Abengoa

Abengoa

Annual Report 2013

- Corporate Governance

- Annual report on the remunerations of members of the boards of listed corporations

A.The company’s remunerations policy for the ongoing financial year

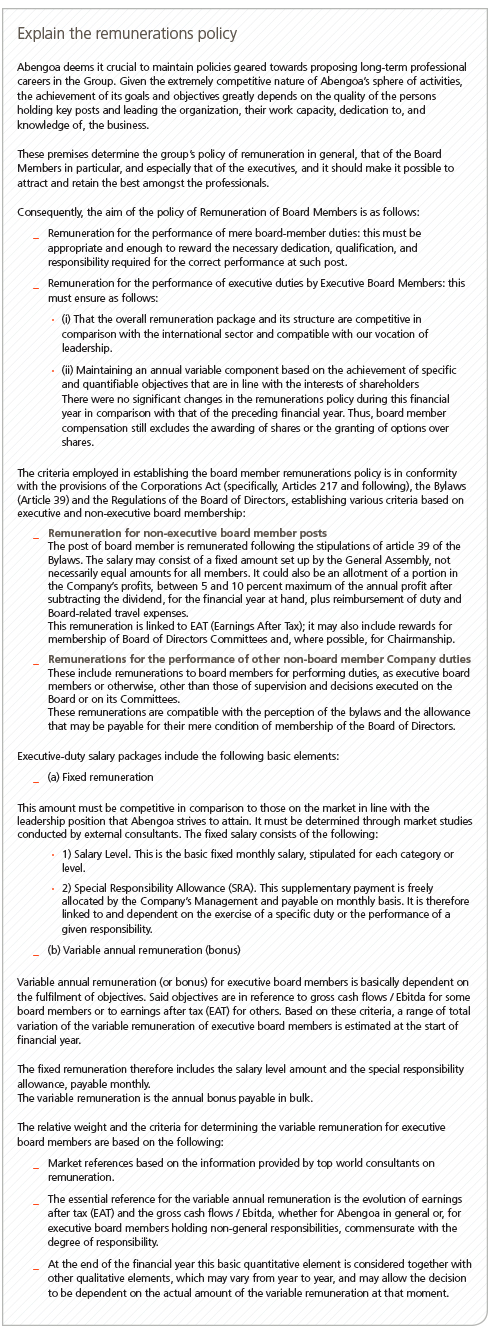

A.1 Explain the company’s remunerations policy. The following information must be provided under this topic:

- General principles and bases for the remuneration policy.

- The most important changes made in the remunerations policy with regards to that applied in the last financial year, as well as changes made in the conditions for the exercise of options granted during the financial year.

- Criteria and composition of groups of comparable companies whose policies have been considered remuneration for establishing the remuneration policy of the company.

- The relative significance of variables with regards to fixed remunerations and the criteria implemented to determine the various components of the remuneration package of board members (rewards/benefits package).

A.2 Information on the preparation and decision-making process followed to determine the remuneration policy and the role played, if so, by the remunerations committee and other monitoring organs in establishing such remunerations policy. As the case may be, said information must include the power vested in the Remunerations Committee, its composition and the identity of the External Consultants that rendered the advisory services in defining the remunerations policy. It must also include the nature of the board members who, if any, participated in defining the remunerations policy.

Explain the process involved in determining the remunerations policy

By virtue of the task assigned by the Board of Directors, the remunerations policy is prepared, discussed and formulated by the Appointments and

Remunerations Committee which then submits the resulting proposal to the Board of Directors for approval at the start of each financial year.

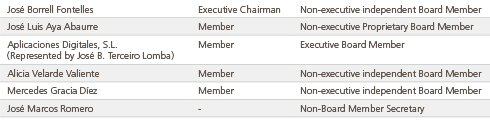

The current members of the Appointments and Remunerations Committee, and, as such, participants in defining the remunerations policy, are as follows:

The secretary was appointed during the Appointments and Remunerations Committee meeting held via circular resolution on 28th January 2004; the Chairman was however appointed during the Appointments and Remunerations Committee meeting held on 23rd July 2012.

