Abengoa

Abengoa

Annual Report 2013

- Legal and Economic-Financial Information

- Consolidated management report

2013 Consolidated management report

1.- Entity´s position

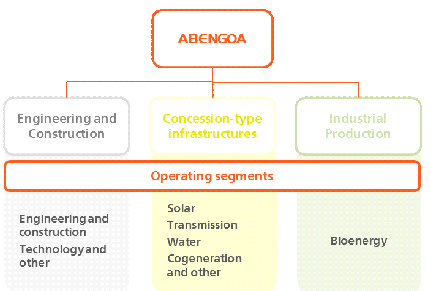

1.1. Organizational structure

Abengoa, S.A. is a technology company, and the head of a group of companies, which at the end of 2013 comprised the following

- The holding parent company itself.

- 534 subsidiaries.

- 19 associates and 24 joint businesses as well as certain companies of the Group being involved in 219 temporary joint ventures. Furthermore, the Group’s companies have shareholdings of less than 20% in other entities.

Independent of the legal structure, Abengoa is managed as outlined below.

Abengoa is an international company that applies innovative technology solutions for sustainability in the energy and environment sectors, generating electricity from renewable resources, converting biomass into biofuels and producing drinking water from sea water. The Company supplies engineering projects under the ‘turnkey’ contract modality and operates assets that generate renewable energy, produce biofuel, manage water resources, desalinate sea water and treat sewage.

Abengoa’s activities are focused on the energy and environmental sectors, and integrate operations throughout the value chain including R&D+i, project development, engineering and construction, and operations and maintenance of its own assets and for third parties.

Abengoa’s business is organized into the following three activities:

- Engineering and construction: includes our traditional engineering activities in the energy and water sectors, with more than 70 years of experience in the market and the development of thermo-solar technology. Abengoa is specialized in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others.

- Concession-type infrastructures: groups together the company’s extensive portfolio of proprietary concession assets that generate revenues governed by long term sales agreements, such as take-or-pay contracts, tariff contracts or power purchase agreements. This activity includes the operation of electric (solar, cogeneration or wind) energy generation plants and transmission lines. These assets generate low demand risk and we focus on operating them as efficiently as possible.

- Industrial production: covers Abengoa’s businesses with a commodity component, such as biofuels and industrial waste recycling (until the sale of shareholding in Befesa Medio Ambiente, S.L.U. (Befesa), see Note 7.1). The Company holds an important leadership position in these activities in the geographical markets in which it operates.

Abengoa’s Chief Operating Decision Maker (‘CODM’) assesses the performance and assignment of resources according to the above identified segments. The CODM in Abengoa considers the revenues as a measure of the activity and the EBITDA (Earnings before interest, tax, depreciation and amortization) as measure of the performance of each segment. In order to assess performance of the business, the CODM receives reports of each reportable segment using revenues and EBITDA. Net interest expense evolution is assessed on a consolidated basis given that the majority of the corporate financing is incurred at the holding level and that most of the related assets are held at project companies which are financed through non-recourse project finance. The depreciation, amortization and impairment charges are assessed on a consolidated basis in order to analyze the evolution of net income and to determine the dividend pay-out ratio. These charges are not taken into consideration by CODM for the allocation of resources because they are non-cash charges.

The process to allocate resources by the CODM takes place prior to the award of a new project. Prior to presenting a bid, the company must ensure that the non-recourse financing for the new project has been obtained. These efforts are taken on a project by project basis. Once the project has been awarded, its evolution is monitored at a lower level and the CODM receives periodic information (revenues and EBITDA) on each operating segment’s performance.

Abengoa structure

1.2. Operation

a) Information by activities

Abengoa’s activity is grouped under the following three activities which are in turn composed of seven operating segments (eight operating segments until the sale of shareholding in Befesa):

- Engineering and construction; includes our traditional engineering activities in the energy and water sectors, with more than 70 years of experience in the market as well as the development of solar technology.

This activity comprises two operating segments:

- Engineering and construction – Abengoa is specialized in carrying out complex turn-key projects for thermo-solar plants, solar-gas hybrid plants, conventional generation plants, biofuels plants and water infrastructures, as well as large-scale desalination plants and transmission lines, among others. This activity covers the operating segment.

- Technology and other – This segment includes those activities related to the development of thermo-solar technology, water management technology and innovative technology businesses such as hydrogen energy or the management of energy crops.

- Concession-type infrastructures; groups together the company’s proprietary concession assets that generate revenues governed by long term sales agreements, such as take-or-pay contracts, tariff contracts or power purchase agreements. This activity includes the operation of electric (solar, cogeneration or wind) energy generation plants and transmission lines. These assets generate low demand risk and we focus on operating them as efficiently as possible.

This activity currently comprises four operating segments:

- Solar – Operation and maintenance of solar energy plants, mainly using thermo-solar technology;

- Transmission – Operation and maintenance of high-voltage transmission power line infrastructures;

- Water – Operation and maintenance of facilities aimed at generating, transporting, treating and managing water, including desalination and water treatment and purification plants;

- Cogeneration and other – Operation and maintenance of conventional cogeneration electricity plants.

- Industrial production; covers Abengoa’s businesses with a commodity component, such as biofuels (industrial waste recycling was part of this activity until the sale of shareholding in Befesa). The company holds an important leadership position in these activities in the geographical markets in which it operates.

This activity comprises one operating segment:

- Biofuels – Production and development of biofuels, mainly bioethanol for transport, which uses cereals, sugar cane and oil seeds (soya, rape and palm) as raw materials.

b) Competitive position

Over the course of our 70-year history, we have developed a unique and integrated business model that applies our accumulated engineering expertise to promoting sustainable development solutions, including delivering new methods for generating power from the sun, developing biofuels, producing potable water from seawater, efficiently transporting electricity. A cornerstone of our business model has been investment in proprietary technologies, particularly in areas with relatively high barriers to entry. Thanks to it, ee have a developed portfolio of businesses focused on EPC and concession project opportunities, many of which are based on customer contracts or long-term concession projects attractive and growing energy and environmental markets.

We have developed a leadership position in the energy sector in recent years, as highlighted by the following:

- We have been recognized for the seventh consecutive year by the prestigious magazine Engineering News-Record (ENR) as a leading ‘International contractor in transmission and distribution’ in 2013. We have also regained the first place in the ‘Power’ category and for the third consecutive year we have been recognized the number one international contractor for solar power.

- We are a global leader in solar CSP technology, having developed and built the first two comercial tower technology plants (PS10 and PS20) in Seville (Spain), the first integrated solar combined cycle (‘‘ISCC’’) plant in the world in Ain-Beni-Mathar (Morocco), the second ISCC plant in Hassi-R’Mel (Algeria) and the world´s largest parabolic trough plant with a total installed capacity of 280 MW (also being the first solar plant in the United States with thermal energy storage) in Arizona (the Solana project), while we continue working in the 280 MW Mojave plant in California, the 50 MW CSP solar tower plant and the 100 MW parabolic trough plant with 3 hour storage capacity in South Africa. Additionally, in the recent months we have also been awarded several CSP projects in Israel, South Africa and Chile.

- We are a global leader in the biofuels industry, with plants in Europe, the United States and Brazil. We ranked first in Europe and seventh in the United States in first-generation bioethanol in terms of installed capacity (source: Ethanol Producer Magazine and ePURE) and enjoy a global leadership position in the development of technology for the production of second-generation bioethanol on a commercial scale.

In addition, Abengoa has been internationally recognized for its accomplishments in the desalination industry, such as the Global Water Intelligence's (GWI) awards ‘2012 Desalination Company of the Year,’ ‘2010 Desalination Deal of the Year,’ and ‘2009 Desalination Company of the Year.’ These awards have been awarded respectively for the Nungua desalination plant, in Ghana, the Qingdao desalination project in China, and the Algerian desalination projects of Ténès, Honaine and Skikda. All plants were developed with the latest available advances in reverse osmosis (RO) desalination technology.

We are currently ranked as the 12th desalination plant supplier according to GWI's Global Water Markets 2014 report. Supporting our activities in RO desalination, we continue to expand our business into construction and management of water and wastewater infrastructures for municipal and industrial clients. For example, we have just completed the construction of a water treatment facility to supply drinking water in southern Angola for more than 250,000 people. Through these activities Abengoa continues its path in the environmental sector; producing, treating, and regenerating water for a sustainable world.

