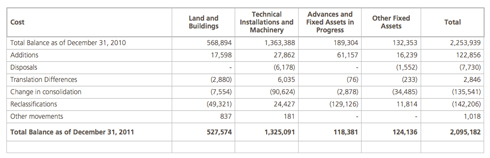

2.3. Property, plant and equipment

2.3.1. Presentation

For the purposes of preparing these Consolidated Financial Statements, property, plant and equipment has been divided into the following categories:

a) Property, plant and equipment

This category includes property, plant and equipment of companies or project companies which have been self-financed or financed through external financing with recourse facilities.

b) Property, plant and equipment in Projects

This category includes property, plant and equipment of companies or project companies which are financed through non-recourse project finance (for further details see Notes 2.4 and 10 on Fixed Assets in Projects).

2.3.2. Measurement

In general, items included within property, plant and equipment are measured at historical cost less depreciation and impairment losses, with the exception of land, which is presented at cost less any impairment losses.

The historical cost includes all expenses directly attributable to the acquisition of property, plant and equipment.

Subsequent costs are capitalized in the asset’s carrying amount or are recognized as a separate asset when it is probable that future economic benefits associated with that asset can be separately and reliably identified.

All other repair and maintenance costs are charged to the Consolidated Income Statement in the period in which they are incurred.

Work carried out by the Group on its own property, plant and equipment is valued at production cost and is shown as ordinary income in the Consolidated Income Statement of the company which undertook the work.

In those projects in which the asset is constructed internally by the group and that are not under the scope of IFRIC 12 on Service Concession Agreements (see Note 2.24), the entire intragroup income and expenses are eliminated so that the assets are reflected at their acquisition cost.

In addition, such internal construction projects are capitalized as an increase in the carrying amount of the asset, with regard to both financing obtained specifically for each project and non-project-specific financing from financial institutions. The capitalization of borrowing costs ceases at the moment when a development process of an asset is suspended, applying such cessation during the extension of the suspension period.

Costs incurred during the construction period may also include gains or losses from foreign-currency cash-flow hedging instruments for the acquisition of property, plant and equipment in foreign currency, which have been transferred directly from equity.

With regard to investments in property, plant and equipment located on land belonging to third parties, an initial estimate of the costs of dismantling the asset and restoring the site to its original condition is also included in the carrying amount of the asset. Such costs are recorded at their net present value in accordance with IAS 37.

The annual depreciation rates of property, plant and equipment (including property, plant and equipment in projects) are as follows:

Waste ponds and similar assets are depreciated on the basis of the volume of waste in the ponds.The assets’ residual values and useful economic lives are reviewed, and adjusted if necessary, at the end of the accounting period of the company which owns the asset.

When the carrying amount of an asset is greater than its recoverable amount, the carrying amount is reduced immediately to reflect the lower recoverable amount.

Gains and losses on the disposal of property, plant and equipment, calculated as proceeds received less the asset’s net carrying amount, are recognized in the Consolidated Income Statement, within the caption “Other operating income”.

2.4. Fixed assets in projects (project finance)

This category includes property, plant and equipment and intangible assets of consolidated companies which are financed through Non-recourse Project Finance, that are raised specifically and solely to finance individual projects as detailed in the terms of the loan agreement.

These non-recourse Project Finance assets are generally the result of projects which consist of the design, construction, financing, application and maintenance of large-scale complex operational assets or infrastructures, which are owned by the company or are under concession for a period of time. The projects are initially financed through non-recourse medium-term bridge loans and later by Non-recourse Project Finance.

In this respect, the basis of the financing agreement between the Company and the bank lies in the allocation of the cash flows generated by the project to the repayment of the principal amount and interest expenses, excluding or limiting the amount secured by other assets, in such a way that the bank recovers the investment solely through the cash flows generated by the project financed, any other debt being subordinated to the debt arising from the non-recourse financing applied to projects until the non-recourse debt has been fully repaid. For this reason, fixed assets in projects are separately reported on the face of the Consolidated Statement of Financial Position, as is the related non-recourse debt in the liability section of the same statement.

In addition, within the fixed assets in projects line item of the Consolidated Statement of Financial Position, assets are sub-classified under the following two sub-headings, depending upon their nature and their accounting treatment:

- Property, plant and equipment: includes tangible fixed assets which are financed through a non-recourse loan and are not subject to a concession agreement as described below. Their accounting treatment is described in Note 2.3.

- Intangible assets: includes fixed assets financed through non-recourse loans, mainly related to Service Concession Agreements, which are accounted for as intangible assets in accordance with IFRIC 12 (see Note 2.24). The rest of the assets shown under this heading are the intangible assets owned by the project company, the description and accounting treatment of which are set forth in Note 2.5.

Non-recourse project finance typically includes the following guarantees:

- Shares of the project developers are pledged.

- Assignment of collection rights.

- Limitations on the availability of assets relating to the project.

- Compliance with debt coverage ratios.

- Subordination of the payment of interest and dividends to meeting these ratios.

Once the project finance has been repaid and the non-recourse debt and related guarantees fully extinguished, any remaining net book value reported under this category are reclassified to the Property, Plant and Equipment or Intangible Assets line items, as applicable, in the Consolidated Statement of Financial Position.