The Appointments and Remunerations Committee consequently comprises of one executive and four non-executive board members, in compliance with the requirements set forth in the Financial Systems Reform Law. Likewise, in accordance with the provisions in Article 2 of its Internal Regulations, the position of committee chairman must be held by a non-executive board member.

External consultants did not participate in determining the remunerations policy.

A.3 Indicate the nature and amount of the fixed components, where possible, itemizing the rewards of the executive board members for performing top-management duties, listing all additional rewards as chairperson or as member of a board of directors committee, stating the allowance for sitting on the board and its committees or other fixed remunerations as board member, and estimating the total of the fixed annual remuneration. Identify other benefits not payable in cash and the basic parameters by which they are awarded.

Explain the fixed components of the remuneration

In Abengoa, only executive board members are entitled to fixed remunerations, which are entirely derived from salaries assigned for the performance of duties. During the 2013 financial year, the total paid as salary to executive board members is €2,435 thousands of Euros.

Both allowances of board of directors and amounts payable for committee membership or chairmanship were paid only for attending. Amounts paid in 2013 under said items are as follows:

- Allowance for board of directors: €1,580 thousands of Euros

- Membership or chairmanship of committees: €499 thousands of Euros

Individuals serving as executive board members, in their condition as employees of the company, are granted life insurance coverage and the Company paid the 2013 premium in the amount of €2 thousands of Euros.

In addition, the company engaged security services for the amount of €108 thousands of Euros.

A.4 Indicate the amounts and explain the nature and main characteristics of the variable components of the remunerations system.

Specifically:

- Identify all remuneration plans of which board members are the beneficiaries, the scope, approval date, initial application date, and validity period, including their main characteristics. If the plans involve options held over shares and other financial instruments, the general characteristics of such plans must include information on the conditions governing the exercise of said options or financial instruments for each of the plans.

- Indicate all remunerations in concept of participation in benefits or bonus, and the reasons why.

- Explain the basic parameters and grounds for any system of bonus allocation

- The classification of board members (executive, external proprietary, external independent and other external board members) who are beneficiaries of remuneration systems or plans that incorporate variable remuneration.

- The basis for said systems of variable remunerations or plans, the criteria for evaluating the selected performance, the components and methods of evaluation to determine whether or not said evaluation criteria are met, and an estimate of the absolute amount of the variable remunerations that may arise from the remuneration plan in vigour, based on the degree of completion of the hypothesis or objectives taken as reference.In such a case, report on the periods of deferment or postponement established for payment and/or the periods for retaining shares or other financial instruments if existing.

Explain the variable components of the remuneration systems

Variable annual remuneration (or bonus) for executive board members is basically dependent on the fulfilment of objectives. Said objectives are in reference to gross cash flows / Ebitda for some board members or to earnings after tax (EAT) for others. Based on these criteria, a range of total variation of the variable remuneration of executive board members is estimated at the start of financial year.

The variable remuneration is the annual bonus payable in bulk.

The total amount of the bonus payable to the executive board members for the 2013 financial year reaches €10,595 thousands of Euros.

Extraordinary Variable Compensation Plan for Directors.

Currently the company has a long-term extraordinary variable compensation plan for directors, approved by the Company’s Board of Directors in February 2011 following a proposal forwarded by the Appointments and Remunerations Committee.

Among other directors, said Plan includes the executive board members as beneficiaries (the participants), and covers a period of five years (2011 to 2015), and establishes the following as beneficiary eligibility conditions:

- (a) That the beneficiary remains as employee of either Abengoa or of any of its subsidiaries, for a given period.

