Abengoa

Abengoa

Annual Report 2010

-

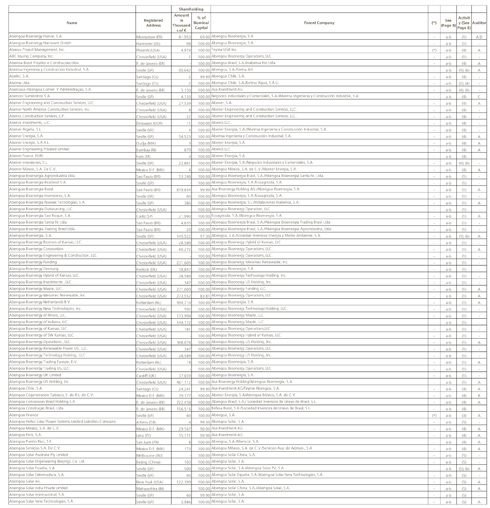

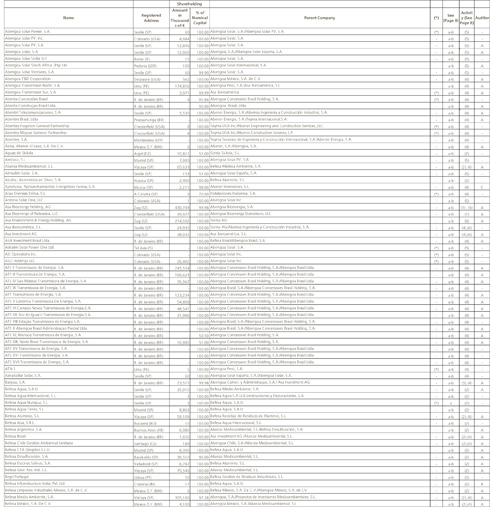

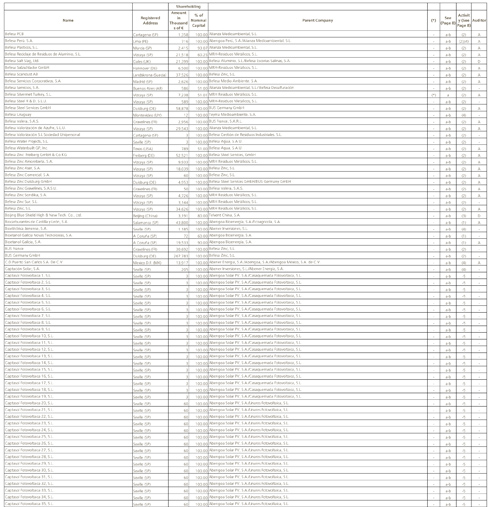

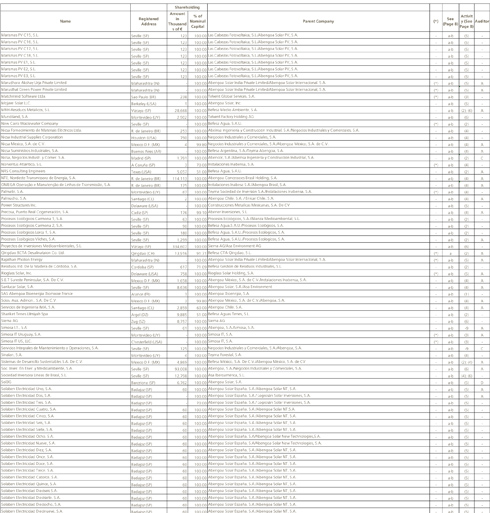

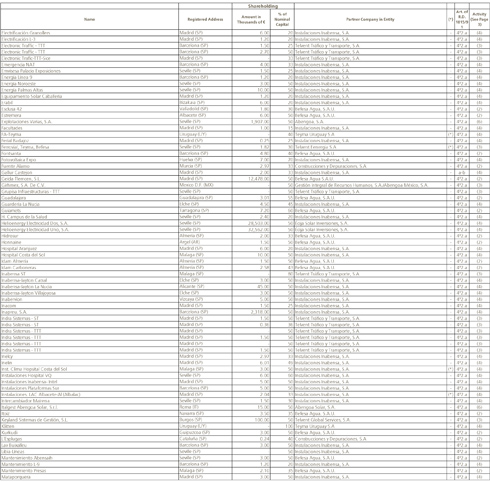

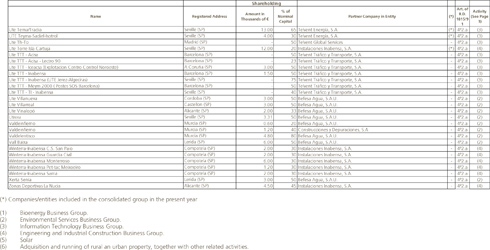

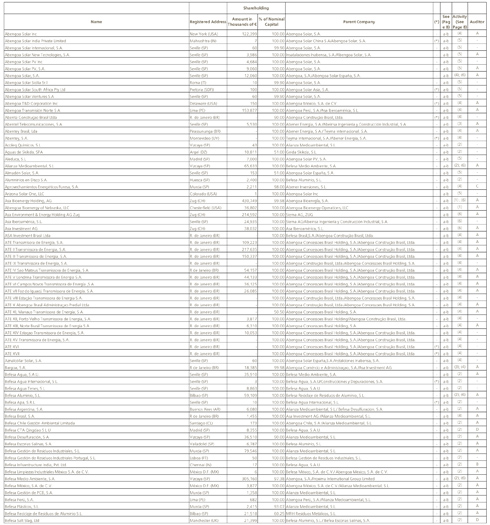

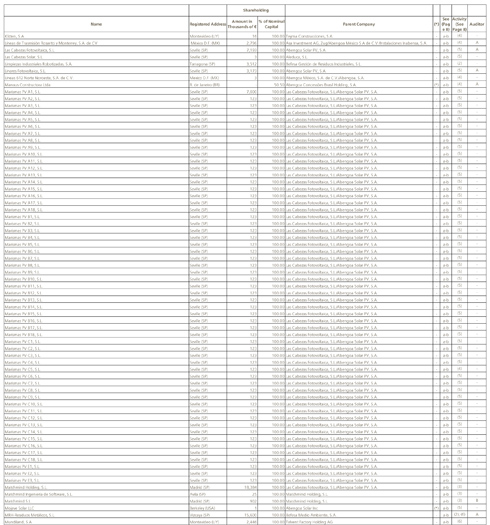

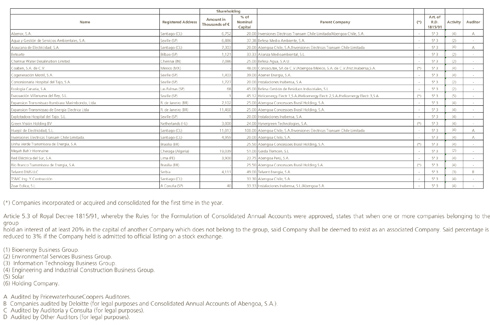