2.5. Intangible assets

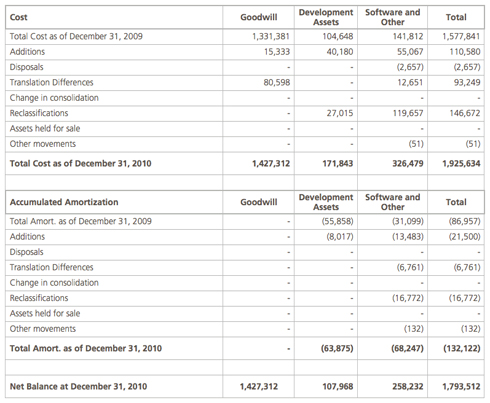

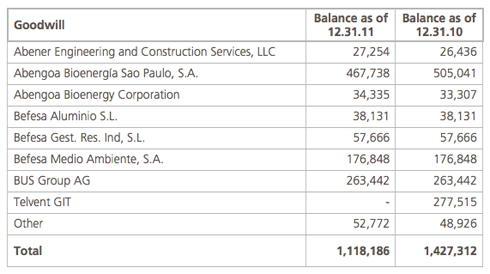

a) Goodwill

Goodwill is recognized as the excess of the sum of the considerations transferred, the amount of any non-controlling interest in the acquire and the fair value, on the date of acquisition, of the previously held interest in the acquiree over the fair value, at the acquisition date, of the identifiable assets acquired and the liabilities and contingent liabilities assumed. If the sum of the considerations transferred, the amount of any non-controlling interest in the acquiree and previously held interest in the acquiree is lower than the fair value of the net assets acquired and it represents a bargain purchase, the difference is recognized directly in the Income Statement.

Goodwill relating to the acquisition of subsidiaries is included in intangible assets, while goodwill relating to associates is included in investments in associates.

Goodwill is carried at cost less accumulated impairment losses (see Note 2.7). Goodwill is allocated to Cash Generating Units (CGU) for the purposes of impairment testing, these CGU’s being the units which are expected to benefit from the business combination that generated the goodwill.

Gains and losses on disposal of an entity include the carrying amount of goodwill relating to the entity sold.

b) Computer programs

Licenses for computer programs are capitalized on the basis of the original program, comprising purchase costs and preparation/installation cost directly associated with the program. Such costs are amortized over their estimated useful life. Development and maintenance costs are expensed to the Income Statement in the period in which they are incurred.

Costs directly related with the production of identifiable computer programs adapted to the needs of the Group and which are likely to generate economic benefit in excess of their costs for a period of one year are recognized as intangible assets if they fulfill the following conditions:

-

It is technically possible to complete the production of intangible asset in such a way that it is available for use or sale;

-

Management intends to complete the intangible asset for its use or sale;

-

The Company is able to use or sell the intangible asset;

-

There is availability of appropriate technical, financial or other resources to complete the development and to use or sell the intangible asset; and

-

Disbursements attributed to the intangible asset during its development may be reliably measured.

Costs directly related to the production of computer programs recognized as intangible assets are amortized over their estimated useful lives which do not normally exceed 10 years.

Costs that fail to meet the criteria above are recognized as expenses when incurred.

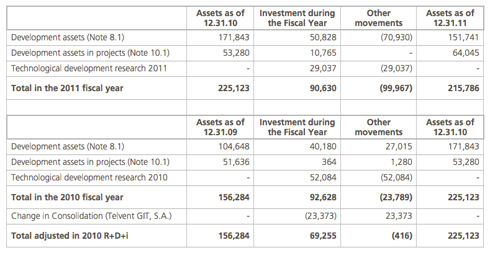

c) Research and development cost

Research costs are recognized as an expense in the period in which they are incurred and they are identified on a project by project basis.

Development costs (relating to the design and testing of new and improved products) are recognized as an intangible asset when all the following criteria are met:

-

It is probable that the project will be successful, taking into account its technical and commercial viability, so that the project will be available for its use or sale;

-

It is probable that the project will generate future economic benefits, in terms of both external sales or internal use;

-

Management intends to complete the project for its use or sale;

-

The Company is able to use or sell the intangible asset;

-

There is availability of appropriate technical, financial or other resources to complete the development and to use or sell the intangible asset; and

-

The costs of the project/product can be estimated reliably.

Once the product is in the market, the capitalized costs are amortized on a straight-line basis over the period for which the product is expected to generate economic benefits, which is normally 5 years, except for development assets related to the thermo-solar plant using tower technology which are amortized over 25 years.

Any other development costs are recognized as an expense in the period in which they are incurred and are not recognized as an asset in later periods.

Grants or subsidized loans obtained to finance research and development projects are recognized in the Income Statement following the rules of capitalization or expensing which have been described above.

Emission rights of greenhouse gases for own use

This heading recognizes greenhouse gas emissions rights obtained by the Group through allocation by the competent national authority, which are used against the emissions discharged in the course of the Group’s production activities. These emission rights are measured at their cost of acquisition and are derecognized from the Consolidated Statement of Financial Position when used, under the National Assignation Plan for Greenhouse Gas Permits or when they expire.

Emission rights are tested for impairment to establish whether their acquisition cost is greater than their fair value. If impairment is recognized and, subsequently, the market value of the rights recovers, the impairment loss is reversed through the Consolidated Income Statement, up to the limit of the original carrying value of the rights.

When emitting greenhouse gases into the atmosphere, the emitting company provides for the tonnage of CO2 emitted at the average purchase price per tone of rights acquired. Any emissions in excess of the value of the rights purchased in a certain period will give rise to a provision for the cost of the rights at that date.