- (b) That during each financial year of the given period the beneficiary must be entitled to the annual bonus within the framework of the Abengoa strategic business plan in which said beneficiary worked during said year, as long as he/she meets at least 90% of the objectives set forth in said plan (net benefit, hiring, margins, etc.). The annual objectives that must be met so as to be entitled to an annual bonus (variable remuneration) are dependent on the volume of business envisaged and its margin, the execution of projects, level of outstanding payments, etc.

Upon the maturity of the Plan, the only moment of accrual and enforceability, it shall be liquidated in proportion to the number of financial years consolidated.

- (c) That the five-year plan of Abengoa or the relevant subsidiary must be met in accordance with the strategic plan of June 2011, and the beneficiary must be employed in one of said entities for the 2011-2015 financial years.

- (d) That the average trading of the Abengoa shares not be lower than a specified value, during the last three months of 2015.

In the event that a beneficiary of the aforementioned plan ceases to be such (whether by voluntary severance or fair dismissal) before the date the plan is scheduled to mature, he/she shall not be entitled to any payment whatsoever by virtue of the plan.

On the other hand, in the event of a demise of a beneficiary, its inheritors shall be entitled, when the plan matures, to claim the amount accumulated during the completed financial year(s) preceding the demise.

Should a beneficiary retire as a result of reaching the retirement age established by law or due to total disability (preventing said beneficiary from performing any other kind of work) before the date the plan is scheduled to mature, said beneficiary shall be entitled to claim the amount accumulated during the completed financial year(s) preceding such retirement, as long as the other established conditions are met.

Abengoa shall acknowledge the corresponding remuneration upon maturity if the aforementioned conditions are met.

A.5 Explain the main characteristics of the long-term savings systems, including retirement and any other survivor’s pensions, partially or totally financed by the company, whether internally or externally endowed, estimating the equivalent annual amount or cost, indicating the type of plan, whether defined contribution or defined-benefits, the conditions of the consolidation of the economic rights for the board members and their compatibility with any kind of compensation for early termination or for the resolution of the contractual relationship between the company and the board member.

Also indicate the pension plan contributions paid on behalf of board member, or any increase in the vested rights of board member in the case of contributions to defined-benefit plans;

Explain the long-term savings systems

The compensation package for Abengoa board members does not include any long-term savings system.

A.6 Indicate any board member severance packages agreed upon or paid.

Explain the compensations

Abengoa does not entertain any agreed-upon board member severance package and the company did not pay any compensation under such item during the 2013 financial year.

A7. Indicate the conditions that must be included in the contracts of those who perform senior management duties as executive directors. Among others, the disclosure must include the duration of the contract, the limits of compensations, the continuance clauses, the length of the periods of advance notice, the payments in lieu of the aforementioned periods of advance notice, and any other clauses in relation to hiring bonus, as well as compensations or golden parachutes for early termination or the resolution of any contractual relationship between the company and the executive board member. It must also include non-concurrent, exclusivity, continuance, loyalty and post-contractual non-competition agreements or pacts.

Explain the conditions of contracts signed with executive board members

Contracts signed with executive board members are indefinite but not considered special contracts of senior management. Such contracts are consequently adjusted and subject to the ordinary labour laws. There are no foreseeable exceptional circumstances relating to the Company eventually rescinding the services of a board member.

A.8 Explain any supplementary remuneration payable to board members in consideration for rendered services other than those inherent in their duties.

Explain the supplementary remunerations

In Abengoa there are no supplementary remunerations payable to its board members.

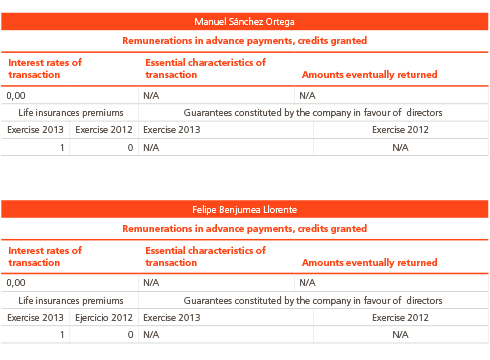

A.9 Indicate any payments in the form of advances, credits and guarantees granted, stating the interest rates, essential features and the amounts gradually returned, including the obligations assumed in the form of guarantees.