2.- Evolution and business results

2.1. Financial situation

a) Changes in consolidation and/or in accounting policies

New accounting standards

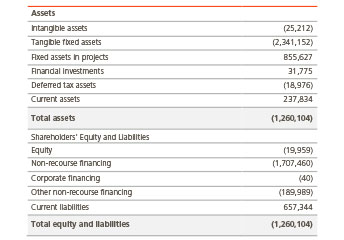

The Company has applied IFRS 10, 11 & 12 as well as the amendments to IAS 27 and 28 beginning on January 1, 2013. The main impacts of the application of the new standards relate to:

- The de-consolidation of projects that do not fulfill the conditions of effective control in terms of decision making and their integration in the consolidated financial statements according to the equity method. In the case of Abengoa, it affects the Solana and Mojave solar-thermal projects in the USA, the Kaxu and Khi solar projects in South Africa and our second-generation ethanol plant in Hugoton, which will be carried under the equity method during their construction phases.

- The elimination of the proportional consolidation method for joint ventures, replaced with the equity method. In Abengoa’s case, the most significant assets that will change from proportional consolidation to the equity method are the Helioenergy 1 and 2 solar-thermal plants and the Honaine desalination plant in Algeria.

The standars referred to above have been applied retrospectively for comparative porposes, as required by IAS 8 Accounting policies, changes in accounting estimates and errors. Based on the foregoing the effect of the de-consolidation of the affected companies and their integration according to the equity method on the consolidated statements of financial position as of December 31, 2012 is shown below:

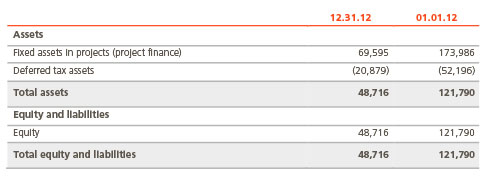

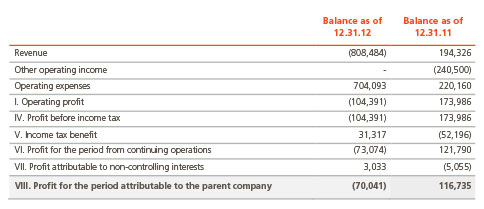

IFRIC 12 – Service concession arrangements

After the change in accounting policy in relation to the first application of IFRIC 12 Service Concession Agreements’ to the solar-thermal plants in Spain described in the Consolidated Financial Statements as of December 31, 2013 and based on the provisions of IAS 8.14 for Accounting Policies, Changes in Accounting Estimates and Errors, IFRIC 12 has been applied by recasting the comparative information presented, to make it comparable with the information as of December 31, 2013. The impact of this recasting on the consolidated statements of the financial position as of December, 31 2012 and December 31, 2011 has been as follows:

In addition, the effect of this recasting on the consolidated income statements for the years 2012 and 2011 has been as follows:

Discontinued operations

On June 13, 2013, Abengoa S.A. signed an agreement with funds managed by Triton Partners to wholly transfer Abengoa's shareholding in Befesa Medio Ambiente (Befesa). The agreed sale price was €1,075 million. Considering the net debt adjustments, total consideration to Abengoa amounts to €620 million. Of this amount, €331 million was received on 15 July, when the transaction was definitively completed. The remaining amount is a deferred compensation of €17 million, a €48 million credit note with a five-year maturity and a €225 million subordinated convertible instrument with a 15-year maturity (subject to two five-year extensions), with interest rate of 6-month Euribor in effect at closing date plus a differential of 6%. Upon the occurrence of certain triggering events including, but not limited to, Befesa’s failure to meet certain financial targets or the exit of the Triton Funds from Befesa, may be converted into approximately 14% of the shares of Befesa. Abengoa has recorded the sale transaction, recognizing a gain of €0.4 million.

Taking into account the significance of the activities carried out by Befesa to Abengoa, the sale of this shareholding is considered as a discontinued operation and is reported as such, in accordance with the stipulations and requirements of IFRS 5. In accordance with this standard, the results generated by Befesa until the close of the sale and the result of this sale are considered in a single heading, Profit (loss) from discontinued operations. Likewise, the Consolidated Income Statement for the year 2013, which is included for comparison purposes, also includes the reclassification of the results generated by the activities that are now considered to be discontinued, under a single heading.

Held for sale

As of December 31, 2013, the Company has started a process of negociations to sell its 92.6% interest in Qingdao BCTA Desalination Co., Ltd., (‘Qingdao’) a desalination plant in China. Given that as of that date the subsidiary is available for inmediate sale and the sale is highly probable, the Company has classified the assets and liabilities of Qingdao as held for sale in the Consolidated Statement of Financial Position as of December 31, 2013. Until closing of the sale transaction, the assets will be reported as held for sale in accordance with the stipulations and requirements of IFRS 5, Non-Current Assets Held for Sale and Discontinued Operations.

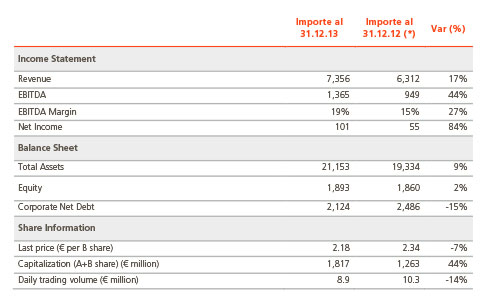

b) Main figures

Financial Data

- Revenues of €7,356 million, an increase of 17% compared to 2012.

- Ebitda of €1,365 million, an increase of 44% compared to 2012.

Operating Data

- 84% of our revenues from international markets outside of Spain.

- United States became the first country in revenues with 28% of total revenues.

- Engineering and Construction backlog up to €6,796 million, as of December 31, 2013.

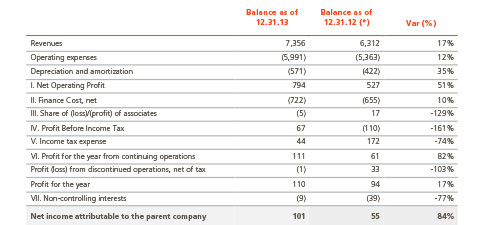

c) Consolidated income statement

Revenues

Abengoa’s consolidated revenues in the year 2013 have reached €7,356 million, representing a 17% increase from the previous year. The increase is mainly due to the revenues increase in Engineering and Construction, where we can highlight the construction of thermo-solar plant in the in the United States and South Africa, a combined-cycle plant in Poland and a significant progress in the Eolic Proyects in Uruguay.

Ebitda

Ebitda the year ended December, 31 2013 reached €1,365 million, a 44% increase from the previous year. This increase was mainly due to contribution of the aforementioned revenues increase in Engineering and Construction business, new concessions assets in operation (Qingdao´s desalination in China, transmission lines in Brazil and the cogeneration plant for Pemex in Mexico), as well as the margin recovery in Bioenergy business.

Finance cost net

Net financial expenses increased in €67 million, mainly due to financial expenses increase, lower interest capitalization due to the entry into operation of Solana, Solaben 1 and 6 projects, which was partially offset by the increase of positive valuation of the embedded derivative in the convertible bonds and related options with respect to the previous year.

Income Tax Expense

Corporate income tax benefit reached €44 million in 2013, from €172 million from previous year. This figure was affected by various incentives for exporting goods and services from Spain, for investment and commitments to R&D+i activities, the contribution to Abengoa’s profit from results from other countries, as well as prevailing tax legislation.

Profit for the year from continuing operations

Given the above, Abengoa’s income from continuing operations increased by 82% from €61 million in 2012 to €111 million in 2013.

Profit from discontinued operations, net of tax

As indicated in Note 2.1.a, the sale of Befesa is considered as a discontinued operation in both periods.

Profit for the year attributable to the parent company

As a result of the above, the profit attributable to Abengoa’s parent company increased by 84% from €55 million achieved in 2012, to €111 million in 2013.

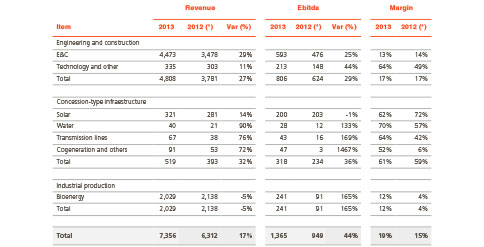

d) Results by activities

The Segment reveneus, EBIDTA and margins for the years 2013 and 2012 is as follows:

Engineering and Construction

Revenues in Engineering and Construction increased by 27% compared to the previous year, to €4,808 million (€3,781 million in 2012), while Ebitda increased by 29% to €806 million compared to the figure recorded in 2012 (€624 million). This growth was mainly driven by:

- Execution of the Mojave solar plant in California (USA), Imperial Valley Plat (USA) as well as solar plants Khi and KaXu (South Africa).

- Execution of combined-cycle plants in Poland and Mexico.

- Execution of eolic projects in Uruguay.