In the event that the emission rights are not for own use but intended to be traded in the market, the contents of Note 2.12 will be applicable.

2.6. Borrowing costsInterest costs incurred in the construction of any qualifying asset are capitalized over the period required to complete and prepare the asset for its intended use (at Abengoa a qualifying asset is defined as an asset for which the production or preparation phase is longer than one year).

Costs incurred relating to non-recourse factoring are expensed when the factoring transaction is completed with the financial institution.

Remaining borrowing costs are expensed in the period in which they are incurred.

2.7. Impairment of non-financial assets

On a quarterly basis, Abengoa reviews its property, plant and equipment, intangible assets with finite and indefinite useful life and goodwill to identify any indicators of impairment. In case any indicator of impairment is identified, Abengoa reviews the asset to determine whether there has been any impairment.

To establish whether there has been any impairment of asset, it is necessary to calculate the asset’s recoverable amount.

The recoverable amount is the higher of its market value less costs to sell and the value in use, defined as the present value of the estimated future cash flows to be generated by the asset. In the event that the asset does not generate cash flows independently of other assets, Abengoa calculates the recoverable amount of the Cash-Generating Unit to which the asset belongs.

To calculate its value in use, the assumptions include a discount rate, growth rates and projected changes in both selling prices and costs. The discount rate is estimated by Management, pre-tax, to reflect both changes in the value of money over time and the risks associated with the specific Cash-Generating Unit. Growth rates and movements in prices and costs are projected based upon internal and industry projections and management experience respectively. Financial projections range between 5 and 10 years depending on the growth potential of each Cash Generating Unit (see Note 8.4.b).

In the event that the recoverable amount of an asset is lower than its carrying amount, an impairment charge for the difference between the recoverable amount and the carrying value of the asset is recorded in the Consolidated Income Statement under the item “Depreciation, amortization and impairment charges”. With the exception of goodwill, impairment losses recognized in prior periods which are later deemed to have been recovered are credited to the same income statement heading.

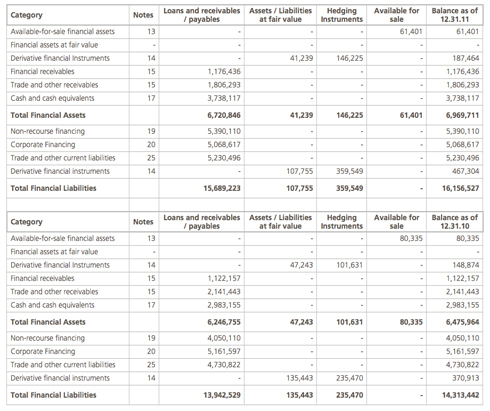

2.8. Financial Investments (current and non-current)

Financial investments are classified into the following categories, based primarily on the purpose for which they were acquired:

a) financial assets at fair value through profit and loss;

b) loans and accounts receivable;

c) financial assets held to maturity; and

d) financial assets available for sale.

Management determines the classification of each financial asset upon initial recognition, with their classification subsequently being reviewed at each year end.a) Financial assets at fair value through profit and loss

This category includes the financial assets acquired for trading and those initially designated at fair value through profit and loss. A financial asset is classified in this category if it is acquired mainly for the purpose of sale in the short term or if it is so designated by Management. Financial derivatives are also classified as acquired for trading unless they are designated as hedging instruments. The assets of this category are classified as current assets, if they are expected to be realized in less than 12 months after the year-end date. Otherwise, they are classified as non-current assets.

These financial assets are recognized initially at fair value, without including transaction costs. Subsequent changes in fair value of the assets are recognized under “Gains or losses from financial assets at fair value” within the “Finance income or expense” line of the Income Statement for the period.

b) Loans and accounts receivables

Loans and accounts receivables are considered to be non-derivative financial assets with fixed or determinable payments which are not listed on an active market. They are included as current assets except in cases in which they mature more than 12 months after the date of the Statement of Financial Position.

Following the application of IFRIC 12, certain assets under concession can qualify as financial receivables (see Note 2.24).

Loans and accounts receivables are initially recognized at fair value plus transaction costs. Subsequently to their initial recognition, loans and receivables are measured at amortized costs in accordance with the effective interest rate method. Interest calculated using the effective interest rate method is recognized under “Interest income from loans and debts” within the “Other net finance income/expense” line of the Income Statement.

c) Financial assets held to maturityThis category includes those financial assets which are expected to be held to maturity and which and are not derivatives and have fixed or determinable payments.

These assets are initially recognized at fair value plus transaction costs and subsequently at their amortized cost under the effective interest rate method. Interest calculated under the effective interest rate method is recognized under “Other finance income” within the “Other net finance income/expense” line of the Consolidated Income Statement.

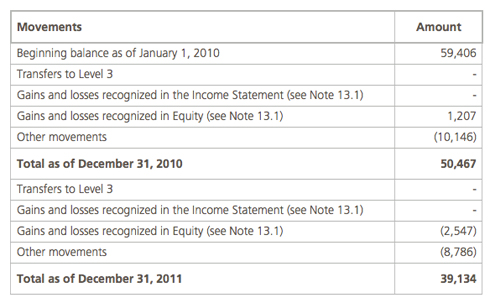

d) Activos financieros disponibles para la venta

This category includes non-derivative financial assets which do not fall within any of the previously mentioned categories. For Abengoa, they primarily comprise interests in other companies that are not consolidated. They are classified as non-current assets, unless Management anticipates the disposal of such investments within 12 months following the date of the company’s Statement of Financial Position.

