Abengoa

Abengoa

Annual Report 2012

- Corporate Governance

- Annual Report on Corporate Governance

- Ownership structure

A. Ownership Structure

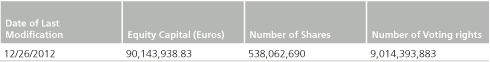

A.1. Complete the following table on the company’s stock capital:

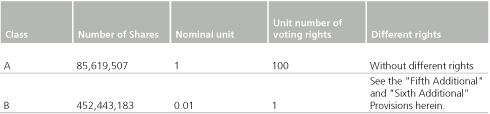

Indicate whether there are different types of shares with different rights associated:

Yes.

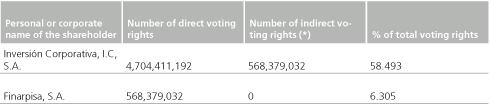

A.2. List the direct and indirect holders of significant ownership interests in your company at year-end, excluding board members:

Indicate the most significant movements in the shareholding structure of the company over the year:

See the seventh additional provision herein.

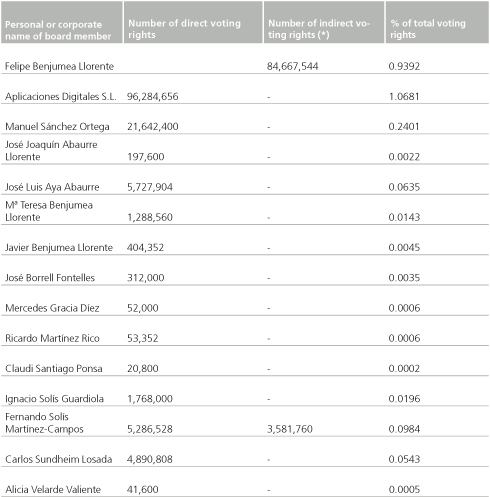

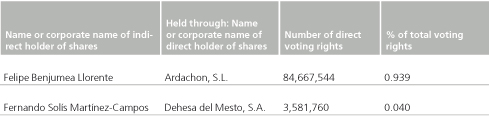

A.3. Complete the following tables on the members of the Board of Directors of the Company that hold voting rights through company shares:

% total of voting rights held by board of directors 2.510 %

Complete the following tables on the company’s Board of Directors with rights over company shares:

The board members do not hold rights over company shares.

A.4. Indicate, as the case may be, any family, commercial, contractual or corporate relations between owners of significant shareholdings, insofar as these are known by the company, unless they bear little relevance or arise from ordinary trading or course of business:

Type of relationship

Societal

Brief description:

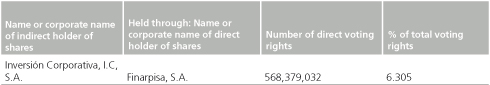

Inversión Corporativa, I.C, S.A holds 100% shares in Finarpisa, S.A.

A.5. Indicate, as the case may be, any commercial, contractual or corporate relations between owners of significant shareholdings on the one hand, and the company and/or its group on the other, unless these bear little relevance or arise from ordinary trading or course of business:

No evidence or indication of the existence of such.

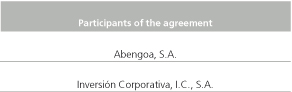

A.6. Indicate whether the company was informed of any shareholders’ agreements affecting the company pursuant to Article 112 of the Spanish Securities Market Law. If so, provide a brief description and list the shareholders bound by the agreement:

Yes.

% of equity capital affected:

58.493%

Brief description of pact:

Under the framework of investment agreement signed on November 9, 2011 between Abengoa and First Reserve Corporation, Inversión Corporativa IC and Finarpisa SA, in their capacity as Abengoa shareholders, made a commitment, effective November 4, 2011, undersigned on October 4, 2011, to regulate the exercise of their respective voting rights in the Abengoa general assemblies in relation to the proposal, appointment, ratification, re-election or replacement of a board member representing First Reserve Corporation.

By virtue of said commitment, Inversión Corporativa I.C., S.A. and Finarpisa, S.A., jointly agree on the following:

(i) to vote on the following through their representatives on the Board of Directors of Abengoa: (a) the appointment of the candidate proposed to said board to serve as board member designated by investor based on the co-optation procedure envisaged in the Corporations Act; and (b) the proposal to recommend that during the next meeting of the general assembly the Shareholders of Abengoa appoint, as the case may be, a replacement for the board member designated by investor on the Board of Directors.

(ii) to vote in the corresponding general assembly of shareholders of Abengoa in favour of the appointment of the candidate proposed by Investor to serve as investor’s representative on the Board of Directors;

(iii) FRC or any of its subsidiaries holding Abengoa class B shares or any other instrument convertible in, or exchangeable for, Abengoa Class B shares, issued in accordance with the Investment Agreement stipulations or with any other transaction document, may not propose or ask the Board of Directors to recommend that the shareholders make any kind of changes to the Company Bylaws which may adversely affect the equality rights of Class B shares and Class A shares as regards the distribution of dividends or analogous such as envisaged in the Bylaws.

% of equity capital affected:

58.493%

Brief description of pact:

On August 27, 2012, Inversión Corporativa, I.C., S.A. and its subsidiary, Finarpisa, S.A., modified the shareholder agreement with the Abengoa shareholder, First Reserve Corporation (reported to this committee accordingly due to the Price-sensitive content (relevant fact) dated November 9, 2011).