- Progress in Quadras transmission lines for Sierra Gorda in Chile.

- Progress in the execution of high speed train Meca-Medina.

- Construction of Cogeneration Plants in Mexico.

Concession-type Infrastructures

Revenues in the Concession-type Infrastructures area increased by 32% compared to the previous year, to €519 million (€393 million in 2012), while Ebitda rose by 36% to €318 million compared to €234 million in 2012. These increases were mainly due to start-up of various concessions (Desalination plant of Qingdao in China, transmission lines of Brazil of Manaus and the cogeneration plant for Pemex in Mexico) that balanced out lower Ebitda generated by Solar business as consequence of consecutive government reforms in Spain, as well as poor weather conditions registered during the first quarter of 2013.

Industrial Production

Revenues level in Bioenergy Business decreased by 5% compared to the previous year, to €2,029 million (€2,138 million in 2012) due to reduction in Etanol price, while Ebitda reached €241 million compared to €91 million registered in 2012, mainly driven by a favorable resolution from the Court of Arbitration of the International Chamber of Commerce in relation with the arbitration against Adriano Gianetti Dedini Ometto and Adriano Ometto Agrícola Ltda by an amount of €141.8 million (Note 15.10 of the Consolidated Financial Statements) and also by a significant margin increase in Europe and specially in USA.

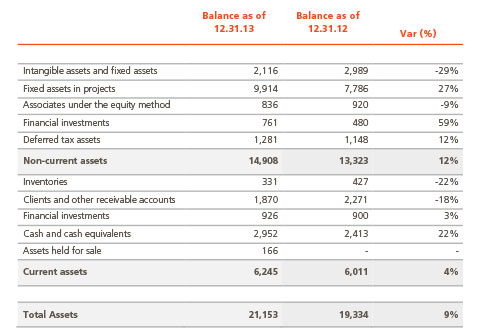

e) Consolidated statement of financial position

Consolidated statements of financial position

A summary of Abengoa’s consolidated balance sheet for 2013 and 2012 is given below, with main variations:

- Non-current assets increased primarily due to the start-up and fully consolidation of Solana (€1,136 million), execution of Solaben 1 and 6 (reclassified to projects) and the assets under construction related to Cogeneration activity, Eolic and Transmissions Lines, partially balanced out by differeces in foreign exchange (Brazilian Real and US Dollar) and reclassification of Qingdao´s short-term discontinued assets. In addition, the decrease in Investments in Associates due to the full consolidation of Solana is partially offset by the equity contributions made by Solar and Bioenergy in companies consolidated via the equity method (Mojave, Khi, Kaxu and Hugoton) and due to the capitalization of interest, as well as an increase in financial investments for the convertible loan and credit notes generated by the sale of Befesa (224 million euros).

- Net increase in current assets, mainly due to the reclassification of the discontinued assets of Qingdao from long term assets to assets held for sale, and due to the net increase in cash and and cash equivalents following the issue of ordinary and convertible bonds, asset rotations and the capital increase with listing in Nasdaq.

- Shareholders’ equity increased by 2%, primarily due to the positive results for the year, the capital increase by going public in the Nasdaq and reduction in negative cash flow hedge derivatives and the dividends distribution policy, partially offset by the negative effect of translation difference arising mainly from the depreciation of the Brazilian real with respect to the Euro.

- Non-current liabilities increased by 17%, mainly due to the ordinary bonds issuance by Abengoa Finance of €873 million, convertible bonds issuance by Abengoa S.A. of €400 million with partial recovery of convertible bonds of €100 million during 2014 and the non-recourse financing projects (Traansmission Lines, Cogeneration, Desalatios and Solana´s debt integration). Partially balanced out by non current liabilities decrease of Befesa, the short-term reclassifications of maturities in 2014 (Syndicated Financing Loan, BEI, ICO, BID, and Convertible Bonds), the downgrade in derivatives valuation and the foreign exchange depreciation (Brazilian Real and US Dollar).

- Current liabilities keep stable during 2013, with an increase by 1%, driven mainly by the reclassification from the Qingdao´s long-term discontinued liabilities to liabiliaties held for sale and reclassification of corporate debt maturities in 2014 (PS, BEI, ICO, BIC and Convertible Bond) partially balanced out by non current liabilities decrease of Befesa and the maturity payment of the Syndicated Loan in July 2013.

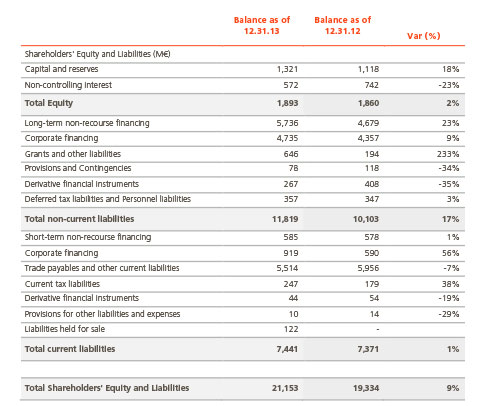

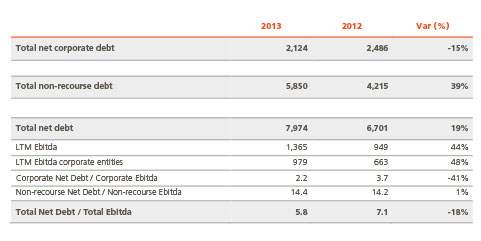

Net Debt Composition

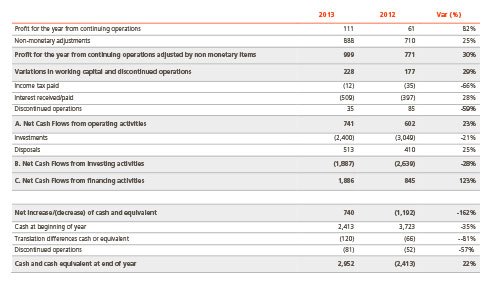

f) Consolidated cash flow statements

A summary of the Consolidated Cash Flow Statements of Abengoa for the years ended December 31, 2013 and 2012 with the main variations per item, are given below:

- Net cash flows from operations reached €741 million, mainly achieved by financial result from activities during the year, as well as the positive evolution of working capital.

- In terms of net cash flows from investing activities €1,887 million, the most significant investments were in the construction of Solar thermal plants (Spain, US and South Africa), Traansmission Lines (Brazil and Peru), Cogeneration (Mexico), Bioenergy (US) and in the construction of an Eolic plant in Uruguay. Regarding disposals, it is worth noting the cash generated by the sale of Befesa to a Private Equity Fund.

- In terms of net cash flows from financing activities, it is worth noting the net generation of cash as a concequence basically of the new corporate financing (bonds issuance) and new non recourse financing projects (Solar, Traansmission Lines, Desalinations and Cogenerations), as well as the capital increase carried out during the year.

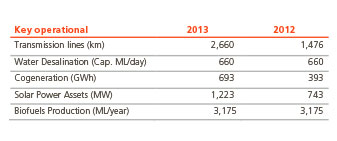

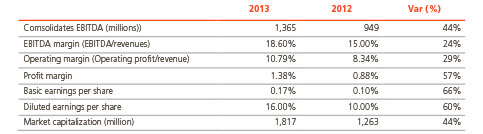

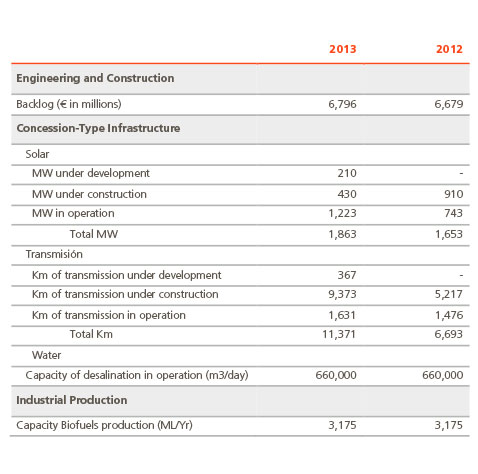

2.2. Financial and non-financial key indicators

The main operational and financial indicators for the years ended December 31, 2013 and 2012 are as follows:

The key performance indicators for each activity is detailed below for the years 2013 and 2012:

2.3. Matters relating to the environment and human resources

a) Environment

The principles of the environmental policies of Abengoa are based on compliance with the current legal regulations applicable, preventing or minimizing damaging or negative environmental consequences, reducing the consumption of energy and natural resources, and achieving ongoing improvement in environmental conduct.