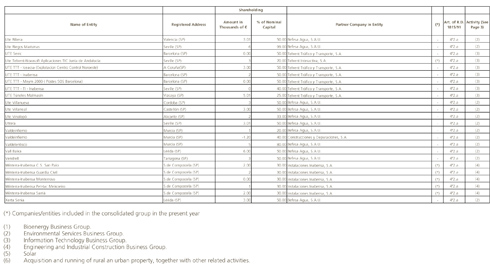

Appendix I Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method

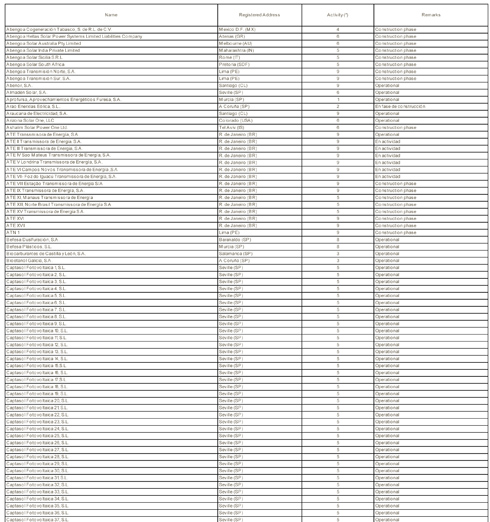

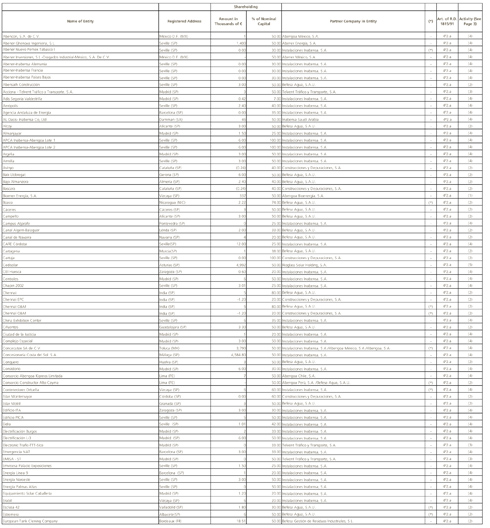

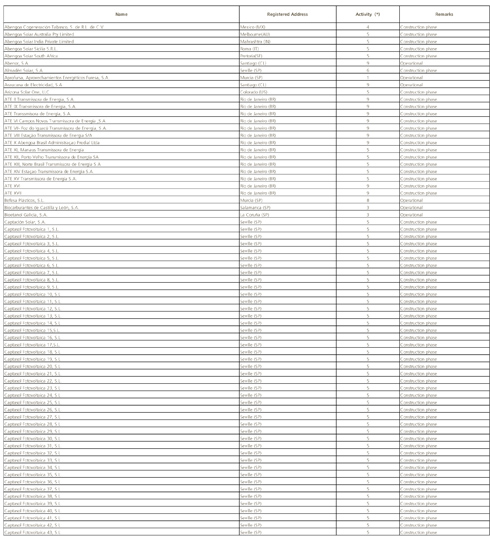

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

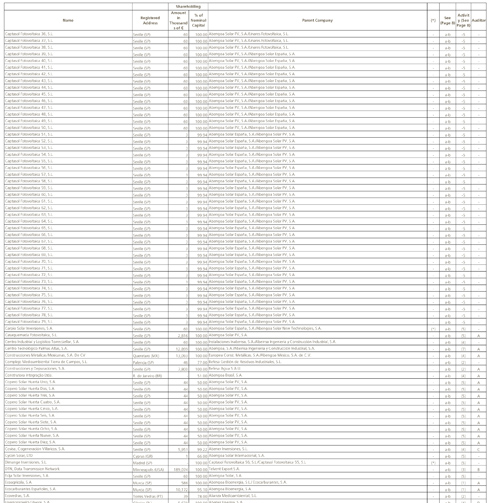

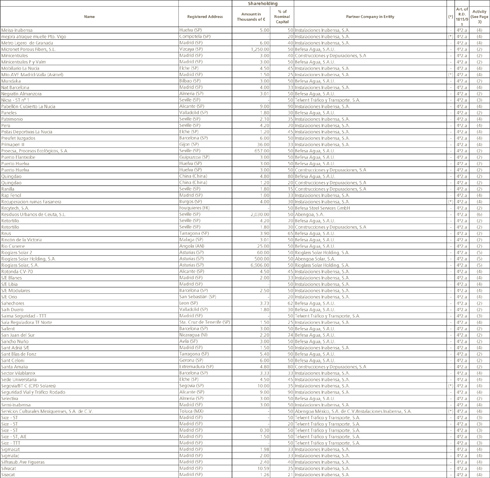

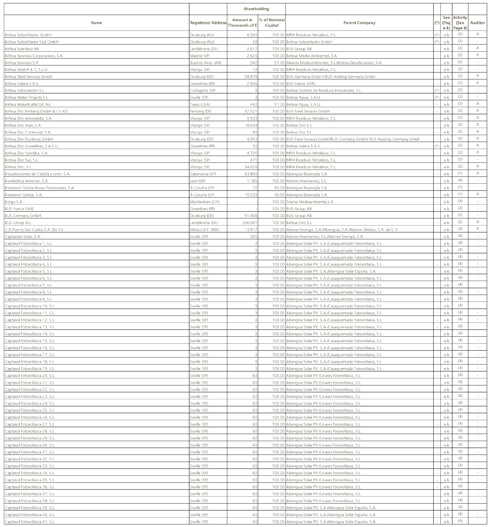

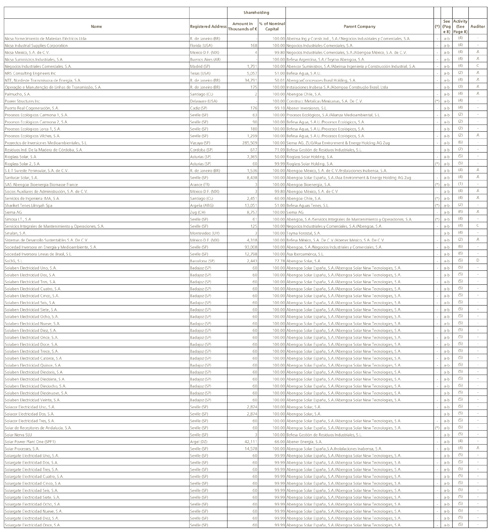

