Abengoa

Abengoa

Annual Report 2011

- Legal and Economic-Financial Information

- Consolidated analytical report

- Consolidated cash flow statement

Consolidated cash flow statement

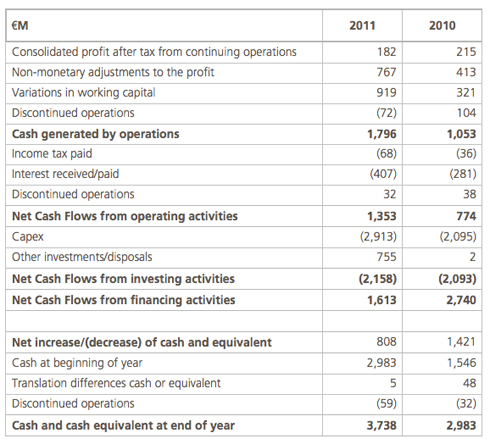

A summary of the Consolidated Cash Flow Statement of Abengoa at the close of 2011 and 2010 with the main variations per item, is given below:

- Net cash flows from operations increased by 75% to €1,353 M compared to €774 M the year before, mostly from increase in Ebitda and cash generated from working capital.

- In terms of net cash flows from investing activities, the most significant investments were in the construction of solar thermal plants in Spain; and in the construction of desalination plants in Algeria, India and China and transmission lines in Brazil and Peru. Regarding disposals, it is worth noting the cash generated by the sales of Telvent and transmission lines in Brazil.

- In terms of net cash flows from financing activities, it is worth noting that the Group managed to arrange financing for €2,042 M under difficult financing conditions, taking the figure for net cash flows from financing activities to €1,613 M. Also being of note is the €300 M capital increase subscribed by First Reserve.

© 2011 Abengoa. All rights reserved