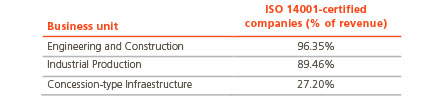

In response to this commitment to the sustainable use of energy and natural resources, Abengoa, in its Management Rules and Guidelines for the entire Group, explicitly establishes the obligation to implement and certify environmental management systems in accordance with the ISO 14001 International Standard.

Consequently, by year-end 2013, the percentage of Companies with Environment Management Systems certified according to the ISO 14001 Standard per sales volume is 93.92% (91.98% in 2012).

The table below lists the percentage of distribution of the Companies with Certified Environmental Management Systems, broken down by business unit:

b) Human resources

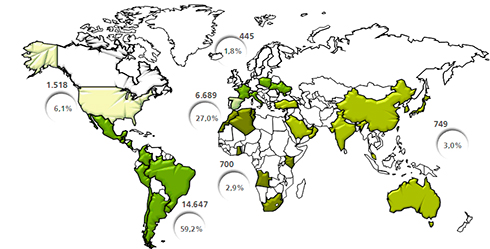

During 2013, Abengoa’s workforce decreased by 6.3% to 24,748 people at December 31, compared to the previous year (26,402).

Geographical distribution of the workforce

The distribution of the average number of employees was 27% in Spain and 73% abroad.

Distribution by professional groups

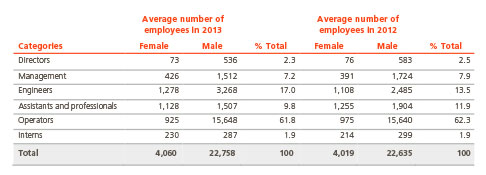

The average number of employees during 2013 and 2012 was:

3.- Liquidity and capital resources

Abengoa’s liquidity and financing policy is intended to ensure that the company keeps sufficient funds available to meet its financial obligations as they fall due. Abengoa uses two main sources of financing:

- Non-recourse project financing, which is typically used to finance any significant investment. The repayment profile of each project is established on the basis of the projected cash flow generation of the business, allowing for variability depending on whether the cash flows of the transaction or project can be forecast accurately. This ensures that sufficient financing is available to meet deadlines and maturities, which mitigates the liquidity risk significantly.

- Corporate Financing, used to finance the activities of the remaining companies which are not financed under the aforementioned financing model. This means of financing is managed through Abengoa S.A., which pools cash held by the rest of the companies so as to be able to re-distribute funds in accordance with the needs of the Group and to ensure that the necessary resources are obtained from the bank and capital markets.

To ensure there are sufficient funds available for debt repayment in relation to its cash-generating capacity, the Corporate Financial Department annually prepares and the Board of Directors reviews a Financial Plan that details all the financing needs and how such financing will be provided. We fund in advance disbursements for major cash requirements, such as capital expenditures, debt repayments and working capital requirements. In addition, as a general rule, we do not commit our own equity in projects until the associated long term financing is obtained.

During 2013, Abengoa covered its financing needs through the following financial transactions:

- In 2012, the Company completed the refinancing of its syndicated loans as well as new financing transactions in subsidiaries which have the support of export credit agencies.

- During 2013 the Company successfully extended the maturity profile of its debt maturities through access to capital markets.

- In January 2013 the Company issued € 400 million convertible notes due in 2019. In addition, in February 2013 the Company issued € 250 million ordinary notes due in 2018 (the ‘February notes’) and in October and November 2013, additional notes fungible with the February notes were issued for an amount of €50 and €250 million, respectively.

- Furthermore, the Company completed a capital increase for a total amount of € 517.5 million in October 2013.

- Finally, in November 2013 Abengoa issued USD 450 million ordinary notes due in 2020. We aim to maintain our strong liquidity position, extend the debt maturities of our existing corporate loans and bonds, continue to access the capital markets from time to time, as appropriate, and further diversify our funding sources. We aim to continue to raise equity funding at the project company level through partnerships.

We aim to maintain our strong liquidity position, extend the debt maturities of our existing corporate loans and bonds, continue to access the capital markets from time to time, as appropriate, and further diversify our funding sources. We aim to continue to raise equity funding at the project company level through partnerships.

In accordance with the foregoing, the sources of financing are diversified, in an attempt to prevent concentrations that may affect our liquidity risk.

a) Contractual obligations and off-balance sheet

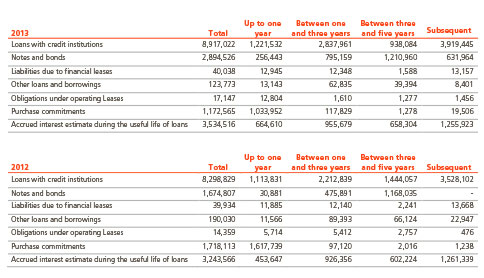

The following table shows the breakdown of the third-party commitments and contractual obligations as of December 31, 2013 and 2012 (in thousands of Euros):

b) Investment plan

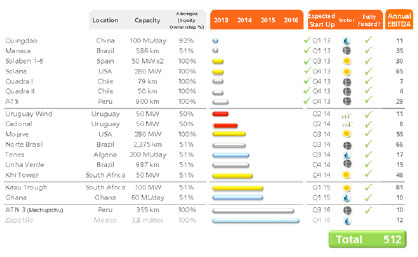

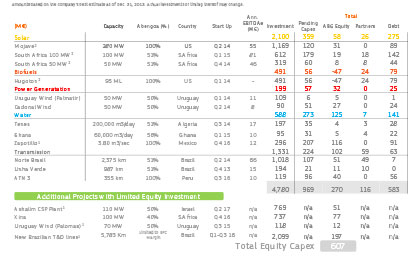

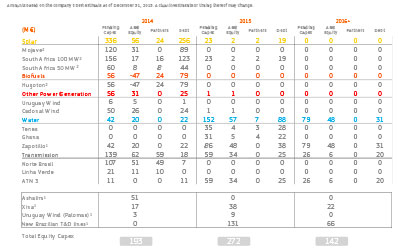

The nature and maturity of future investment commitments are detailed as follows:

Main projects in execution and under development (indicated in light grey)

Capex 2014-2016

1 Uncommitted project (financing and/or partner’s contribution still pending to be secured

2 This project falls under the scope of IFRS 10 and is therefore consolidated through equity method until entry into operation.

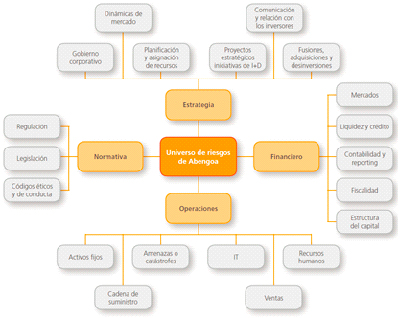

4.- Principal risks and uncertainties

4.1. Operational risks

4.1.1. Regulatory risk

Risk derived from a reliance on favorable regulation of the renewable energy activity and bioethanol production

- a) Solar electricity generation

Renewable energy is rapidly maturing but its cost of generating electricity is still significantly higher than conventional energy (nuclear, coal, gas, hydroelectric). Governments have established support mechanisms to make renewable generation projects economically viable, mainly in the form of subsidized tariffs (in Spain), supplemented in specific cases with direct support for investment (mainly in the USA). These tariffs vary depending on the technology (wind, photovoltaic, solar-thermal, biomass) since they are in different stages of maturity and the regulator seeks to promote the development of each type by giving developers sufficient economic incentive in the form of a reasonable return on their investment. Without this support, any renewable energy project would currently be unfeasible, although as the technology matures, the need for this support diminishes or even completely disappears over the long term.

- b) Bioenergy consumption

The consumption of bioenergy for transport, one of the Company’s activity areas, is also subject to regulation via specific public support policies both nationally and internationally. Biofuels cost more to produce than gasoline or diesel and therefore requires government support to incentivize its use. The use of biofuels offers a series of environmental and energy advantages compared to oil-based fuels, making them potentially useful tools for implementing European policies to combat climate change and reduce oil dependency.

Notwithstanding the above, despite major support in the field of biofuels from governments and regulatory authorities in the jurisdictions in which Abengoa operates, and despite the fact that authorities have reiterated their intention to maintain this support, it is possible that existing policies may change over time.

Furthermore, biofuels are not the only alternative to oil-based fuels for use in transport, as shown by the recent development of electric vehicle technology. Different alternative sources with the potential to progressively substitute fossil fuels in transport can coexist. The future demand for all forms of transport could be covered via a combination of electricity (fuel cells) and biofuels as the main options; synthetic fuels (increasingly produced from renewable sources) as an intermediate solution; methane as an additional fuel; and supplemented by liquid petroleum gas. Many of these alternative sources receive or will receive government support in the form of different types of incentives, which may reduce the support specifically given to biofuels. The level of public support can be influenced by external factors, such as public criticism in some countries at the alleged effect of biofuels on an increase in food prices.