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

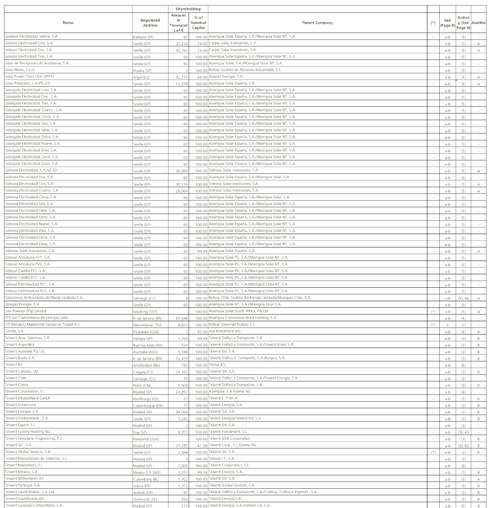

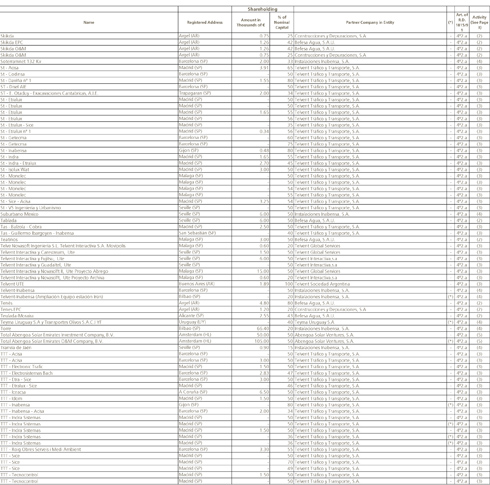

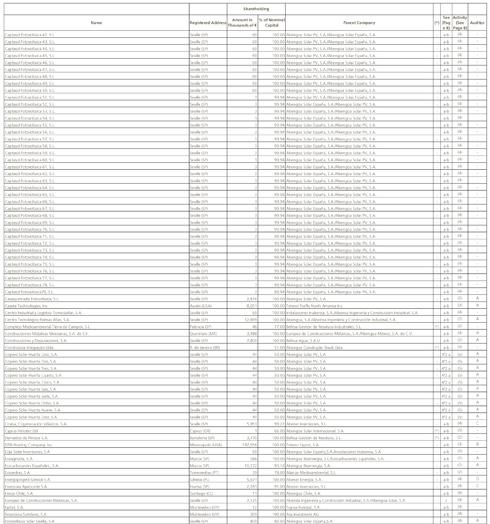

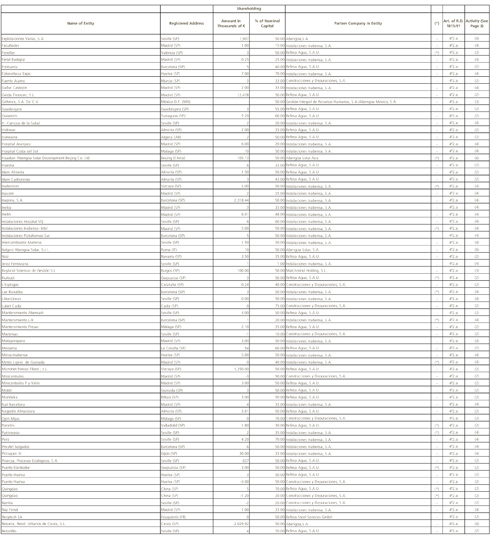

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

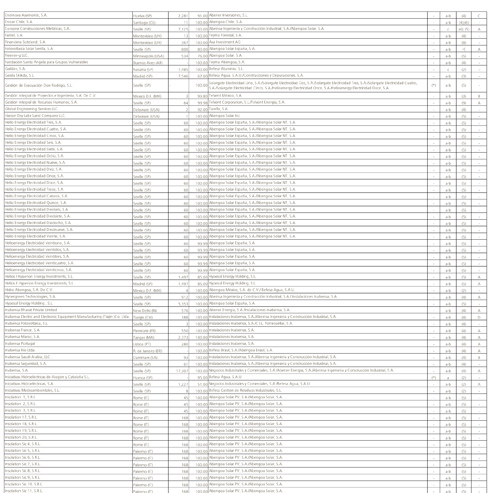

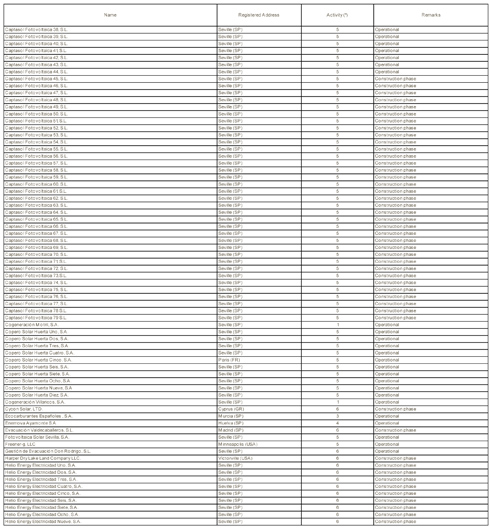

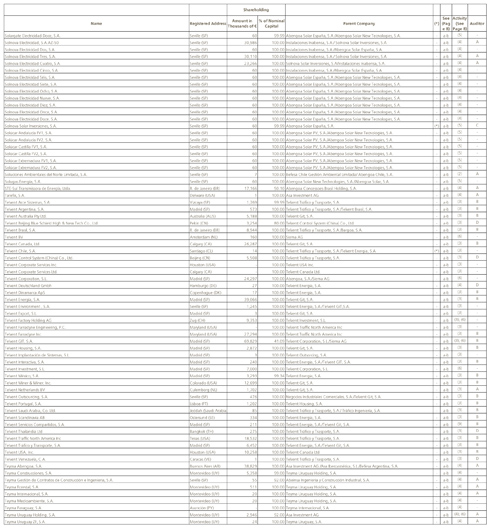