Explain the advances, credits and guarantees granted

Abengoa has not granted any advances, credits or guarantees to members of its Board of Directors.

A.10 Explain the main characteristics of remunerations-in-kind.

Explain the remunerations-in-kind

Remunerations-in-kind is reduced to bonus payable by the Company in the form of life insurance for individuals serving on the executive board -because of their condition as employees of Abengoa and not as its board members- and for the security services.

A.11 Indicate the remunerations accumulated by a board member through payments made by the listed company to a third party entity where the board member renders services, if the payments are meant for remunerating the member’s services in the entity.

Explain the remunerations accumulated by the board member through payments made by the listed company to a third party entity where the board member renders services

No payments were made to any company for the purpose of remunerating the services rendered to Abengoa by external board members.

A.12 Explain any kind of compensation other than those listed above, of whatever nature and provenance within the group, especially if considered an associate transaction or if its omission would distort the true nature of the total remuneration received by the board member.

Explain the other wage components

There are no wage components other than those outlined in previous sections.

A.13 Explain the actions taken by the company in relation to the remunerations system to reduce exposure to excessive risks and to adjust it to the company’s long-term objectives, values and interests, including, as the case may be, a reference to: measures put in place to guarantee that the remuneration policy coincides and remains in line with the company’s long-term results; measures to establish the appropriate equilibrium between the fixed and variable components of the remuneration; measures put in place with regards to categories of personnel whose professional activities bear material repercussion on the entity’s risks profile; recovery formulae or clauses to ensure the refund of variable components of remuneration paid based on results if it happens that such components had already been paid because of some data initially deemed accurate but later proven to be erroneous and misleading and the measures put in place to prevent conflicts of interests, as the case may be.

Explain the actions taken to reduce the risks

To ensure the effective running of the organization and to guarantee the company’s long-term future, in addition to a good strategic planning, it is inevitable to retain an accurate and rigorous management that considers the risks associated with the company’s activity itself and to have a foresight into how to mitigate them.

Thus, Abengoa has a global system for managing its own risks, included in the common management systems, which permits the monitoring and identification of risks and which are regularly updated for the purpose of creating a culture of common management, achieving the objectives set forth in the area and having the capacity to adjust in order to mitigate threats that may surface in an environment as competitive as the present.

The introduction of this system enforces the following:

- The management of risks at all levels of the organization, without any exceptions.

- Its full integration into the strategy and into the systems for achieving the fixed objectives.

- The full support of the management to evaluate, follow-up on and comply with guidelines relating to the management of threats.

This system of risks management is based on three tools:

- The compulsory internal norms (NOC).

- The compulsory process to be followed (POC).

- The Universal Risks Model (URM).

Compliance with them is guaranteed through the verification conducted by the Internal Audits Department and at committee meetings regularly held with senior staff and chairman’s office.

These tools and common management systems are designed from quality standards aimed at complying with international rules and regulations like the ISO 31000 and the Sarbanes-Oxley Act, and have been certified by companies of international repute.

The Universal Risks Model (URM) is the methodology that Abengoa uses for the identification, comprehension and evaluation of the risks that may affect the company. Its main purpose is to obtain an integral vision of them, designing an efficient system that is in line with the business goals and objectives of Abengoa.

The URM consists of more than 55 risks classified into 20 different categories grouped into 4 large areas: financial, strategic, regulations and transactions.

The URM is subject to annual revisions to ensure that the calculations designed for each risk are the most appropriate for the day-to-day operations of the company.

B. Remunerations policy envisaged for future financial years

B.1 Prepare a general forecast of the remunerations policy for future financial years, describing said policy with regards to the following: fixed components and allowances and remunerations of variable nature; the relation between remunerations and results; forecasting systems; the conditions of the contracts of executive board members; and the forecasts of the most significant changes in the remuneration policy in comparison with previous financial years.