Abengoa’s activities are subject to multiple jurisdictions with varying degrees of regulatory compliance, which require significant effort by the Company to comply with them

Abengoa’s internationalization means that its activities are subject to multiple jurisdictions with varying degrees of regulatory compliance, especially in intensively regulated sectors. This multi-jurisdictional regulatory environment requires considerable effort in order to comply with all legal requirements, which represents a significant risk since non-compliance with any of the numerous precepts could result in licenses being revoked, fines being imposed or penalties that prevent Abengoa from contracting with various public entities.

Risks associated with Concession-type Infrastructure projects that operate under regulated tariffs or very long term concession agreements

Revenues obtained through concession-type infrastructure projects are highly dependent on regulated tariffs or, if applicable, long term price agreements that can last between 25 and 30 years depending on the asset. Abengoa has very little room for maneuver in terms of amending tariffs or prices when faced with adverse operating situations, such as fluctuations in commodity prices, exchange rates, costs of labor and subcontractors, during the construction phase and the operating phase of these projects. These projects are normally calculated with tariffs or prices that are higher than the operations and maintenance cost. The Company’s experience of operating concession-type assets is relatively recent, with three years’ experience in the case of CSP plants (solar-thermal technology) and nine years in the case of electricity transmission lines for proprietary assets. Nevertheless, the Company has extensive experience in providing maintenance services for electricity transmission lines for third parties.

4.1.2. Operational risk

Risks from developing, constructing and operating new projects

The development, construction and operation of traditional power plants, renewable energy plants, desalination plants, water treatment plants, electricity transmission lines, as well as other projects that Abengoa carries out, involves a highly complex process that depends on a large number of variables.

To correctly develop and finance each project, Abengoa must obtain licenses and sufficient financing, as well as sign agreements to purchase or lease land, procure equipment and for the construction, for operations and maintenance, transport and fuel supply, and agreements to sell all or the majority of the production. Furthermore, these factors may significantly affect its capacity to develop and complete new infrastructure projects.

Revenues from long term agreements: risks derived from the existence of termination and/or renewal clauses of the concession agreements managed by Abengoa; cancellation of pending projects in Engineering and Construction; and the non-renewal of distribution agreements in Bioenergy

Concessions

Projects that involve operating concessions are governed by public agreements, in which the corresponding public body defines certain entitlements. However, these agreements are subject to cancellation or termination clauses that can be applied in the event of non-compliance with the commitments established in the agreements. The average remaining term of the concessions managed by Abengoa is 26 years.

Bioenergy distribution agreements

Abengoa sells bioenergy through medium and long term agreements, mainly in Europe. However, it is not possible to guarantee that these agreements will be renewed.

Backlog of projects in the Engineering and Construction activity

It is important to note that the term “backlog” usually refers to projects, operations and services for which the Company has commitments, and includes projects, operations and services for which it does not have firm commitments. Some of the contracted projects are subject to some type of contingency, usually the requirement to obtain external financing.

All backlog projects are subject to unexpected changes and cancellations, since the projects may be part of the backlog for a long period of time. The engineering and construction agreements that Abengoa signs in order to develop its projects are usually implemented over a period that may exceed two years until the construction phase is complete. This situation increases the possibility of these agreements being prematurely terminated. Such cancellations are governed legally and contractually with established compensation procedures. However, if Abengoa itself is in breach or at fault, the Company may not have the right to receive the compensation that applies in the case of early termination.

Variations in energy costs may negatively impact the Company’s results

Some of Abengoa’s activities, especially ethanol production and recycling (the latter was performed until Abengoa sold Befesa) involve significant energy consumption, especially gas.

The profitability of activities that are highly reliant on these inputs is therefore sensitive to fluctuations in their prices. Despite the fact that agreements to purchase gas and Abengoa’s other sources of energy normally include adjustment or hedging mechanisms against a rise in prices, the Company cannot guarantee that these mechanisms cover all of the additional costs that could be incurred from a rise in the price of gas or other energy inputs (especially in long term agreements signed with clients and in agreements that do not include these adjustment clauses).

Risks derived from associations with third parties to execute certain projects

Abengoa has made investments in certain projects with third parties, which contribute their technical expertise. In some cases, these collaborations are conducted through agreements to create joint ventures in which Abengoa only has partial control. These types of projects are subject to the risk that decisions that may be crucial to the success of the project or about investment in the project, are blocked, or are subject to the risk that the third parties may in some way implement strategies that are contrary to Abengoa’s economic interests, resulting in a lower return.

Risks arising from delays or cost-overruns in the Engineering and Construction activity due to the technical difficulty of the projects and the long term nature of their implementation

In the Engineering and Construction activity, it is important to note that, apart from exceptions, all of the agreements that Abengoa has entered into are “turnkey” construction agreements (also called EPC agreements). Under these agreements the client receives a completed facility in exchange for a fixed price. These projects are subject to very long construction periods that range between one and three years. This type of agreement involves a certain amount of risk since the price offered prior to beginning the project is based on cost estimates that may change over the course of the construction period, which can affect the profitability of certain projects, or even cause significant losses. As well as causing cost overruns, delays can result in deadlines being missed or the need to pay a penalty to the client, depending on what has been negotiated. Furthermore, in most EPC contracts Abengoa is responsible for every aspect of the project, from the engineering through to the construction, including the commissioning of the project. In addition to the general responsibilities for each project, Abengoa must also assume the technical risk and the associated guarantee commitments.

Risks derived from the requirement for a high degree of investment in fixed assets (Capex), which increases the need for third party financing in order to develop pending projects

To carry out its operations, the Company requires a high level of investment in fixed assets, mainly in the Concessions-type Infrastructures activity. The Company is going through an expansion phase for proprietary assets and plants for the Concessions-type Infrastructures activity. Investment, especially in concessions, is recovered over the long term.

The significant need for investment means that the Company is reliant on access to the capital markets and bank funding to finance new projects and to manage its general corporate funding requirements. Difficulties in accessing financing caused by a high level of existing indebtedness, among other factors, could increase the cost of financing, which may even be impossible to obtain, with the subsequent reduction in the internal rate of return of projects that partially depend on the Company’s level of borrowing. Nevertheless, Abengoa is committed to carrying out only those projects that fulfil certain internal requirements (yield, strategic fit, limited investment by the group) and for which financing has been obtained. Consequently, Abengoa’s growth in this area is related to the availability of funding in the financial environment in which it operates.

Abengoa operates with high levels of debt

Abengoa’s operations are capital intensive and the Company therefore operates with a high level of indebtedness.

The main ratio that Abengoa must observe is its net debt over EBITDA, excluding the debt and EBITDA from projects financed under non-recourse formats, as defined in its main corporate finance agreements. As at December 31, 2013, this ratio was 1.69x with the maximum limit being 3.0x until December 30, 2014.

At the end of 2013 the covenant ratio for Net Debt and corporate EBITDA, according to the clauses of the syndicated loan, was 1.69x. This ratio is obtained by calculating the total liquidity of the companies with non-recourse financing; debt is calculated as the amount of the reserve account for debt servicing; and R&D+i expenses for the period are excluded from EBITDA.

In relation to the non-recourse debt of project companies, it should be noted that the majority of the Company’s projects are developed in regulated environments, in which the debt is repaid over a long time frame according to the concession agreement, a regulated tariff or, if appropriate, power or water purchase agreements, so that the gearing (meaning the proportion of debt to capital) of these projects is higher than in financing with recourse to the parent company or other group companies (corporate financing). Since non-recourse financing is used for most projects, it makes sense to analyze debt at two separate levels (non-recourse and corporate, since the parent company is only liable for corporate debt).

Notwithstanding the above, a breach of the payment obligations assumed by borrowing companies (usually project companies) could have major consequences for the Company and its group, including but not limited to lower dividends, lower interest or payments to be received by Abengoa (which Abengoa then uses to repay corporate debt) or losses incurred in the event that guarantees provided by project companies under non-recourse financing agreements are enforced.

Likewise, the current high level of indebtedness could increase in the future due to Capex investments in projects using project finance formats, in which the associated debt will be drawn down as the project is implemented and for which the financing is already committed. This high level of debt could require the use of a significant part of the operational cash flow in order to pay the debt, thereby reducing the capacity to finance working capital, future Capex, investment in R&D+i or other general corporate objectives, as well as limiting the Company’s capacity to obtain additional financing.

