Abengoa

Abengoa

Annual Report 2010

- Activities

- Report from the Chairman

2010 was yet another good year for Abengoa. In spite of the economic and financial crisis plaguing some of our markets, we continued to report double-digit growth. Revenues increased by 34 % in comparison to 2009 to total €5,566 M, EBITDA climbed by 26 % to €942 M, and net profit rose by 22 % for a total of €207 M.

Our strategy focuses on offering innovative technological solutions for sustainable development in the energy and environment sectors. Coupled with our geographic diversification, this has enabled us to report consistent double-digit growth over the last fifteen years. We believe that demand for our solutions will continue to increase as the world becomes increasingly more aware of the overriding need for sustainable development.

The two factors we consider essential in order for a solution to be accepted at Abengoa are technology, which is hugely important and affords us a competitive edge, and global leadership. We are convinced that industrial innovation is key to forging a more sustainable world. In our case, we ended the year with 99 patents that had either been granted or which were in the process of being approved.

In this regard, 2010 marked several important milestones for Abengoa, including commencement of construction of Solana, in the United States, which boasts 280 MW of installed power and six hours of molten salt storage; initiation of work on the 100 MW solar thermal power plant in Abu Dhabi, and the operational roll-out in Spain of a further three such plants, each with 50 MW of installed power.

In the biofuel area, we fulfilled our present first-generation bioethanol investment plan by starting up three new plants in Illinois and Indiana (USA), and in Rotterdam (the Netherlands), with a combined annual production capacity of 300 Mgal -1,150 ML-. To this we may add the successful operation of our second-generation biomass-ethanol production plant in Salamanca, Spain.

In India, we completed construction and start-up of a desalination plant in Chennai with a capacity of 100,000 m3 per day.

Work also got underway on the 2,350 km Porto Velho - Araraquara 600 kV direct current power transmission line. Furthermore, together with twenty other partners, the company entered into an agreement to constitute Medgrid, an initiative aimed at developing and promoting a Euro-Mediterranean power grid to encourage the transmission of power produced in countries located on the southern shores of the Mediterranean to the European market.

For the first time, Abengoa features this year the three segments that best reflect the company’s reality, stemming from its evolution and transformation over the last fifteen years. The parameters guiding the company at that time are no longer valid today. Nevertheless, the bulk of this Annual Report has been structured for the last time around the company’s five traditional business units. In this Report, we have continued to gradually migrate towards the approach to reporting activities we initiated in our presentation of results for the third quarter of 2010. To this end, we have included a table illustrating the key figures in accordance with the new segment composition, as well as a summary of the Activity Report prepared from this new perspective.

We achieved significant growth this year in our three business segments (Engineering and construction, Concession type infrastructures and Industrial production).

- Backed by 70 years of experience in the industry, Engineering and construction draws together our traditional engineering activity associated with energy, water and information technologies. We specialize in the execution of complex turnkey projects involving concentrating solar power plants; solar-gas hybrid plants; conventional generating plants; power transmission lines; hydraulic infrastructure, including, among others, major desalinating plants; biofuel plants; and critical infrastructure control systems.

In this segment revenues totaled €3,121 M in 2010, up 26 % on 2009, and EBITDA increased by 7 % year-on-year to reach €415 M. During the past twelve months, Abengoa’s new order intake totaled €4,200 M and closed the year with a backlog of €9,274 M, which affords significant visibility for our revenues in the medium term.

- Concession-type infraestructures group together any asset operations for which we have long-term contract, including take-or-pay contracts, power/water purchase agreements and tariff-type sales contracts. This segment therefore includes solar power plants, transmission lines, cogeneration plants and desalination plants. For these particular assets, our efforts focus on streamlining operations. We have a young asset portfolio, with an average of 27 years of pending life, and a total of €34,976 M in future income. We should also highlight the company’s investment volume in assets currently in the construction phase, which will more than double our current capacity once they enter into operation. This is a segment that affords Abengoa tremendous future exposure.

Revenues from this segment totaled €309 M in 2010, up 41 % on 2009, while EBITDA amounted to €208 M, representing a year-on-year jump of 46 %. This high growth is primarily attributed to the operational start-up of several solar plants and desalination plants, as well as various power transmission line segments.

- The Industrial production segment encompasses Abengoa’s business in the biofuel and metal recycling area. These activities, also based on proprietary assets, are focused on high-growth markets in which the company boasts a position of technological leadership.

Revenues from this segment totaled €2,137 M in 2010, up 48 % on 2009, while EBITDA rose by 46 % to reach €320 M. The key factors here lie in higher ethanol production as a result of three new plants in operation (two in the USA and one in Europe), which have increased our capacity to over 820 Mgal -3,100 ML- per year, as well as the recovery of recycled material volumes in Europe in the wake of a crisis-stricken 2009.

As we can see, 44 % of our revenues and 56 % of our EBITDA in 2010 was generated by the asset operations, in comparison to 2009 figures of 40 % and 48 %, respectively, or the 19 % and 30 % of 2000, which shows the company’s evolution towards greater stability and recurrence in terms of income.

By territory, we experienced growth in the United States, Latin America, Europe and Asia, where we witnessed the highest growth rate in percentage terms (up 81 % with respect to 2009), primarily on the back of the first major EPC contracts we secured in the Middle East and the start of construction work on a desalination plant in Quingdao, China.