Financial assets available for sale are recognized initially at fair value plus transaction costs. Subsequent changes in the fair value of these financial assets are recognized directly in equity, with the exception of translation differences of monetary assets, which are charged to the Consolidated Income Statement. Dividends from available-for-sale financial assets are recognized under “Other finance income” within the “Other net finance income/expense” line of the Consolidated Income Statement when the right to receive the dividend is established.

When available-for-sale financial assets are sold or are impaired, the accumulated amount recorded in equity is transferred to the Income Statement. The amount of the cumulative gain or loss that is reclassified from equity to profit or loss in cases when the financial assets are impaired is the difference between the acquisition cost (net of any principal repayment and amortization) and current fair value, less any impairment loss on that financial asset previously recognized in profit or loss. To establish whether the assets have been impaired, it is necessary to consider whether the reduction in their fair value is significantly below cost and whether it will be for a prolonged period of time. The accumulated loss is the difference between the acquisition cost and the fair value less any impairment losses. Impairment losses recognized in the Income Statement are not later reversed through the Income Statement.

Acquisitions and disposals of financial assets are recognized on the trading date, i.e. the date upon which there is a commitment to purchase or sell the asset. The investments are derecognized when the right to received cash flows from the investment has expired or has been transferred and all the risks and rewards derived from owning the asset have likewise been substantially transferred.

The fair value of listed financial assets is based upon current purchase prices. If the market for a given financial asset is not active (and for assets which are not listed), the fair value is established using valuation techniques such as considering recent free market transactions between interested and knowledgeable parties, in relation to other substantially similar instruments, analyzing discounted cash flows and option price fixing models, using to the greatest extent possible, information available in the market.

At the date of each Statement of Financial Position, the Group evaluates if there is any objective evidence that the value of any financial asset or any group of financial assets has been impaired.

2.9. Derivative financial instruments and hedging activities

Derivatives are initially recognized at fair value on the date that the derivative contract is entered into, and are subsequently measured at fair value. The basis for recognizing the gain or loss from changes in the fair value of the derivative depends upon whether the derivative is designated as a hedging instrument and, if so, the nature of the item being hedged.

The relationship between hedging instruments and hedged items is documented at the beginning of each transaction, as well as its objectives for risk management and strategy for undertaking various hedge transactions.

Both at the start of the hedge and subsequently on a continued basis at each closing date, an effectiveness test is performed on each of the derivative financial instruments designated as a hedge to justify being offset against changes in the fair value or cash flows relating to the hedged items.

The most common methods that have been chosen by the Group to measure the effectiveness of financial instruments designated to be hedges, are the dollar offset and regression methods.

Prospectivo: realizado a la fecha de designación y en cada cierre contable a efectos de determinar que la relación de cobertura sigue siendo efectiva y puede ser designada para el siguiente período.

Either of these methods are applied by the Group to perform the following effectiveness tests:

- Prospective effectiveness test: performed at the designation date and at each accounting closing date for the purposes of determining that the hedge relationship continues to be effective and can be designated in the subsequent period.

- Retrospective effectiveness test: performed at each accounting closing date in order to determine the ineffectiveness of the hedge, which must be recognized in the Consolidated Income Statement.

On this basis there are three types of derivative:

a) Fair value hedge for recognized assets and liabilities

Changes in fair value are recorded in the Income Statement, together with any changes in the fair value of the asset or liability that is being hedged.

b) Cash flow hedge for forecast transactions

The effective portion of a change in the fair value of cash flow hedges is recognized in equity, whilst the gain or loss relating to the ineffective portion is recognized immediately in the consolidated Income Statement.

However, when designating a one-side risk as a hedged risk the intrinsic value and time value of the financial hedge instrument are separated, recording the changes in the intrinsic value on equity, while changes in the time value are recorded in the Consolidated Income Statement. The Group has financial hedge instruments with these characteristics, such as interest rate options (caps), which are described in Note 14.

Amounts accumulated in equity are transferred to the Income Statement in periods in which the hedged item impacts profit and loss. However, when the forecast transaction which is hedged results in the recognition of a non-financial asset or liability, the gains and losses previously deferred in equity are included in the initial measurement of the cost of the asset or liability.

When the hedging instrument matures or is sold, or when it no longer meets the criteria required for hedge accounting, accumulated gains and losses recorded in equity remain as such until the forecast transaction is ultimately recognized in the Income Statement. However, if it becomes unlikely that the forecast transaction will actually take place, the accumulated gains and losses in equity are recognized immediately in the Income Statement.

c) Net investment hedges in foreing operation

Hedges of a net investment in a foreign operation, including the hedging of a monetary item considered part of a net investment, are recognized in a similar way to cash flow hedges:

-

The part of the loss or gain of the hedging instrument that is determined to be an effective hedge is directly recognized in equity and

-

The part that is ineffective is recognized in the Income Statement of the year

The profit or loss of the hedging instrument in relation to the part of the hedge that is directly recognized in equity is recognized in the Income Statement for the year when the foreign operation is sold or disposed of.The total fair value of hedging instruments is recorded as a non-current asset or liability when the hedged item is to mature at more than 12 months and as a current asset or liability if less than 12 months. Trading derivatives are classified as a current asset or liability.