Abengoa estimates that the cash flows generated by its projects and the level of cash and credit available under their financing agreements, will be sufficient to meet the Company’s future liquidity requirements for at least 12 months. Nevertheless, if debt should increase in the future as a result of developing multiple new projects and the interest payments associated with this, operating cash flow, cash and other resources may not be sufficient to cover the Company’s payment obligations when they fall due or to finance its liquidity needs.

In addition to the current high level of gearing, the terms of the agreements for issuing debt and other financing agreements that regulate debt issuance, enable both Abengoa and its subsidiaries, joint ventures and associated entities to access a significant amount of additional debt in the future, including secured debt, which could increase the aforementioned risks.

As at the date of these Consolidated Financial Statements, Abengoa has not breached any of its corporate financing agreements, which could give rise to the early cancellation of these agreements.

Nevertheless, it should be noted that a breach of these obligations (for example, the requirement to maintain certain financial ratios, restrictions on dividend payments, restrictions on granting loans and guarantees, and restrictions on the availability of assets) agreed by the Company with various financial institutions that have provided third party financing, could lead to the early cancellation of payment obligations under the corresponding finance agreements (and other associated agreements) and, if applicable, the enforcement of guarantees that may have been granted in their favor. Likewise, such a breach could give rise to the early cancellation not only of the aforementioned agreements, but also those that have specific cross default clauses (which the majority of corporate borrowing agreements have) caused by payment default.

In addition, it should be remembered that Abengoa could be forced into early repayment of the debt in financing agreements or to redeem convertible notes and bonds (should the note and bondholders demand it) in the event of a change of control in the Company.

Risk of obtaining less net profit from asset rotation

Abengoa implements a selective rotation strategy of its concession assets (mainly solar plants, electricity transmission lines, desalination and cogeneration plants), through which the Company occasionally divests certain assets in order to maximize the expected return depending on market conditions, asset maturity and Abengoa’s strategy in relation to these assets, while monetizing the value of these projects ahead of schedule in order to maximize shareholder return.

However, Abengoa cannot guarantee that it will be able to obtain the same level of net profit as it has to date, in the future, since the Company’s capacity to generate new business opportunities or opportunities with similar returns to those it currently obtains will depend on market conditions and other factors beyond Abengoa’s control.

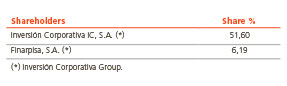

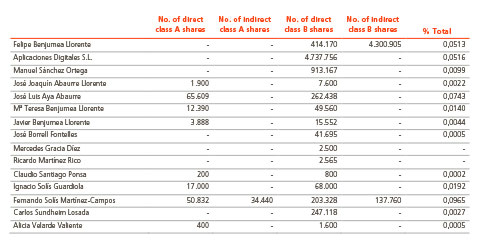

The Company has a controlling shareholder

As at the date of the Consolidated Financial Statements, Inversión Corporativa I.C., S.A. owns 58.18% of the voting rights in Abengoa.

Consequently, this company controls Abengoa under the terms established in Article 42 of the Code of Commerce, and may therefore exercise influence over certain subjects that require shareholders’ approval, notwithstanding the protection and separate voting rights of the Company’s Class B shares in certain situations, according to the Company’s bylaws.

Conflicts could arise from differences between the interests of Inversión Corporativa I.C., S.A. and the remaining shareholders, which may be resolved by the controlling shareholder in a way that does not suit the interests of the other shareholders.

Nevertheless, Inversión Corporativa IC, S.A. has signed a shareholders’ agreement with the Company through which it agrees, among other things, to (i) only exercise its voting rights up to a maximum of 55.93% (the percentage of votes that it had at the date of signing the shareholders’ agreement) in cases in which, as a result of exercising the right to convert Class A shares into Class B shares, which is included in the Company’s bylaws, the total voting rights that it holds as a percentage of the total voting rights of the Company increases; and (ii) that the percentage represented at any given time by the number of shares that it holds with the right to vote (whether these are Class A shares or Class B shares) of the total number of Company shares, will not be less than one quarter of the percentage represented by the voting rights that these shares attribute to Inversión Corporativa IC, S.A. at any given time, in relation to the Company’s total voting rights (in other words, that its voting rights will not be greater than four times its financial rights); and that, should this situation arise, it will sell the necessary amount of Class A shares or will convert them into Class B shares in order to maintain this ratio.

Similarly, through the shareholder agreement with First Reserve Corporation (another shareholder in the Company), Inversión Corporativa IC, S.A. has agreed that while FRC or any of its related companies owns Abengoa Class B shares or any other instrument that is convertible or exchangeable for Abengoa Class B shares, they will not propose or request the Board of Directors to recommend to shareholders any modification to the Company’s bylaws that adversely affects the equal rights between Class B and Class A shares in relation to the distribution of dividends or similar distributions as established in the bylaws and that if this proposal were to be submitted by another shareholder, or by the Board of Directors, they will vote against it.

The products and services of the renewable energy sector are part of a market that is subject to strict competition rules

Abengoa operates in a competitive environment in its solar-thermal business. In general, renewable energy competes with conventional energies that are cheaper and more competitive. Renewable energy is currently subsidized in order to bridge the difference in cost and it has various specific implementation targets. This support for renewable energy may not continue in the future.

It is possible that some of the Company’s current competitors or new participants in the market could respond more quickly to regulatory changes or develop a technology with significantly different production costs. Furthermore, existing or future competitors may be able to dedicate more financial, technical and management resources to developing, promoting and selling their electricity.

The results of the Engineering and Construction activity significantly depend on the growth of the Company’s Concession-type Infrastructures and Industrial Production activities.

The Engineering and Construction business is Abengoa’s most important activity in terms of revenues. A significant part of this activity depends on the construction of new assets by the Concession-type Infrastructures activity (especially power generation plants, transmission lines and water infrastructures) and the Industrial Production activity (bioenergy plants).

If Abengoa is not successful in winning new contracts in its Concession-type Infrastructures activity, the revenues and profitability of the Engineering and Construction activity will suffer.

The evolution of interest rates and the Company’s hedging may affect its results

In the normal course of its business, the Company is exposed to various types of market risk, including the impact of exchange rate movements. Part of its borrowing accrues interest at variable rates, normally referenced to indicators such as EURIBOR and LIBOR. However none of its corporate debt is exposed to interest rate changes until 2014 (fixed rate debt and debt with interest rate hedges). Any increase in interest rates would increase the financial costs associated with the variable interest rate, and would increase the cost of refinancing existing borrowing and issuing new debt.

The evolution of exchange rates and the Company’s hedging could affect its results

Abengoa is exposed to exchange rate risk in transactions denominated in a currency that is not the functional currency of each of the companies that comprise its group.

As the group’s international activities grow, a significant part of its transactions may be carried out in currencies other than the functional currency of each company.

The main exposure to exchange rate risk is US dollar-Euro.

Abengoa’s strategy to reduce its exposure to exchange rate movements in situations in which there is no natural hedge (by adjusting future cash flows from revenues denominated in different currencies to match principal and interest payments in the same currencies) consists of using foreign exchange futures contracts and exchange rate swaps.

Internationalization and country risk

Abengoa has projects on five continents, some of them in emerging countries. Abengoa’s different operations and investments may be affected by different types of risk related to the economic, political and social conditions of the different countries in which it operates, especially countries with a higher degree of instability in the aforementioned factors (Algeria, Angola, China, India, Morocco, Ghana and other Latin American countries). These types of risk are usually jointly referred to as “country risk” and include:

- The effects of inflation and/or possible devaluation of local currencies;

- Possible restrictions on capital movements;

- The possibility of expropriation, asset nationalization or increased intervention by governments in the economy and the management of companies, as well as not granting or revoking previously held licenses;

- The possible imposition of new and higher taxes or levies;

- The possibility of economic crises occurring, or situations of political instability or public disorder.

Abengoa’s policy is to cover the country risk using insurance policies and transferring the risk to financial institutions by means of the corresponding financing agreements and other mechanisms.

The insurance policies taken out by Abengoa may be insufficient to cover the risks arising from projects and the cost of insurance premiums may rise

Abengoa’s projects are exposed to various types of risk that require appropriate coverage in order to mitigate the effects should they occur. Despite Abengoa’s attempts to obtain the correct coverage for the main risks associated with each project, it is not possible to verify that this is sufficient for every type of loss that could arise.

Abengoa’s projects are insured with policies that comply with sector standards in relation to various types of risk, such as risks caused by nature, incidents during assembly, construction or transport and loss of earnings associated with these occurrences. All of the insurance policies taken out by Abengoa comply with the requirements demanded by the institutions that finance the projects and the coverage is verified by independent experts for each project.

