Abengoa

Abengoa

Annual Report 2011

- Legal and Economic-Financial Information

- Consolidated analytical report

- Changes in consolidation and/or in accounting policies

Discontinued operations

Sale of Telvent GIT

On June 1, 2011, our 40% owned subsidiary, Telvent GIT, S.A., or Telvent, entered into an acquisition agreement with Schneider Electric S.A., or SE, under which SE launched a tender offer to acquire all Telvent shares. Concurrently with the signing of the acquisition agreement between SE and Telvent, Abengoa entered into an irrevocable undertaking agreement with SE under which we agreed to tender our 40% shareholding in Telvent as part of the offer.

SE launched the tender offer to acquire all Telvent shares at a price of $40 per share in cash, which represented a company value of €1,360 M, and a premium of 36% to Telvent’s average share price over the previous 90 days prior to the announcement of the offer.

The transaction was closed in September 2011, following completion of the usual closing conditions and once all of the regulatory authorisations had been obtained. The sale generated cash proceeds of €391 M and a total profit from discontinued operations of €91 M for Abengoa, reflected under the heading of “Result for the year from discontinued operations, net of tax” in the income statement for the twelve months ending in December 2011.

Taking into account the significance of the activities carried out by Telvent to Abengoa, the sale of this shareholding is considered as a discontinued operation, in accordance with the requirements of IFRS 5, Non-Current Assets Held for Sale and Discontinued Operations, and is reported under a single heading in the income statement of Abengoa’s Consolidated Financial Statements for the twelve month period ending December 31, 2011.

Likewise, the Consolidated Income Statement for the twelve month period ending December 31, 2010, which is included for comparison purposes in Abengoa’s Consolidated Financial Statements also includes the reclassification of the results generated by the activities that are now considered to be discontinued, under a single heading.

Sale of transmission lines in Brazil

On November 30, 2011, Abengoa, S.A. closed an agreement with Compañía Energética Minas Gerais (CEMIG) through Transmissora Aliança de Energía Eléctrica, S.A. (TAESA) for the sale of 50% shares in the companies STE, ATE, ATE II and ATE III, and 100% in NTE. The sale of said shares brought in cash flow of €479 M and an outcome of €45 M reflected in the section “Other Operating Income” in the Consolidated Income Statement (€43 M after tax).

IFRIC 12: Service concession arrangements

As a result of IFRIC 12 on Service Concession Arrangements coming into effect on January 1, 2010, in accordance with IAS 8 as established in paragraph 29 of the aforementioned IFRIC 12, Abengoa began to apply this interpretation retrospectively with no significant impact on its Consolidated Financial Statements as at the end of 2010, since it had already been applying a similar accounting policy to the interpretation recurrently and in anticipation of the changes, for certain concession assets mainly related to the international concession business for electricity transmission, desalination and solar-thermal plants.

At the date of this application, the Company carried out an analysis of other agreements in the Group and identified further infrastructures, specifically solar-thermal plants in Spain included under the special arrangements of RD 661/2007 and recorded in the pre-assignment register in November 2009, which could potentially be classified as service concession arrangements.

Nevertheless, at the end of 2010, the company decided that it needed to carry out a more in-depth analysis of the issue since the reasons that justified the accounting application of the interpretation had not been sufficiently proven based on the information available at that date. The application of IFRIC 12 therefore had no significant impact on Abengoa’s Consolidated Financial Statements for 2010.

In 2011, Abengoa has continued to analyse the possible accounting application of IFRIC 12 to its solar-thermal plants in Spain, having obtained numerous legal, technical and accounting reports from independent third parties during the course of the year. In September 2011, when the latest reports from accounting experts were received, the company concluded that it should apply IFRIC 12 to its solar-thermal plants in Spain included under the special scheme of Royal Decree 661/2007 and recorded in the pre-assignment register in November 2009, just as it does for its other concession assets, based on these reports, the analysis and newly acquired knowledge.

According to the above paragraphs, the circumstances that would enable IFRIC 12 to be applied to those solar-thermal plants at January 1, 2010 did not arise, therefore in accordance with paragraph 52 of IAS 8 on Accounting Policies, Changes in Accounting Estimates and Errors, the application should be made prospectively from September 1, 2011.

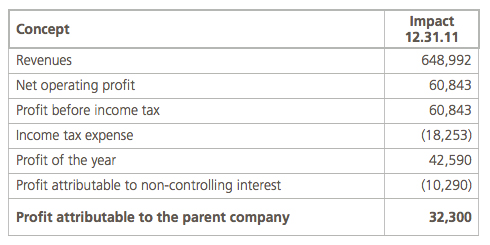

The application of IFRIC 12 to these assets produces an increase in revenues and in the result for the third quarter. The impact of this application on the Consolidated Income Statement for the nine month period ending September 30, 2011 is shown below:

© 2011 Abengoa. All rights reserved