The modification entailed adding “if such proposal is submitted by another shareholder or by the Board of Directors, votes should be cast against it” to the following valid obligation: “FRC or any of its subsidiaries holding Abengoa class B shares or any other instrument convertible in, or exchangeable for, Abengoa Class B shares, issued in accordance with the Investment Agreement stipulations or with any other transaction document, may not propose or ask the Board of Directors to recommend that the shareholders make any kind of changes to the Company Bylaws which may adversely affect the equality rights of Class B shares and Class A shares as regards the distribution of dividends or analogous such as envisaged in the Bylaws”.

% of equity capital affected:

55.93%

Brief description of pact:

On August 27, 2012, Abengoa S.A. entered a shareholder agreement with its top shareholder, Inversión Corporativa, I.C., S.A by virtue of which the latter warrants and undertakes, the following, directly or indirectly, through its subsidiary, Finarpisa S.A.:

(i) To vote in favour of the agreements regarding points 2nd, 3rd, 4th, 5th, 6th and 7th on the Agenda of the Shareholders’ General assembly held on September 30, 2012, as long as it is first verified that the aforementioned agreements are approved by the majority of the shareholders of another class other than those of Inversión Corporativa;

(ii) to not exercise its voting rights except up to a maximum of 55.93% in cases in which, as a result of the exercise of the rights of conversion of Class A shares into Class B shares expected to be included in the Corporate Bylaws, the total percentage of the voting rights it holds are seen increased over the company’s entire voting rights;

(iii) that the percentage of the number of shares with voting rights held at all times (whether such shares are Class A or Class B) over the company’s total number of shares not be at any time lower than one fourth of the percentage of the voting rights that said shares may allocate to Inversión Corporativa in relation to the company’s total number of voting rights (that is, that its voting rights not be higher by more than four times its financial rights); and that, should such be the case, Class A share should be transferred or converted into Class B, in the amount deemed necessary to sustain such proportion.

Specify whether the company is aware of the existence of any concerted actions among its shareholders. If so, provide a brief description:

No.

Expressly indicate any amendments to, or terminations of such agreements or concerted actions during the year:

On August 27, 2012, Inversión Corporativa, I.C., S.A. and its subsidiary, Finarpisa, S.A., modified the shareholder agreement with the Abengoa shareholder, First Reserve Corporation (reported to this committee accordingly due to the Price-sensitive content (relevant fact) dated November 9, 2011), in the manner explained an the start f this section.

A.7. Indicate whether any individuals or corporate bodies currently exercise, or could exercise control over the company pursuant to Article 4 of the Spanish Securities Market Act. If so, please identify:

Personal or corporate name:

Inversión Corporativa, I.C, S.A.

Notes

Inversión Corporativa, I.C, S.A. is the direct holder of 52.19% of the equity capital of Abengoa, S.A. and an indirect holder of 6.31% through its subsidiary, Finarpisa S.A. Inversión Corporativa, I.C, S.A. is bona fide owner of the 100% shares of Finarpisa S.A.

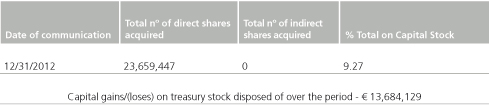

A.8. Complete the following tables on the company’s treasury stock:

At year end:

Held through:

Provide details of any significant changes during the year, in accordance with Royal Decree 1362/2007.

A.9. Provide details of the conditions and timeframes set up by the General Shareholders’ Meeting for the Board of Directors to acquire and/or transfer treasury stock.

The Ordinary General Assembly of Shareholders Meeting held on April 1, 2012, authorized the Board of Directors to buy back the Company’s shares either directly or through its subsidiary or investee companies up to the maximum permitted by current laws at a rate set between one hundredth part of a Euro (€0,01) as a minimum and sixty Euros (€60) as maximum, with express power of substitution in any of its members. Said power shall remain in vigour for eighteen (18) months from this very date, subject to article 144 and following of the Corporations Act.

On November 19, 2007, the company signed a Liquidity Agreement regarding Class A shares with Santander Investment Bolsa, S.V. In replacement of this agreement, on 8th January 2013, pursuant to the conditions set forth in Circular 3/2007, of December 19, of the CNMV, the company signed a liquidity agreement regarding Class A shares.

On 8th November 2012, pursuant to the conditions set forth in Circular 3/2007, of December 19, of the CNMV, the company signed a liquidity agreement regarding Class B shares with Santander Investment Bolsa, S.V.

On December 31, 2012, the balance of treasury stock amounted to 14,681,667. In relation to transactions performed over the year, the number of treasury shares acquired stood at 23,659,447 while treasury shares disposed of amounted to 11,891,215. The net operating result amounted to - €13,684,129.66

A.10 Indicate, as applicable, any law or Bylaw restrictions imposed on voting rights, as well as any legal restrictions on the acquisition or transfer of ownership interests in the share capital. Indicate whether there are any legal restrictions on exercising voting rights:

No.

Indicate whether there are any restrictions included in the company’s Bylaws on exercising voting rights:

No.

Indicate whether there are any legal restrictions on the acquisition or transfer of holdings in the share capital:

No.

A.11. Indicate whether the General Shareholders’ Meeting has agreed to adopt neutralization measures to prevent a public takeover bids pursuant to the provisions of Act 6/2007.

No.

Where applicable, explain the approved measures and terms under which restrictions shall be rendered ineffective:

Not applicable.

© 2012 Abengoa. All rights reserved