Furthermore the insurance policies taken out are subject to review by the insurance companies. In the event that insurance premiums increase in the future and these increases cannot be passed on to clients, these additional costs could have a negative impact for Abengoa. However, no significant increases have occurred in the cost of premiums in the last 12 months.

The Company’s activities may be negatively affected by catastrophes, natural disasters, adverse weather conditions, unexpected geological conditions or other environmental circumstances, as well as by acts of terrorism at any of its sites

In the event that an Abengoa site is affected by a fire, flood, adverse weather conditions or any other type of natural disaster, acts of terrorism, power outages and other catastrophes, or in the event of unexpected geological conditions or other unexpected environmental circumstances, the Company may be unable or only partially able to continue operating at this. This could result in lower revenues from the affected site while the problems exist and lead to higher repair costs.

Abengoa has taken out insurance against natural risks or acts of terrorism and the loss of earnings that may arise from stoppages.

Tax evasion and product tampering in the fuel distribution market in Brazil could distort market prices

In recent years, tax evasion and product tampering have been one of the main problems for fuel distributors in Brazil. In general, such practices combine both tax evasion and fuel tampering by mixing gasoline with solvents or adding anhydrous ethanol in quantities greater than 25% allowable by the law (taxes on anhydrous ethanol are lower than those for hydrated ethanol and gasoline). Taxes account for a highly significant proportion of the cost of fuel sold in Brazil.

Abengoa operates in an activity sector that is closely linked to the economic cycle

The global economic and financial situation and difficulties in accessing financing, the sovereign debt crisis, fiscal deficits and other macroeconomic factors may negatively affect demand from existing or potential clients.

Specifically, the reduction in national infrastructure budgets is impacting Abengoa’s results, since a proportion of the projects are promoted by governmental bodies, which provide the Company with a volume of revenues that would be difficult to substitute with private investment, especially in the current economic environment.

As mentioned, although the economic cycle affects all of the Company’s business, some activities are more dependent on the economic outlook than others.

The demand for bioenergy, like the demand for gasoline or diesel, is relatively inelastic and has not decreased in a significant way despite high fuel prices.

However, Abengoa’s Concession-type Infrastructures activity is much less dependent on the economic outlook, since revenues from this activity primarily come from long-term agreements, which neutralize the fluctuations associated with the economic situation. However, as in Engineering and Construction, it is a Capex intensive activity and could be affected by difficulties in access to financing.

Risks derived from sensitivity in procuring the necessary raw materials for producing bioenergy and volatility of the end product price

Raw materials account for approximately 60 to 70% of bioenergy production costs. The increase in commodity prices (mainly grain and gas) or a decrease in end product prices (ethanol) could mean that operating Abengoa’s production plants becomes unprofitable. To mitigate the risk associated with these prices as much as possible, Abengoa has a policy of not committing its production and sale of biofuels until it has ensured its supply of the necessary raw materials.

Abengoa’s activities could be negatively affected in the event of adverse public opinion about them

Certain people, associations or groups may oppose Abengoa’s projects, such as the construction of renewable energy plants, recycling plants (this activity was performed by Abengoa until it sold Befesa), etc.

Although carrying out these types of projects generally requires an environmental impact study and a public consultation process prior to granting the corresponding administrative authorizations, the Company cannot guarantee that a specific project is going to be accepted by the affected population. Moreover, in those areas in which the corresponding facilities are located next to residential areas, opposition from local residents could lead to the adoption of restrictive rules or measures regarding the facilities.

If part of the population or a particular company decides to oppose the construction of a project or takes legal action, this could make obtaining the corresponding administrative authorizations difficult. In addition, legal action may give rise to the adoption of precautionary measures that force construction to stop, which could cause problems for commissioning the project within the scheduled time frame or achieving Abengoa’s business objectives.

Furthermore, adverse public opinion about the use of grain and sugarcane cannot be ruled out, and to a lesser extent regarding the production of bioethanol, since these are basic consumer goods that are significantly associated with shortages in the food market. In response to public pressure, governments may adopt measures to ensure that the grain and sugar is diverted to the food market instead of bioethanol production, causing problems for existing production activities and Abengoa’s future expansion plans.

Construction projects related to the Engineering and Construction activity and the facilities of the Concession-type Infrastructures and Industrial Production activities are hazardous workplaces

Employees and other personnel that work on Abengoa’s construction projects for the Engineering and Construction activity and at the facilities of the Concession-type Infrastructures and Industrial Production activities are usually surrounded by large scale mechanical equipment, moving vehicles, manufacturing processes or hazardous materials, which are subject to wide-ranging regulations when they are used (for example, occupational health and safety legislation and other applicable regulations). Projects may involve the use of hazardous or highly regulated materials that, if not handled correctly or spilt, could expose the Company to claims that could result in all types of civil, criminal, administrative liabilities (fines or Social Security benefits surcharges).

Despite the fact that the Company has functional groups that are exclusively responsible for monitoring the implementation of health and safety measures, as well as working procedures that are compatible with protecting the environment, throughout the organization (including at construction and maintenance sites), any failure in complying with these regulations could result in liability for the Company. Similarly, Abengoa may be unaware or unable to control compliance with occupational health and safety regulations in the companies that it subcontracts. In the event of non-compliance Abengoa could be found liable.

Historical safety levels are a critical aspect for Abengoa’s reputation. Many of its clients expressly require the Company to comply with specific safety criteria in order to be able to submit bids, and many contracts include automatic termination clauses or withdrawal of all or part of the contractual fees or profits in the event that the Company fails to comply with certain criteria. Consequently, Abengoa’s inability to maintain adequate safety standards could result in lower profitability or the loss of clients or projects.

As at the date of these Consolidated Financial Statements, no agreements have been terminated, no penalties have been imposed and no significant decreases in earnings have occurred due to failures to comply with safety-related obligations.

The existence of two share classes, Class A and Class B, with different voting rights, could deter third parties from carrying out transactions to take control of the Company

There are two main factors that could deter third-party entities from carrying out certain corporate transactions, such as a merger or acquisition, or any other transaction involving a change of control in the Company, which shareholders of Class B shares could consider as beneficial, which in turn could negatively affect the price of Class B shares, which are the following:

- (i) The existence of two share classes with different voting rights and the concentration of voting rights in a single shareholder, Inversión Corporativa IC, S.A., and in the Class A shares; and

- (ii) The right of redemption. Abengoa’s bylaws grant a right of redemption to Class B shares in the event that a takeover bid is made and completed for all of the Company’s shares with voting rights, through which the offeror gains control of the Company and the price offered for Class B shares is not the same as Class A shares. This right of redemption enables Class B shareholders that have not been offered the same price, to request the Company to redeem their shares at the price offered for Class A shares in the tender offer, with the exceptions and limitations established in the Company’s bylaws. This right of redemption does not apply in the event of partial and voluntary tender offers.

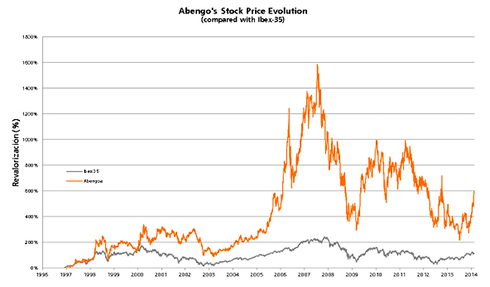

Class B share price volatility

The price of the new shares when admitted to trading shall be determined by the Madrid stock exchange as the lead exchange, based on the closing price of Abengoa’s Class B shares on the day prior to the start of their listing.

The future price of Class B shares may fluctuate significantly. Factors such as the evolution of the Company’s operating results, negative publicity, changes in equity analysts' recommendations about the Company, changes in the global conditions of financial markets, securities markets or the sectors in which the Company operates, could all have a significant negative impact on the price of the Company’s Class B shares.

Risk of significant sales of shares

The sale of a significant number of Abengoa Class B shares in the market after they are admitted for trading, or the perception in the market that such sales may take place, could damage the price of the Class B shares or the Company’s ability to raise capital through future issues.

Abengoa, Inversión Corporativa IC, S.A., Finarpisa, S.A. and the members of the Board of Directors and managers of the Company (with the exception of Mr Claudio Santiago Ponsa), have agreed not to offer, sell, agree to sell, pledge or in any way dispose of (or formalize any transaction designed to dispose of or by means of its execution could reasonably result in the disposal [by means of a real disposal or effective financial disposal derived from a financial agreement, or in any other way] by the Company or a Company subsidiary or any person with a mutual interest in the Company or a Company subsidiary) shares in the Company (whether Class A shares, Class B shares or ADSs that represent the latter), directly or indirectly, or securities convertible into the Company’s shares, nor establish or increase an equivalent short position, nor settle or decrease an equivalent long position, and to publically announce their intention not to carry out any of the aforementioned transactions, from the date of that the format of the capital increase is defined until 180 days have passed from the date that the Class B shares are admitted to trading on the NASDAQ Global Select Market in the USA through ADSs represented by ADRs, which occurred on October 17, 2013. This period could be extended by up to 18 additional days from the end of the period in the event that the Company publishes results or announces their publication during the last 17 days of the originally agreed period.