Spain currently accounts for 26 % of our revenues. Brazil, with 19 %, and the United States, with 16 %, represent, respectively, Abengoa’s second and third most important markets. Latin America continues as the region encompassing the highest percentage of our international business, totaling 31 %, followed by North America and Europe, excluding Spain, both with 16 %.

With these results, we managed to overcome a year characterized by the worst worldwide economic and financial crisis seen in the last 75 years, while at the same time succeeding in laying the foundations for company growth in the coming years. In fact, we continued to invest in those businesses we consider to be the focus of our strategy for the future, and, once again this year, we maintained our R&D+I efforts.

- In 2010 we created Abengoa Research, an R&D group that will carry out highly innovative research for the entire company, supplementing the different R&D+I areas already in place within the organization. We also invested €93 M in R&D+I, and applied for 39 new patents. We are convinced of the importance of technology and innovation for Abengoa’s future, and we therefore continue to support these types of activities. The accomplishments achieved, which have afforded us recognition as leaders in concentrating solar power (CSP) technology and second-generation biofuel development, spur us on in the direction we decided to take many years ago.

- Our human capital constitutes the cornerstone for this generation of knowledge with which we intend to continue growing. We continue to invest in the development of our professionals. We therefore closed 2010 with more than 1.2 M hours of training and an alliance plan in progress with some of the most prestigious universities worldwide to enable us to carry out quality training around the world. Likewise, we continued forward with our international grant program, which this year enjoyed the participation of nearly 700 people, representing an increase of 15 % over 2009. In terms of employment figures, Abengoa has grown by 12 % with respect to last year to reach a total headcount in excess of 26,000 people, thereby consolidating the growth reported in previous years.

- We also continued investing in Corporate Social Responsibility to further the social development and environmental balance of the communities in which we operate, paying particular attention to the disabled and to social awareness of climate change, investing to this end more than €10 M.

- In addition to completing the second inventory of greenhouse gas (GHG) emissions, we worked hard throughout the year on developing a system for labeling all of our products, which, once completed, will enable us to determine the GHG emissions associated with each and every product. We likewise kept working on the development of a system of sustainability indicators to supplement the GHG inventory.

- In 2010 we obtained additional financing totaling €5,000 M approximately, which enables us to fund our investment plan to date. Through prudent administration of our financing needs, we ended the year with cash assets totaling close to €3,000 M, and with sufficiently ample leveraging levels to be able to comfortably face the coming years. Thus, net debt, excluding non-recourse financing, stood at €1,166 M at year-end 2010, 1.8 times our corporate EBITDA, while total net debt amounted to €3,122 M (excluding debt tied up in preoperational assets), 3.3 times our consolidated EBITDA.

- As in 2009, with the aim of ensuring the reliability of our financial information, in 2010 we continued to reinforce our internal control structure, voluntarily adapting it to the requirements established under the US Sarbanes-Oxley Act (SOX). Once again this year, we submitted our company’s internal control system to an independent assessment process carried out by external auditors in accordance with PCAOB auditing standards.

- We also remain staunchly committed to transparency and good governance practices. Our annual report already features six independent audit reports drawn up by external auditors in relation to the following areas: Annual Accounts, SOX Internal Control System, Corporate Social Responsibility Report, Greenhouse Gas Emissions Inventory, Corporate Governance Report, and the Risk Management System Design Process.

Our business model affords us greater visibility as the result of significant investment effort in recent years, which is gradually being reflected in the income statement. We ended the year with over €9,274 M in order backlog in the Engineering and construction area, a total of €34,976 M in Concession-type infraestructures, and with all of our Industrial production plants up and running.

Therefore, our main challenge in 2011 will essentially be to perform our engineering projects in due time and with sufficient margin and to continue operating our assets efficiently.

From 2013 onward, our investment plan will be reflected practically in its entirety in the income statement, once all assets currently under construction go into operation. The objective we have set for that time is to reach €1,500 M in EBITDA, which means doubling 2009 figures. And not only is EBITDA important, but also its corresponding composition and risk profile: approximately 30 % will come from Engineering and construction, 40 % from Concession-type infraestructures, and 30 % from Industrial production.

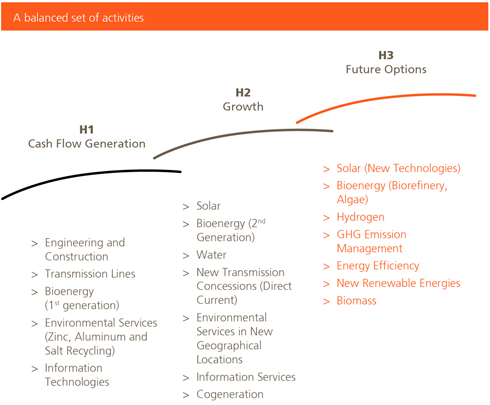

In short, 2010 was yet another year of accomplished objectives, and 2011 should prove to be another year of fresh opportunities. Our goals for the new year in terms of our three-horizon model will be to continue optimizing our cash generating activities, keep investing towards the consolidation of our businesses in high-growth sectors, expand future options and explore new ones. And all of this will take place around the focal point of technological innovation.

This is reflected in our three horizons described below.