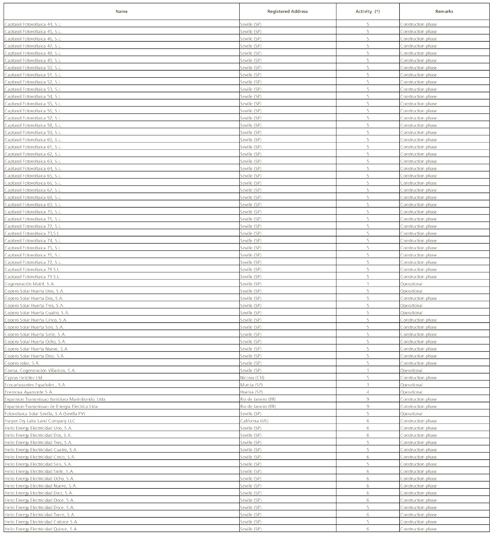

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

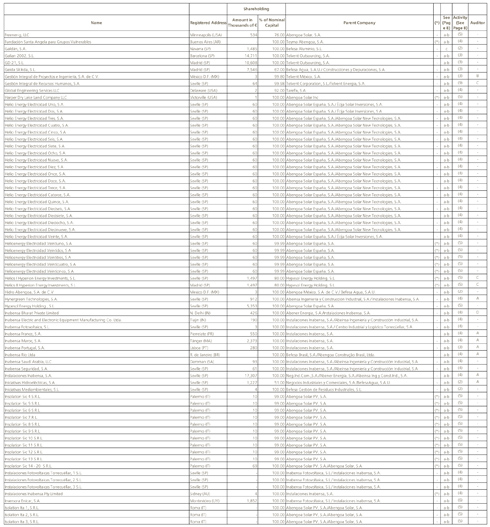

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

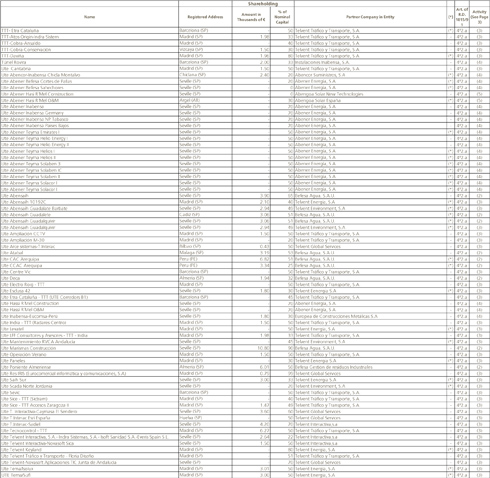

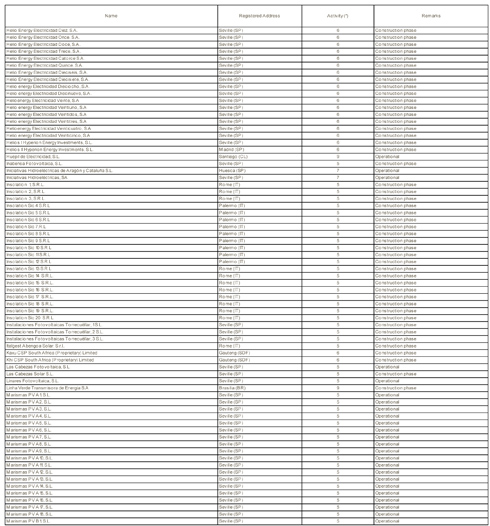

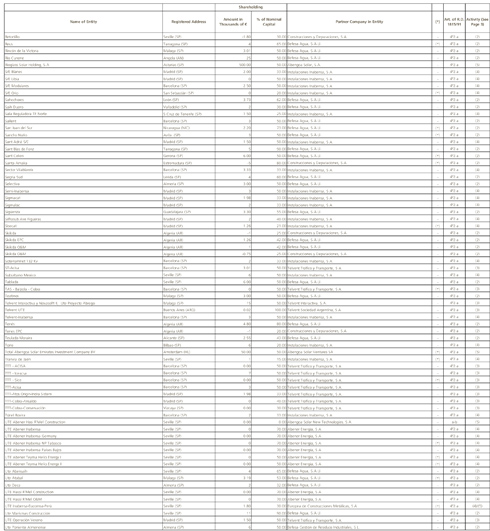

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2010 Consolidation Perimeter using the Global Integration Method (Continuation)