Possibility of differences in the listed prices of Class A shares and Class B shares despite the fact that both share classes have similar financial rights

Despite the fact that both share classes have equivalent financial rights and there is a controlling shareholder, Class A shares and Class B shares may be listed with different prices due to the difference in voting and other non-financial rights, among other reasons.

In particular, there is a risk that a third party may launch a takeover for 100% of the Company’s shares offering a different price for Class A and Class B shares. To mitigate this risk, Article 8 of Abengoa’s bylaws includes a right of redemption for Class B shares under the terms and conditions established therein. This right of redemption does not apply in the event of partial and voluntary tender offers.

Shareholders in countries with non-euro currencies may incur additional risk associated with variations in the exchange rate in relation to holding the Company’s shares

The Company has requested admission to trading of the Class B shares on the US stock market through ADSs denominated in US dollars. With regards to holding the Company’s new shares, shareholders in countries with non-euro currencies incur an additional risk due to variations in the exchange rate. Therefore, the price of the ADSs and the dividends paid may be unfavorably affected by fluctuations in the euro-US dollar exchange rate.

4.1.3. Concentraciones de clientes

During the years 2013 and 2012 there is no client that contributes more than 10% of revenue

4.2. Financial risk

4.2.1. Market risk

Market risk arises when group activities are exposed fundamentally to financial risk derived from changes in foreign exchange rates, interest rates and changes in the fair values of certain raw materials.

To hedge such exposure, Abengoa uses currency forward contracts, options and interest rate swaps as well as future contracts for commodities. The Group does not generally use derivatives for speculative purposes.

- Foreign exchange rate risk: the international activity of the Group generates exposure to foreign exchange rate risk. Foreign exchange rate risk arises when future commercial transactions and assets and liabilities recognized are not denominated in the functional currency of the group company that undertakes the transaction or records the asset or liability. The main exchange rate exposure for the Group relates to the US Dollar against the Euro.

To control foreign exchange risk, the Group purchases forward exchange contracts. Such contracts are designated as fair-value or cash-flow hedges, as appropriate.

In the event that the exchange rate of the US Dollar had risen by 10% against the Euro as of December 31, 2013, with the rest of the variables remaining constant, the effect in the Consolidated Income Statement would have been a loss of €8,496 thousand (loss of €10,602 thousand in 2012) mainly due to the US Dollar net liability position of the Group in companies with Euro functional currency and an increase of €1,192 thousand (decrease of €2,440 in 2012) in other reserves as a result of the cash flow hedging effects on highly probable future transactions.

Details of the financial hedging instruments and foreign currency payments as of December 31, 2013 and 2012 are included in Note 14 of these Notes to these Consolidated Financial Statements.

- Interest rate risk: arises mainly from financial liabilities at variable interest rates.

Abengoa actively manages its risks exposure to variations in interest rates associated with its variable interest debt.

In non-recourse financing (see Note 19), as a general rule, the Company enters into hedging arrangements for at least 80% of the amount and the timeframe of the relevant financing.

In corporate financing (see Note 20), as general rule, 80% of the debt is covered throughout the term of the debt; in addition, in 2009, 2010 and 2013, Abengoa issued notes at a fixed interest rate.

The main interest rate exposure for the Group relates to the variable interest rate with reference to the Euribor.

To control the interest rate risk, the Group primarily uses interest rate swaps and interest rate options (caps and collars), which, in exchange for a fee, offer protection against an increase in interest rates.

In the event that Euribor had risen by 25 basic points as of December 31, 2013, with the rest of the variables remaining constant, the effect in the Consolidated Income Statement would have been a profit of €13,669 thousand (profit of €4,004 thousand in 2012) mainly due to the increase in time value of hedge interest rate options (caps and collars) and an increase of € 48,050 thousand in other reserves (increase of €52,163 thousand in 2012) mainly due to the increase in value of hedging interest derivatives (swaps, caps and collars).

A breakdown of the interest rate derivatives as of December 31, 2013 and 2012 is provided in Note 14 of these Notes to the Consolidated Financial Statements. - Risk of change in commodities prices: arises both through the sale of the Group’s products and the purchase of commodities for production processes. The main risk of change in commodities prices for the Group is related to the price of grain, ethanol, sugar, gas, and aluminum (and zinc until the sale of the Company’s shareholding in Befesa).

In general, the Group uses futures and options listed on organized markets, as well as OTC (over-the-counter) contracts with financial institutions, to mitigate the risk of market price fluctuations.

At December 31, 2013, if the price of grain had increased by 10%, with the rest of the variables remaining constant, the effect in the Consolidated Income Statement would have been null (loss of €35,092 thousand in 2012) and an increase in other reserves of € 4,567 thousand (decrease of €16,391 thousand in 2012) due to open derivative contracts primarily on grain purchases held by the Group.

At December 31, 2013, if the price of ethanol had increased by 10%, with the rest of the variables remaining constant, the effect in the Consolidated Income Statement would have been null (profit of €11,035 thousand in 2012) and an increase in other reserves of €60,040 thousand (null in 2012) due to open derivative contracts primarily on ethanol purchases held by the Group.

A breakdown of the commodity derivative instruments as of December 31, 2013 ad 2012 is included in Note 14 to these Consolidated Financial Statements.

In addition, certain Bioenergy Business Group companies engage in purchase and sale transactions in the grain and ethanol markets, in accordance with a management policy for trading transactions.

Management has approved and supplemented trading strategies to control the purchase and sale of forward and swap contracts, mainly for sugar, grain and ethanol, which are reported on a daily basis, following the internal procedures established in the Transactions Policy. As a risk-mitigation element, the company sets daily limits or ‘stop losses’ for each strategy, depending on the markets in which it operates, the financial instruments purchased and the risks defined in the transaction.

These transactions are measured monthly at fair value through the Consolidated Income Statement. In 2013, Abengoa recorded a profit of €15 thousand (profit of €11,768 thousand in 2012), €15 thousand of which related to profit on settled transactions (€11,768 thousand in 2012) and €0 thousand to open derivative contracts valued at the year ended (€0 thousand in 2012).

4.2.2. Credit risk

The main financial assets exposed to credit risk derived from the failure of the counterparty to meet its obligations are trade and other receivables, current financial investments and cash.

a) Clients and other receivables.

b) Current financial investments and cash.

- Clients and other receivables: Most receivables relate to clients operating in a range of industries and countries with contracts that require ongoing payments as the project advances, the service is rendered or upon delivery of the product. It is a common practice for the company to reserve the right to cancel the work in the event of a material breach, especially non-payment.

In general, and to mitigate the credit risk, prior to any commercial contract or business agreement, the company generally holds a firm commitment from a leading financial institution to purchase the receivables through a non-recourse factoring arrangement. Under these agreements, the company pays the bank for assuming the credit risk and also pays interest for the discounted amounts. The company always assumes the responsibility that the receivables are valid.

Abengoa derecognizes the factored receivables from the Consolidated Statement of Financial Position when all the conditions of IAS 39 for derecognition of assets are met. In other words, an analysis is made to determine whether all risks and rewards of the financial assets have been transferred, comparing the company’s exposure, before and after the transfer, to the variability in the amounts and the calendar of net cash flows from the transferred asset. Once the company’s exposure to this variability has been eliminated or substantially reduced, the financial asset has been transferred

In general, Abengoa considers that the most significant risk related to Clients and other receivables is the risk of non-collection, since: a) trade receivables may be quantitatively significant during the progress of work performed for a project or service rendered; b) it is not under the company’s control. However, the risk of delays in payment typically relates to technical problems, i.e. associated with the technical risk of the service provided and, therefore, within the company’s control.

If the company concludes that the risk associated to the contract has been transferred to the financial institution, the receivable is derecognized in the Consolidated Statement of Financial Position at the time it is transferred, in accordance with IAS 39.20.

An ageing of trade receivables as of December 31, 2013 and 2012 is included in Note 15 ‘Clients and other receivable accounts’. The same note also discloses the credit quality of the clients as well as the movement on provisions for receivables for the years ended December 31, 2013 and 2012. - Financial investments: to control credit risk in financial investments, the Group has established corporate criteria which require that counterparties are always highly rated financial entities and government debt, as well as establishing investing limits with periodic review.

4.2.3. Liquidity risk