General forecasts of the remunerations policy

Abengoa does not foresee any significant changes in the Board of Directors remunerations policy for future financial years. It remains in line with that of the present financial year.

B.2 Explain the decision-making process for determining the remunerations policy envisaged for future financial years, and the role played, if any, by the remunerations committee.

Explain the decision-making process for determining the remunerations policy

The remunerations policy is approved by the Board of Directors, following the proposal from the Appointments and Remunerations Committee.

The Committee is considered validly constituted if the majority of its members are present. Only non-executive board members can act as representatives.

Decisions taken are deemed valid if favourably voted by the majority of the committee members, present or represented. Situations of tie are resolved by Chairman’s vote.

The company’s head of remunerations act as secretary in the Committee meetings.

B.3 Explain the incentives created by the company in the remunerations system to reduce exposure to excessive risks and to adjust it to the company’s long-term objectives, values and interests.

Explain the incentives created to reduce risks

The Abengoa risks management has been paramount in driving the company to the current leadership position held on the market. Its global risks management system, included in the common management systems, permits it to monitor and identify risks at all levels of the organization and to mitigate threats that may arise, without necessarily having to establish specific incentives in that regard in the remuneration policy of the board of directors.

C. Overall summary of how the remunerations policy was applied during the closed financial year.

C.1 Provide a summary of the main features of the structure and wage components of the remunerations policy applied during the closed financial year, detailing the individual components received by each of the board members listed in section D of this report. Also provide a summary of the decisions taken by the board of directors towards the application of said components.

Explain the structure and wage components of the remunerations policy applied during the financial year

The structure and wage components of the Abengoa board members vary based on whether or not the board member is an executive, and is approved by the board of directors at the start of each financial year:

- Remuneration for non-executive board member position

The position of board member is remunerated following the stipulations of article 39 of the Bylaws. The salary may consist of a fixed amount set up by the General Assembly, not necessarily equal amounts for all members. It could also be an allotment of a share in the Company’s profits, between 5 and 10 percent maximum of the annual profit after subtracting the dividend, for the financial year at hand, plus reimbursement of duty and Board-related travel expenses.

This remuneration is linked to EAT (Earnings After Tax); it may also include rewards for membership of Board of Directors Committees and, where possible, for Chairmanship. - Remunerations for the performance of other non-board member Company duties

These include remunerations to board members for performing duties, as executive board members or otherwise, other than those of supervision and decision-making performed on the Board or on its Committees.

These remunerations are compatible with the perception of the bylaws and the allowances payable for the mere condition as members of the Board of Directors.

Executive-duty salary packages include the following basic elements:

- (a) Fixed remuneration

This amount must be competitive in comparison to those on the market in line with the leadership position Abengoa strives to attain. It must be determined through market studies conducted by external consultants. The fixed salary consists of the following:

- 1) Salary Level. This is the basic fixed monthly salary, assigned to each category or level.

- 2) Special Responsibility Allowance (SRA). This supplementary payment is freely decided upon by the Company’s Management and payable on monthly basis, and it is therefore linked to and conditioned by the exercise of a specific duty or the performance of a given responsibility.

- (b) Variable annual remuneration (bonus

Variable annual remuneration (or bonus) for executive board members is basically dependent on the fulfilment of objectives. Said objectives are in reference to gross cash flows / Ebitda for some board members or to earnings after tax (EAT) for others. Based on these criteria, a range of total variation of the variable remuneration of executive board members is estimated at the start of financial year.

The fixed remuneration therefore includes the salary level amount and the special responsibility allowance, payable monthly.

The variable remuneration is the annual bonus payable in bulk.