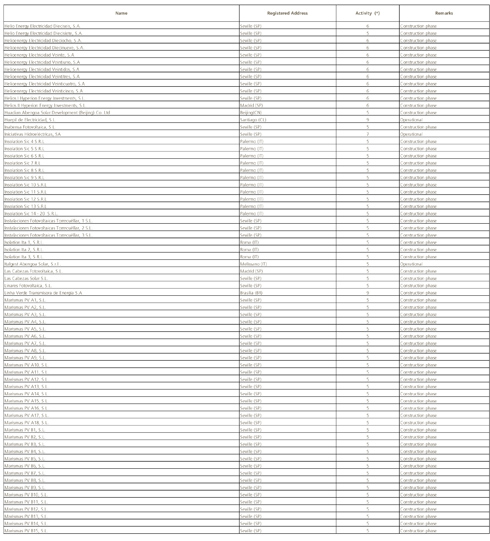

-

Appendix 3 Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2010 Consolidation Perimeter using the Proportional Integration Method (Continuation)

-

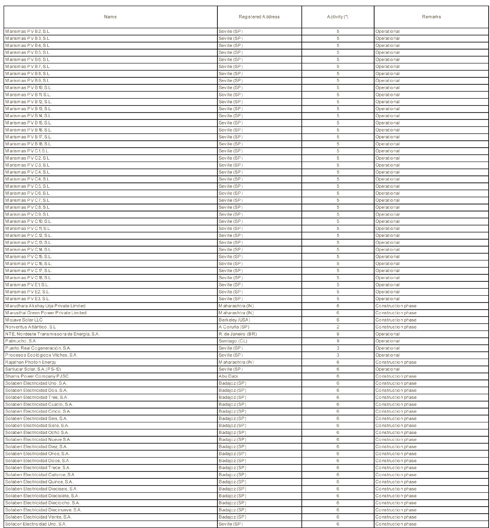

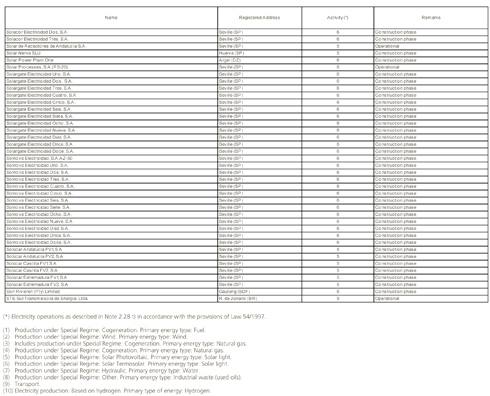

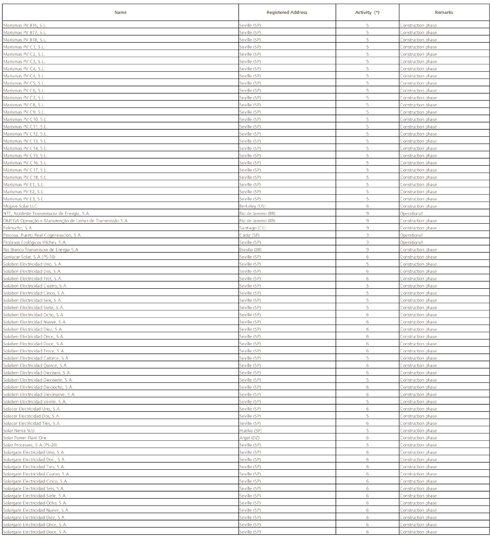

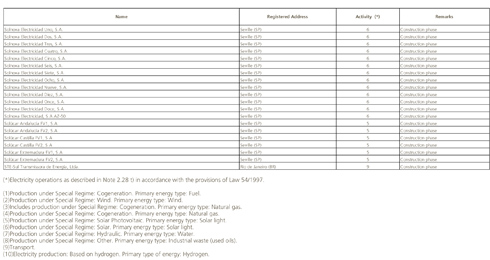

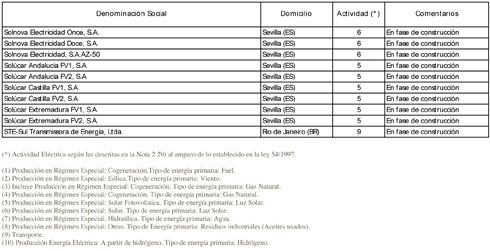

Appendix 4 Companies with Electricity Operations included in the 2010 Consolidation Perimeter

Companies with Electricity Operations included in the 2010 Consolidation Perimeter

Companies with Electricity Operations included in the 2010 Consolidation Perimeter

Companies with Electricity Operations included in the 2010 Consolidation Perimeter

Companies with Electricity Operations included in the 2010 Consolidation Perimeter