Changes in the fair value of derivative instruments which do not qualify for hedge accounting are recognized immediately in the Consolidated Income Statement.

Contracts held for the purposes of receiving or making payment of non-financial elements in accordance with expected purchases, sales or use of goods (“own-use contracts”) of the Group are not recognized as derivative instruments, but as executory contracts. In the event that such contracts include embedded derivatives, they are recognized separately from the host contract, if the economic characteristics of the embedded derivative are not closely related to the economic characteristics of the host contract. The options contracted for the purchase or sale of non-financial elements which may be cancelled through cash outflows are not considered to be own-use contracts.

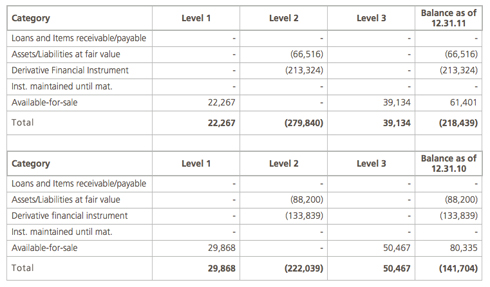

2.10. Fair value estimates

The fair value of financial instruments which are traded on active markets (such as officially listed derivatives, investments acquired for trading and available-for-sale instruments) is determined by the market value as at the date of the Statement of Financial Position.

A market is considered active when quoted prices are readily and regularly available from stock markets, financial intermediaries, among others, and these prices reflect current market transactions regularly occur between parties that operate independently.

The fair value of financial instruments which are not listed and do not have a readily available market value is determined by applying various valuation techniques and through assumptions based upon market conditions as of the date of the Statement of Financial Position. For long-term debt, the market prices of similar instruments are applied. For the remaining financial instruments, other techniques are used such as calculating the present value of estimated future cash flows. The fair value of interest rate swaps is calculated as the present value of estimated future cash flows. The fair value of forward exchange rate contracts is measured on the basis of market forward exchange rates as at the date of Statement of Financial Position.

The nominal value of receivables and payables less estimated impairment adjustments is assumed to be similar to their fair value due to their short-term nature. The fair value of financial liabilities is estimated as the present value of contractual future cash outflows, using market interest rate available to the Group for similar financial instruments.

Detailed information on fair values is included in Note 12.

2.11. Inventories

Inventories are stated at the lower of cost or net realizable value. In general, cost is determined by using the first-in-first-out (FIFO) method. The cost of finished goods and work in progress includes design costs, raw materials, direct labor, other direct costs and general manufacturing costs (assuming normal operating capacity). Borrowing costs are not included. The net realizable value is the estimated sales value in the normal course of business, less applicable variable selling costs.

Cost of inventories includes the transfer from equity of gains and losses on qualifying cash-flow hedging instruments related with the purchase of raw materials or with foreign exchange contracts.

2.12. Carbon emission credits (CERs)

Diversas sociedades de Abengoa llevan a cabo proyectos para disminuir las emisiones de CO2, mediante la participación en proyectos de Mecanismos de Desarrollo Limpio (MDL) y Acción Conjunta (AC) con los que se obtienen Créditos de Emisión de Carbono (CER) y Unidades de Reducción de Emisiones (URE) respectivamente. Los MDL son proyectos para países en vías de desarrollo no obligados al cumplimiento de menores emisiones, mientras que los AC están destinados a países en vías de desarrollo obligados al cumplimiento de menores emisiones.

Both projects are developed in two phases:

- Development phase, which, in turn, has the following stages:

-

Signing an ERPA agreement (Emission Reduction Purchase Agreement), to which certain offer costs are associated.

-

PDD (Project Design Document) development.

-

Obtaining a certification from a qualified third party regarding the project being developed and submitting the certification to the United Nations, where it is registered in a database.

Thus, the Group currently holds various agreements for consultancy services within the framework of the execution of Clean Development Mechanisms (CDM). Costs incurred in connection with such consultancy services are recognized by the Group as non-current receivables.

- Phase of annual verification of the reductions in CO2 emissions. After this verification, the company receives Carbon Emission Credits (CERs), which are registered in the National Register of Emission Rights. CERs are recorded as inventories and measured at market value.

Likewise, the company may hold Emission Allowances assigned by the competent EU Emission Allowance Authority (EUAs), which may also be measured at market price if held for sale. In case of the EUA are held for own use see Note 2.5.d.

Furthermore, there are carbon fund holdings aimed at financing the acquisition of emissions from projects which contribute to a reduction in greenhouse gas emissions in developing countries through CDM’s and JI’s, as discussed above. Certain Abengoa companies have holdings in such carbon reduction funds which are managed by an external Fund Management team. The Fund directs the resources of the funds to purchasing Emission Reductions through CDM’s and JI’s projects.

The company with holdings in the fund incurs in a number of costs (ownership commissions, prepayments and purchases of CER’s). From the start, the holding is recorded on the balance sheet based upon the original Carbon Emission Credit (CER) allocation agreement; however this amount will be allocated over the life of the fund. The price of the CER is fixed for each ERPA. Based upon its percentage holding, and on the fixed price of the CER, it receives a number of CER’s as obtained by the Fund from each project.

These contributions are considered as long-term investments and are recognized in the Consolidated Statements of Financial Position under the heading of “Other receivables accounts”.