D. Detail of individual payments received by each of the board members

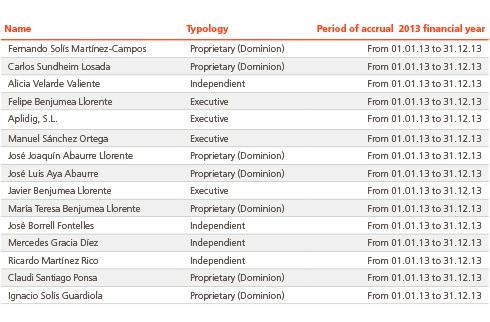

D.1 Complete the following tables with regards to the itemized remunerations of each of the board members (including the wages for the performance of executive duties) received during the financial year.

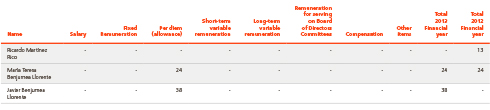

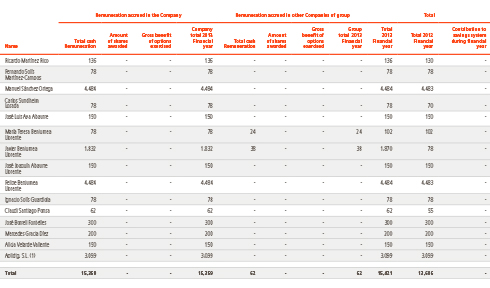

a) Wages and salaries received in the company covered by this report:

i) Remunerations payable in cash (in thousands of Euros)

ii) Share-based remunerations systems

Not applicable.

iii) Long-term savings systems

Not applicable.

iv) Other benefits (thousands of €)

b) Remunerations received by the company’s board members for serving on boards of other companies of the group:

i) Remunerations payable in cash (in thousands of Euros)

ii) Share-based remunerations systems

Not applicable.

iii) Long-term savings systems

N/A.

Not applicable.

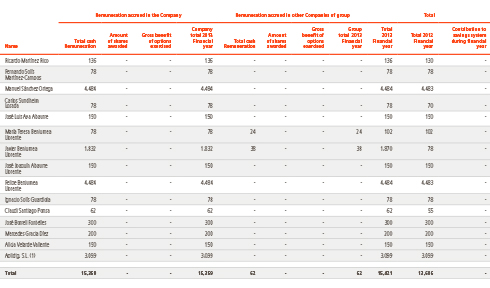

c) Summary of the remunerations (thousands of €):

The summary must include the amounts for all wage components included in this report which the board member may have accumulated, in thousands of Euros.

Regarding the long-term Savings Systems, it must include the contributions made to or funding provided for this kind of systems:

D.2 Report on the relationship between remunerations obtained by board members and the results or other performance measurements of the company, explaining, if so, how the variations in the performance of the company influenced the variations in the remunerations of the board members.

- The essential reference for the variable annual remuneration is the evolution of earnings after tax (EAT) and gross cash flows / Ebitda, whether for Abengoa in general or, for executive board members holding non-general responsibilities, commensurate with the degree of responsibility.

- At the end of the financial year this basic quantitative element is be considered together with other qualitative elements, which may vary from year to year, and may allow the decision to be based on the actual amount of the variable remuneration at that moment.

- Based on the criteria established for determining the annual bonus, it is payable in proportion to the degree of fulfilment.

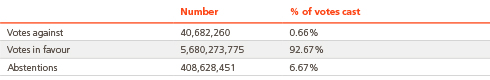

D.3 Report the result of the general meeting’s consultative voting cast on the annual report on remunerations of the previous financial year, indicating the number of votes cast against it:

E. Other information of interest

Provide a brief detail of any other relevant aspects with regards to board member remunerations which have not been included or considered in the other sections of this report, but which should be necessarily included in order for the information, compiled on the structure and practices of remuneration with regards to board members, to be deemed complete and reasonable.

Abengoa’s remunerations policy does not include other relevant elements than those already outlined in the preceding sections of this report.

This Annual Remunerations Report was approved by the company’s Board of Directors at its meeting held on 20th February 2014.

Indicate whether Board Members voted against or abstained from voting for or against the approval of this Report.

Yes No X

© 2013 Abengoa. All rights reserved