-

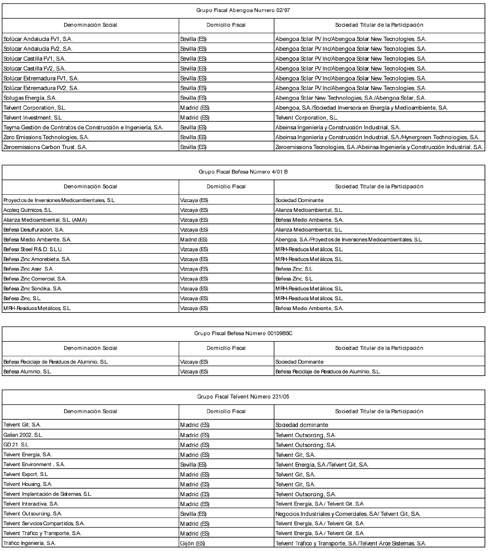

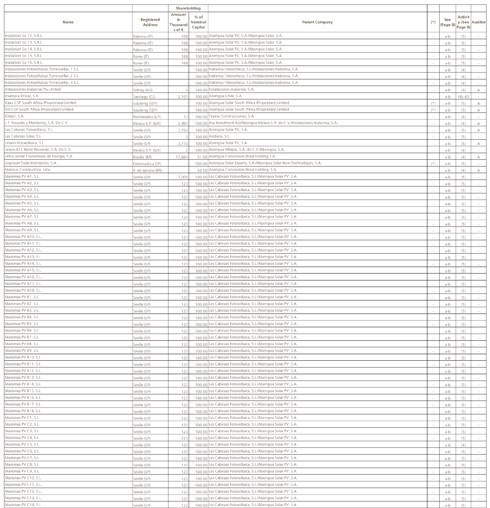

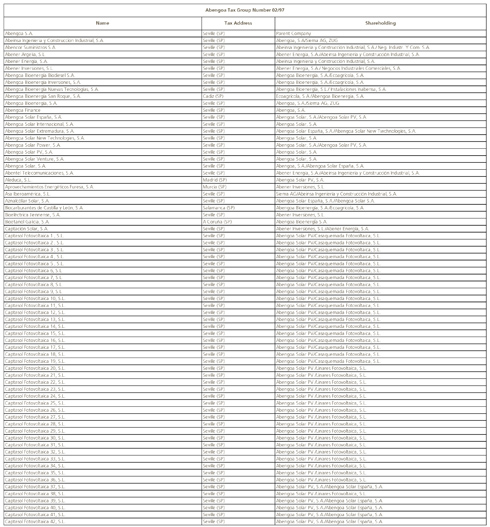

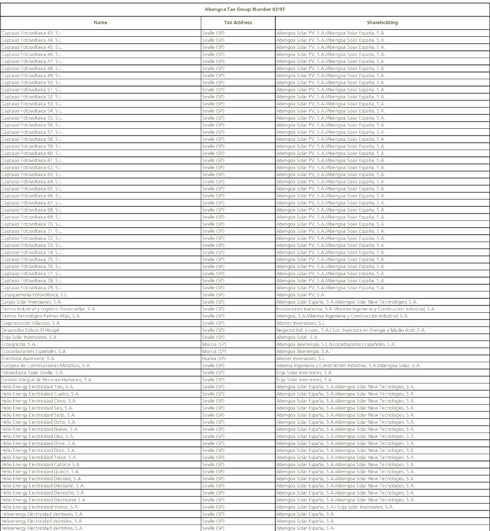

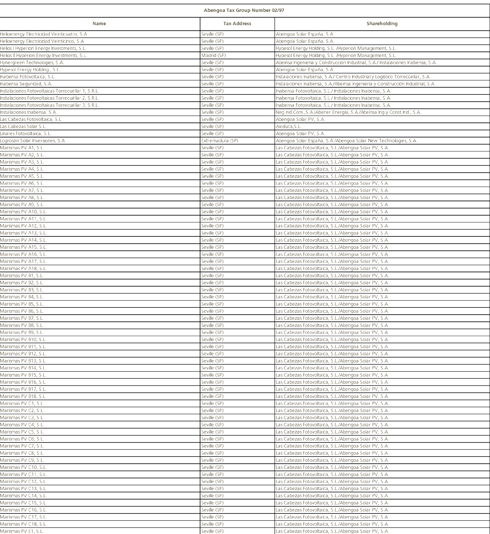

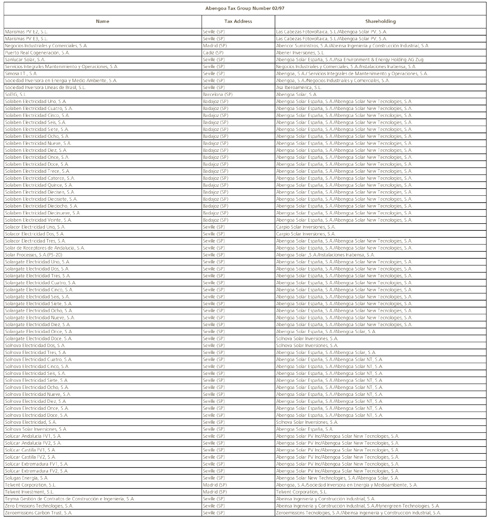

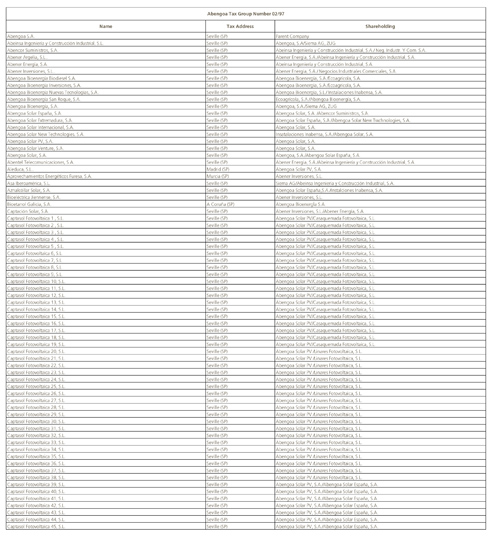

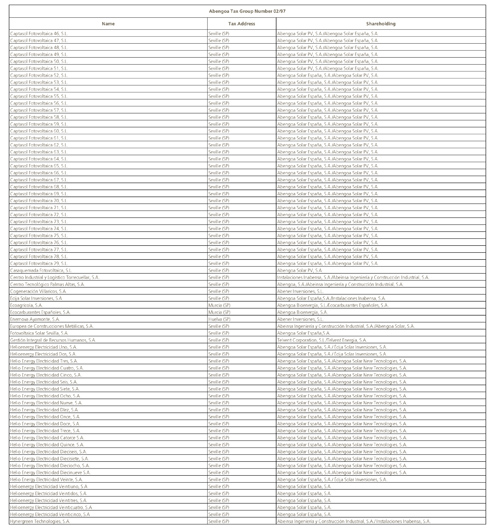

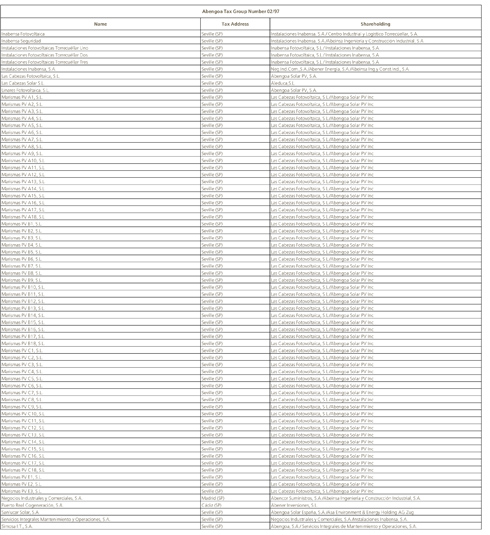

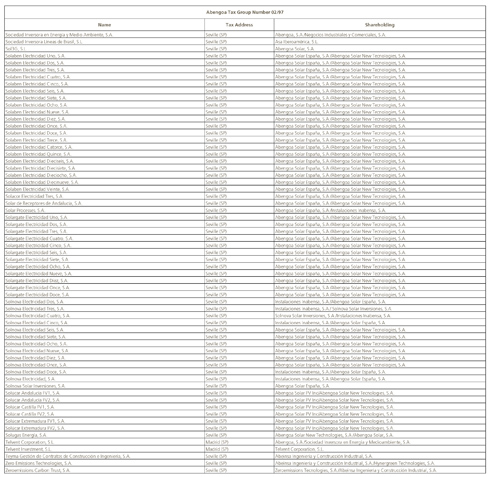

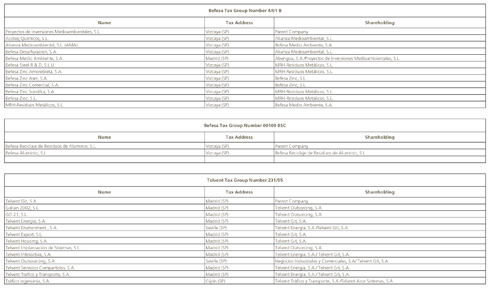

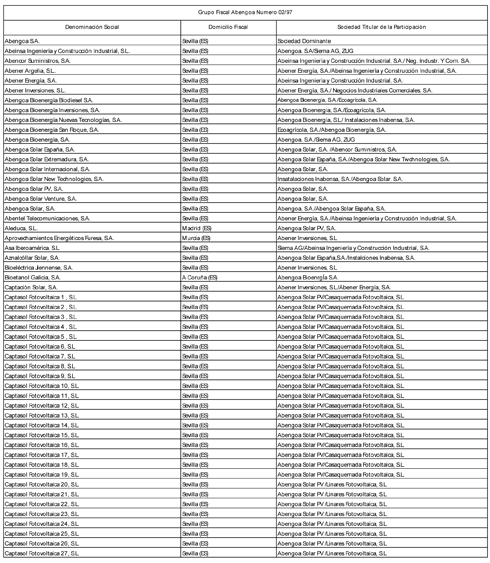

Appendix 5 Companies taxed under the Special Regime for Company Groups at 12.31.10