2.13. Biological assets

Abengoa recognizes sugar cane in production as biological assets. The production period of sugar cane covers the period from preparation of the land and sowing the seedlings until the plant is ready for first production and harvesting. Biological assets are classified as property, plant and equipment in the Statement of Financial Position. Biological assets are recognized at fair value, calculated as the market value less estimated harvesting and transport costs.

Agricultural products harvested from biological assets, which in the case of Abengoa are cut sugar cane, are classified as inventories and measured at fair value less estimated sale costs at the point of sale or harvesting.

The reference used for the market value of biological assets and agricultural products is typically the projected cane crop price in April, provided on a monthly basis by the Cane, Sugar and Alcohol Producers Board (Consecana).

Gains or losses arising as a result of changes in the fair value of such assets are recognized in Net operating profit in the Consolidated Income Statement.

To obtain the fair value of the sugar cane while growing, a number of assumptions and estimates have been made in relation to the area of land sown, the estimated TRS (Total Recoverable Sugar contained within the cane) per tonne to be harvested and the average degree of growth of the agricultural product in the different areas sown.

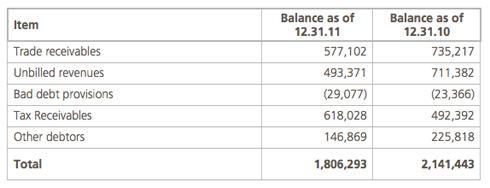

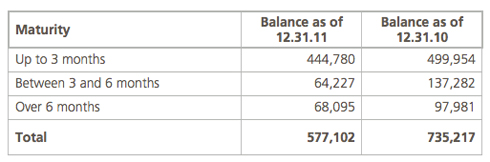

2.14. Clients and other receivables

Clients and other receivables relate to amounts due from customers for sales of goods and services rendered in the normal course of operation. These items are included under current assets, unless maturing in more than 12 months after the balance sheet date, in which case the items are recorded under non-current assets.

Clients and other receivables are recognized initially at fair value and are subsequently measured at amortized cost using the effective interest rate method, less provision for impairment. Trade receivables falling due in less than one year are carried at their face value at both initial recognition and subsequent measurement, provided that the effect of not discounting flows is not significant.

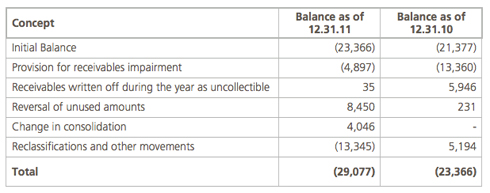

A provision for impairment of trade receivables is recorded when there is objective evidence that the Group will not be able to recover all amounts due as per the original terms of the receivables.

The existence of significant financial difficulties, the probability that the debtor is in bankruptcy or financial reorganization and the lack or delay in payments are considered evidence that the receivable is impaired.

The amount of the provision is the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the effective interest rate.

When a trade receivable is uncollectable, it is written off against the bad debt provision. Subsequent recovery of trade receivables which were previously written off is credited against “Other operating expenses” in the Income Statement.

Clients and other receivables which have been factored with financial entities are only removed from the Company’s accounting records and excluded from receivable assets on the Consolidated Statement of Financial Condition if all risks and rewards of ownership of the related financial assets have been transferred, comparing the Company’s exposure, before and after the transfer, to the variability in the amounts and the calendar of net cash flows from the transferred asset. Once the Company’s exposure to this variability has been eliminated or substantially reduced, the financial asset has been transferred, and is derecognized from the Consolidated Statement of Financial Condition (See Note 4.b).

2.15. Cash and cash equivalents

Cash and cash equivalents include cash in hand, cash in bank and other highly-liquid current investments with an original maturity of three months or less.

In the Consolidated Statement of Financial Position, bank overdrafts are classified as borrowings within current liabilities.

2.16. Share capital

Parent company shares are classified as equity.

Transaction costs directly attributable to new shares are presented in equity as a reduction, net of taxes, to the consideration received from the issue. Any amounts received from the sale of treasury shares, net of transaction costs, are classified in equity.

2.17. Government grants

Non-refundable capital grants are recognized at fair value when it is considered that there is a reasonable assurance that the grant will be received and that the necessary qualifying conditions, as agreed with the entity assigning the grant, will be adequately complied with.

Grants related to income are deferred in the Consolidated Statement of Financial Position and are recognized in “Other operating income” in the Income Statement based on the period necessary to match them with the costs they intend to compensate.

Grants related to fixed assets are recorded as non-current liabilities in the Consolidated Statement of Financial Position and are recognized in “Other operating income” in the Consolidated Income Statement on a straight-line basis over the estimated useful economic life of the assets.

2.18. Loans and borrowings

External resources are classified in the following categories:

a) Non-recourse financing applied to projects (project financing) (see note 19);

b) Corporate financing (see Note 20);

Loans and borrowings are initially recognized at fair value, net of transaction costs incurred. Borrowings are subsequently measured at amortized cost and any difference between the proceeds initially received (net of transaction costs incurred in obtaining such proceeds) and the repayment value is recognized in the Income Statement over the duration of the borrowing using the effective interest rate method.

Interest-free loans mainly granted for research and development projects are initially recognized at fair value. The difference between the cash-flow received and the fair value of the loan for development projects capitalized is recorded within “Grants and Other Liabilities” in the Consolidated Statement of Financial Position, allocating it to the income statement according to the useful life of the asset. The difference between the cash received and the fair value of the loan used as subsidies for research costs is recognized as income under “Grants” within the “Other operating income” in the Consolidated Income Statement when the costs are incurred. Where the loan is received before the costs are incurred, the difference is recognized as “Grants and other liabilities” of the Consolidated Statement of Financial Position.

