Abengoa

Abengoa

Annual Report 2010

- Corporate Governance

- Annual Report on Corporate Governance

- Ownership Structure

Informe Anual de Gobierno Corporativo de las Sociedades Anónimas Cotizadas

A - Ownership Structure

A.1. Complete the following table on the company’s share capital:

Indicate whether different types of shares exist with different associated rights:

No

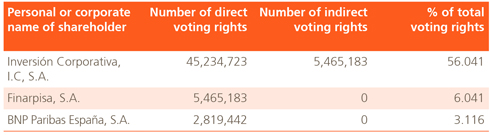

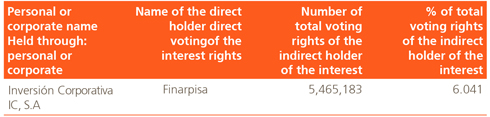

A.2.List the direct and indirect holders of significant ownership interests in your company at year-end, excluding directors:

Indicate the most significant movements in the shareholding structure of the company over the year:

None

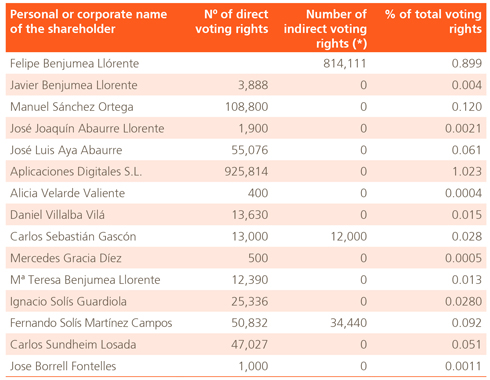

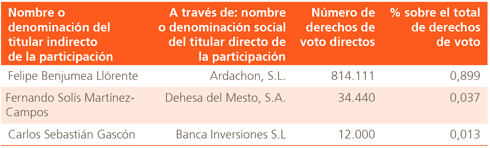

A.3 Complete the following tables on those company directors that hold voting rights through company shares:

% of total voting rights held by the members of the Board of Directors

2.3381%

Complete the following tables on those members of the company’s Board of Directors that hold rights over company shares:

The directors do not hold rights over company shares.

A.4 Indicate, as applicable, any family, commercial, contractual or corporate relations between owners of significant shareholdings, insofar as these as known by the company, unless they bear little relevance or arise from ordinary trading or course of business:

No record.

A.5 Indicate, as applicable, any commercial, contractual or corporate relations between owners of significant shareholdings on the one hand, and the company and/or its group on the other, unless these bear little relevance or arise from ordinary trading or course of business:

No record.

A.6 Indicate whether any shareholders’ agreements affecting the company have been communicated to the company pursuant to Art. 112 of the Spanish Securities Market Act (Ley del Mercado de Valores). If so, provide a brief description and list the shareholders bound by the agreement:

No record.

Specify whether the company is aware of the existence of any concerted actions among its shareholders. If so, provide a brief description:

No record.

Expressly indicate any amendments to, or terminations of such agreements or concerted actions during the year:

No record.

A.7 Indicate whether any individuals or bodies corporate currently exercise, or could exercise control over the company pursuant to Article 4 of the Spanish Securities Market Act (Ley del Mercado de Valores). If so, please identify:

Personal or corporate name:

Inversión Corporativa, I.C., S.A.

Comments.

In accordance with Article 4 of the Spanish Securities Market Act, the company Inversión Corporativa holds more than 50% of the share capital.

A.8 Complete los siguientes cuadros sobre la autocartera de la sociedad:

At year end:

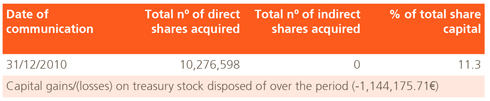

Provide details of any significant changes during the year, in accordance with Royal Decree 1362/2007 (Real Decreto 1362/2007).

A.9 Provide details of the applicable conditions and timeframes governing the powers of the Board of Directors, as conferred by the General Shareholders’ Meeting, to acquire and/or transfer treasury stock.

The Ordinary General Assembly of Shareholders’ Meeting held on 11th April 2010 granted authorization to the Board of Directors for the share buyback of the company’s own shares, whether directly or through subsidiaries or companies in which shares are held up, to the maximum envisaged in the current provisions at a price ranging from six Euros (€6) minimum to sixty Euros (€60) maximum per share. Said authorization is valid for eighteen (18) months counting from date granted, and shall remain subject to the Fourth Section of Chapter IV of the Consolidated Text of the LSA.

On November 19, 2007, the company signed an agreement with Santander Investment Bolsa, S.V., the aim being to enhance the liquidity of transactions involving shares, ensure consistent stock prices and avoid fluctuations caused by non-market trends, without this contract interfering with the normal functioning of the market and in strict compliance with applicable stock market law. Although the agreement does not meet the conditions set forth in Circular Notice 3 dated 19 December 2007 (Circular 3/2007) of the Spanish Securities and Exchange Commission (Comisión Nacional del Mercado de Valores, hereinafter CNMV), Abengoa has been voluntarily complying with the information reporting requirements prescribed by said Circular Notice 3/2007 for such purpose. The transactions effected under the aforesaid Agreement have been duly communicated on a quarterly basis to the Spanish CNMV and likewise posted on the company’s website.

On December 31, 2010, the balance of treasury stock amounted to 225,250.

In relation to transactions performed over the year, the number of treasury shares acquired stood at 10,276,598 while treasury shares disposed of amounted to 10,196,803, with a net operating result of - 1,144,175.71€.

A.10 Indicate, as applicable, any restrictions imposed by law or the Bylaws on voting rights, as well as any legal restrictions on the acquisition or transfer of ownership interests in the share capital. Indicate whether there are any legal restrictions on exercising voting rights:Porcentaje máximo de derechos de voto que puede ejercer un accionista por restricción legal:

Maximum percentage of voting rights that a shareholder may exercise by reason of legal restriction:

No restriction.

Indicate whether there are any restrictions included in the company’s Bylaws on exercising voting rights:

No.

Maximum percentage of voting rights that a shareholder may exercise by reason of restrictions included in the Bylaws

No restriction.

Indicate whether there are any legal restrictions on the acquisition or transfer of holdings in the share capital:

No restriction.

A.11 Indicate whether the General Shareholders’ Meeting has agreed to adopt neutralization measures to prevent a public takeover bid pursuant to the provisions of Act 6/2007 (Ley 6/2007).

The matter has not arisen.

Where applicable, explain the approved