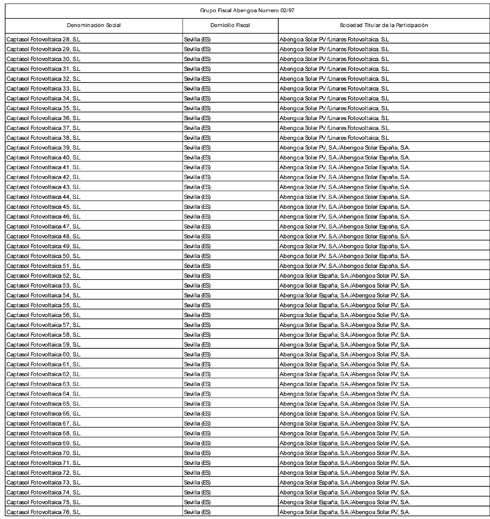

Companies taxed under the Special Regime for Company Groups at 12.31.10(Continuation)

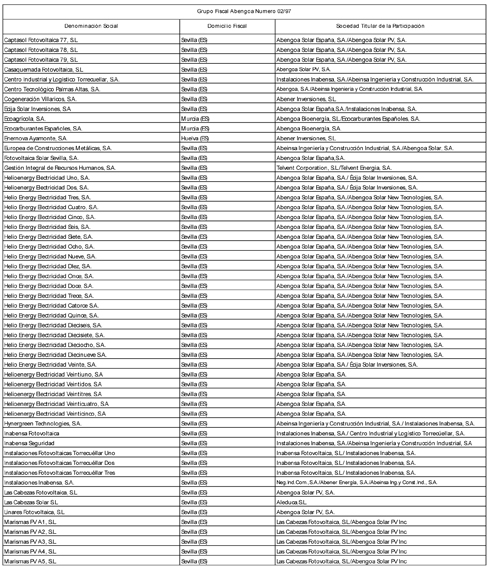

Companies taxed under the Special Regime for Company Groups at 12.31.10(Continuation)

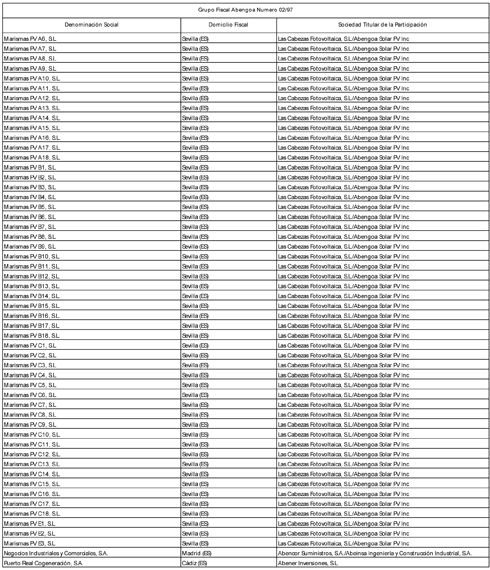

Companies taxed under the Special Regime for Company Groups at 12.31.10(Continuation)

Companies taxed under the Special Regime for Company Groups at 12.31.10(Continuation)

Companies taxed under the Special Regime for Company Groups at 12.31.10(Continuation)