Commissions paid for obtaining credit lines are recognized as transaction costs if it is probable that part or all of the credit line will be drawn down. If this is the case, commissions are deferred until the credit line is drawn down. If it is not probable that all or part of the credit line will be drawn down, commission costs are recorded as an advance payment for liquidity services and amortized over the period for which the credit line is available to the Group.

Loans and borrowings are classified as current liabilities unless an unconditional right exists to defer their repayment by at least 12 months following the date of the Consolidated Statement of Financial Position.

2.18.1.Convertible bonds

Pursuant to the Terms and Conditions of each of the convertible bond issues when the investors exercise their conversion right, the Company may decide whether to deliver shares of the company or a combination of cash for the nominal value and shares for the difference (for more information on convertible bonds, see Note 20.3).

In accordance with IAS 32 and 39 and the Terms and Conditions of the issue, since the bond grants the parties the right to choose the form of settlement, the instrument represents a financial liability. Because of Abengoa’s contractual right to choose the type of payment and the possibility of paying through a variable number of shares, the conversion option qualifies as an embedded derivative. Thus, the convertible bond is considered a hybrid instrument, which includes a component of liability for financial debt and an embedded derivative for the conversion option held by the bondholder.

For convertible bonds that qualify as hybrid instruments, the Company initially measures the embedded derivative at fair value and classifies it under the derivative financial instruments liability heading. At the end of each period, the embedded derivative is re-measured and changes in fair value are recognized under “Other financial income or expense” within the “Financial income or expense” line of the Consolidated Income Statement. The financial liability component of the bond is initially calculated as the difference between the nominal value received for the bonds and the fair value of the aforementioned embedded derivative. Subsequently, the financial liability component is measured at amortized cost until it is settled upon conversion or maturity. In general, transaction costs are recognized as a deduction in the value of the debt in the Consolidated Statement of Financial Position and included as part of its amortized cost.

2.18.2.Ordinary bonds

In the case of ordinary bonds, the company initially recognizes the financial debt at its fair value, net of transaction costs incurred. Subsequently, the bond is measured at amortized cost until settlement upon maturity. Any other difference between the proceeds obtained (net of transaction costs) and the redemption value is recognized in the Income Statement over the term of the debt using the effective interest rate method. Ordinary bonds are classified as non-current liabilities unless they mature during the 12 months following the date of the Consolidated Statement of Financial Position (see Note 20.3).

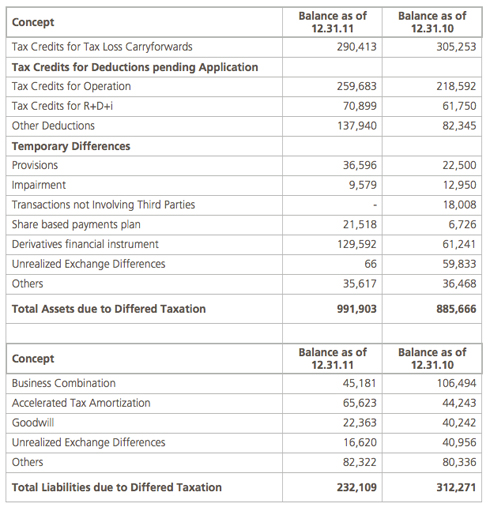

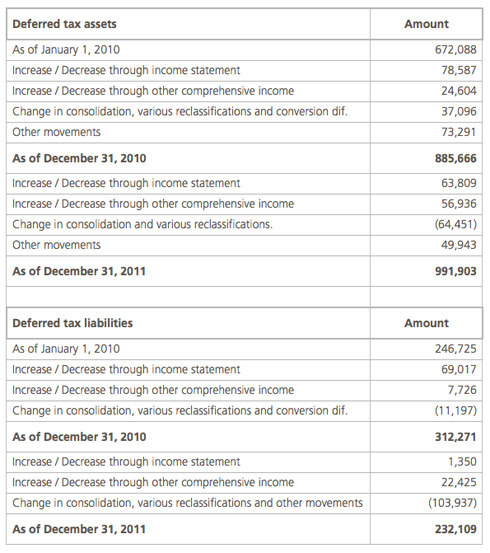

2.19. Current and deferred income taxes

Income tax expense for the period comprises current and deferred taxes. Income tax is recognized in the Consolidated Income Statement, except to the extent that it relates to items recognized directly in equity. In these cases, income tax is also recognized directly in equity.

Current income tax charge is calculated on the basis of the tax laws in force or about to enter into force as of the date of the Consolidated Statement of Financial Position in the countries in which the subsidiaries and associates operate and generate taxable income.

Deferred income tax is calculated in accordance with the Statement of Financial Position liability method, based upon the temporary differences arising between the carrying amount of assets and liabilities and their tax base. However, deferred income tax is not recognized if it arises from initial recognition of an asset or liability in a transaction other than a business combination that, at the time of the transaction, affects neither the accounting nor the taxable profit or loss. Deferred income tax is determined using tax rates and regulations which are enacted or substantially enacted at the date of the Statement of Financial Position and are expected to apply and/or be in force at the time when the deferred income tax asset is realized or the deferred income tax liability is settled.

Deferred income tax assets are recognized only to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised.

Deferred income tax is recognized on temporary differences arising on investments in subsidiaries and associates, except where the timing of the reversal of the temporary differences is controlled by the Group and it is not probable that they will reverse in the foreseeable future.

All Spanish companies (with the exception of companies registered and domiciled in the Basque Country) applied a corporate tax rate of 30% in 2011 and 2010. Those domiciled in the Basque Country are subject to a corporate tax rate of 28% in 2011and 2010.

2.20. Employee benefits

a) Share plans

Certain Group companies have obligations in connection with certain share-based incentive plans for managers and employees. These plans are linked to the attainment of certain management objectives for the following years. When there is no active market for the shares granted by the plan, personnel expense is recognized on the basis of the repurchase price identified in the plan during the vesting period. When the shares have a market value, personnel expense is recognized during the vesting period based on their fair value at grant date. In either case, the impact of these share plans on Abengoa’s Consolidated Financial Statements is not significant.

Share plans are considered a cash-settled share-based payment plans in accordance with IFRS 2, since the company compensates the participants for their services in exchange for the assumption of the market risk on the shares. By use of the guarantee on the loan, Abengoa guarantees participants, up to the end of the plan period, no personal losses in conjunction with a change in the price of the shares purchased. As such, Abengoa measures and recognizes at the end of each reporting period, a liability based on the value of the shares. Upon expiration of the Plan, the employee may sell the shares to repay the individual loan or may otherwise repay the loan as they wish.

b) Bonus schemes

In connection with such bonus schemes plan the Group recognizes a personnel expense in the Consolidated Income Statement for the amounts annually accrued in accordance with the percentage of compliance with the plan’s established objectives.

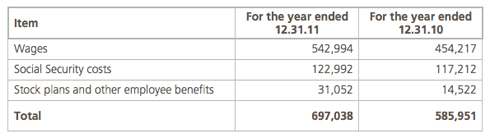

Note 29 of this Consolidated Report reflect the information detailing the expenses incurred from employee benefits.

2.21. Provisions and contingencies

Provisions are recognized when:

- There is a present obligation, either legal or constructive, as a result of past events;

- It is more likely than not that there will be a future outflow of resources to settle the obligation; and

- The amount has been reliably estimated.

When there are a number of similar obligations, the likelihood that a cash outflow will be required in settlement is determined by considering the type of obligations as a whole. The provision is recognized even if the likelihood of an outflow with respect to certain items included within the same class is low.

Provisions are measured at the present value of the expected expenditure required to settle the obligation, recognizing any increases in the provision over time as an interest expense.

Contingent liabilities reflect possible obligations to third parties and known obligations which are not recognized due to the low probability of a future outflow of economic resources being required to settle the obligation or, if applicable, because the possible future value of the settlement cannot be reliably estimated. Such contingencies are not recognized in the Statement of Financial Position unless they have been acquired in a business combination. The balance of Provisions disclosed in the Notes reflects management’s best estimate of the potential exposure as of the date of preparation of the Consolidated Financial Statements.

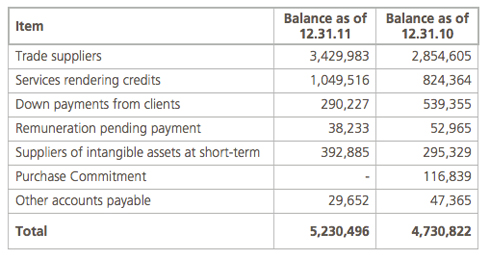

2.22. Trade payables and other liabilities

Trade payables and other liabilities are payment obligations arising from the purchase of goods or services from suppliers in the ordinary course of business and are recognized initially at fair value and are subsequently measured at their amortized cost using the effective interest method.

Other liabilities are payment obligations not arising from the purchase of goods or services and that are not treated as debt financing transactions. These accounts are classified as current liabilities if payment falls due within one year. Otherwise they are presented as non-current liabilities.

Advances received from customers are recognized as “Other current liabilities”.

2.23. Foreign currency transactions

a) Functional currency

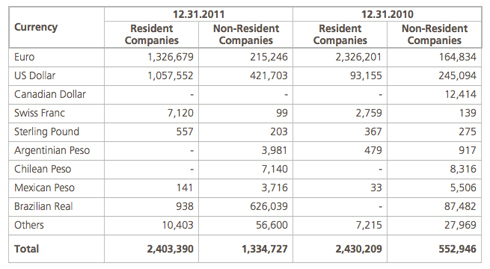

The components of the financial statements of each of the companies within the Group are measured and reported in the currency of the principal economic environment in which the company operates (the functional currency). The Consolidated Financial Statements are presented in euro, which is Abengoa’s functional and reporting currency.

b) Transactions and balances

Transactions denominated in foreign currency are translated into the functional currency applying the exchange rates in force at the time of the transactions. Foreign currency gains and losses that result from the settlement of these transactions and the translation of monetary assets and liabilities denominated in foreign currency at the year-end rates are recognized in the Consolidated Income Statement, unless they are deferred in equity, as occurs with cash-flow hedges and net investment in foreign operations hedges.

c) Translation of the financial statements of foreign companies within the Group

The Income Statements and Statements of Financial Position of all Group companies with a functional currency other than the reporting currency (Euro) are translated into the reporting currency as follows:

- All assets, rights and obligations are translated to the reporting currency using the exchange rate in force at the closing date of the Financial Statements.