-

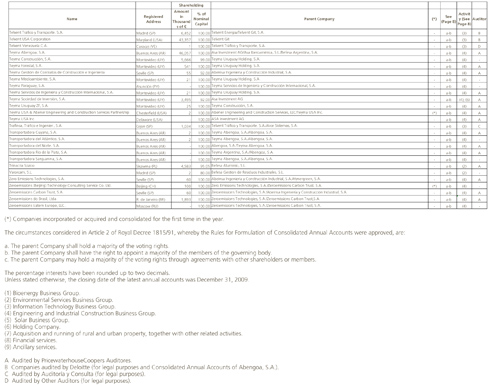

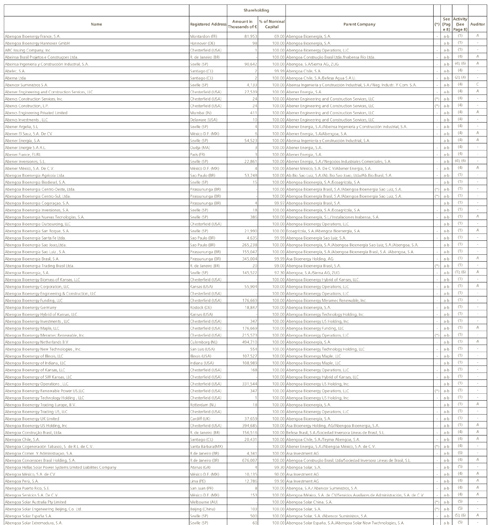

Appendix 6 Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

Dependent Companies included in the 2009 Consolidation Perimeter using the Global Integration Method (Continuation)

-

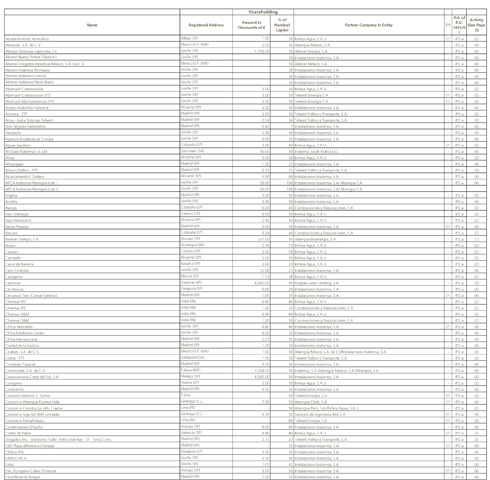

Appendix 7 Associated Companies included in the 2009 Consolidation Perimeter using the Participation Method

Associated Companies included in the 2009 Consolidation Perimeter using the Participation Method

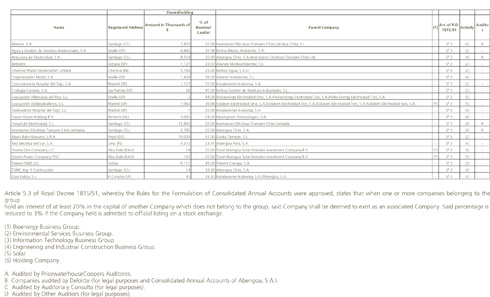

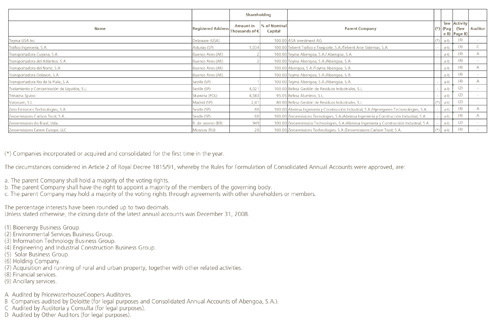

(*) Companies incorporated or acquired and consolidated for the first time in the year.

Article 5.3 of Royal Decree 1815/91, whereby the Rules for the Formulation of Consolidated Annual Accounts were approved, states that when one or more companies belonging to the group

hold an interest of at least 20% in the capital of another Company which does not belong to the group, said Company shall be deemed to exist as an associated Company. Said percentage is

reduced to 3% if the Company held is admitted to official listing on a stock exchange.(1) Bioenergy Business Group.

(2) Environmental Services Business Group.

(3) Information Technology Business Group.

(4) Engineering and Industrial Construction Business Group.

(5) Solar

(6) Holding Company.A Audited by PricewaterhouseCoopers Auditores.

B Companies audited by Deloitte (for legal purposes and Consolidated Annual Accounts of Abengoa, S.A.).

C Audited by Auditoría y Consulta (for legal purposes).

D Audited by Other Auditors (for legal purposes).

-

Appendix 8 Joint Ventures included in the 2009 Consolidation Perimeter using the Proportional Integration Method

Joint Ventures included in the 2009 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2009 Consolidation Perimeter using the Proportional Integration Method (Continuation)

Joint Ventures included in the 2009 Consolidation Perimeter using the Proportional Integration Method (Continuation)

-

Appendix 9 Companies with Electricity Operations included in the 2009 Consolidation Perimeter

Companies with Electricity Operations included in the 2009 Consolidation Perimeter (Continuation)

Companies with Electricity Operations included in the 2009 Consolidation Perimeter (Continuation)

Companies with Electricity Operations included in the 2009 Consolidation Perimeter (Continuation)

Companies with Electricity Operations included in the 2009 Consolidation Perimeter (Continuation)

Companies with Electricity Operations included in the 2009 Consolidation Perimeter (Continuation)

Companies with Electricity Operations included in the 2009 Consolidation Perimeter (Continuation)

-

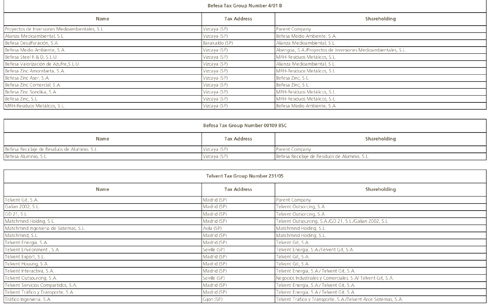

Appendix 10 Companies taxed under the Special Regime for Company Groups at 12.31.09

Companies taxed under the Special Regime for Company Groups at 12.31.09 (Continuation)

Companies taxed under the Special Regime for Company Groups at 12.31.09 (Continuation)

Companies taxed under the Special Regime for Company Groups at 12.31.09 (Continuation)

Companies taxed under the Special Regime for Company Groups at 12.31.09 (Continuation)