Abengoa

Abengoa

Annual Report 2009

Report from the Chairman

In spite of the economic context, 2009 was a good year for Abengoa. Revenues totaled €4,147 M, up 10 % on 2008; gross flows increased 46 %, to €916 M; EBITDA increased 39 %, to €750 M; and net profit rose 21 %, to €170 M.

For the fourteenth year in a row, that is, since Abengoa was listed on the stock exchange, we have achieved a profitable double-digit growth rate as a product of concentrating our efforts on high-growth businesses that offer innovative solutions for sustainability and our focus on geographical diversification. And we are convinced that we will manage to do this again in 2010 in light of the fact that we ended 2009 with our highest backlog ever, totaling €7,655 M, including the construction of solar power plants recently entered into the renewables registry in Spain.

This year we promoted, together with eleven other organizations, the creation of the Desertec Project, the goal of which is to meet 15 % of the demand for electrical power in Europe, as well as a substantial portion of northern Africa and the Middle East, through solar thermal plants and other renewable energy sources by the year 2050. We are also helping to enhance electrical power grid efficiency and security by improving generation, distribution and consumption control (Smart Grid).

Three high-growth businesses related to sustainable development – Solar, Bioenergy, and Water –, together with the main Industrial Engineering and Construction businesses, obtained substantial increases in revenue and profitability with respect to 2008. This has helped to compensate the weaker performance of businesses affected by the drop in industrial activity in Europe, fundamentally in Metal Recycling, and specific Industrial Construction activities in Spain:

- Our Solar business brought in revenues totaling €116 M, up 78 %, and gross cash flows increased 80 %, for a total of €73 M. This business continues to show a high rate of growth with virtually no impact from the present economic situation, witnessing only a delay in starting up certain projects due to a slowdown in reaching financial closure.

- Bioenergy revenues totaled €1010 M, up 22 %, and cash flows from operating activity increased 69 %, with the figure totaling €188 M. Operational start-up of the San Roque (Spain) and Lacq (France) plants, in addition to the gradual margin recovery in the United States and higher sugar prices in Brazil, were the factors contributing to this year’s significant improvement in profitability.

- In Environmental Services, revenues dropped 17 % to €722 M, and gross flows showed a 25 % decrease, to €119 M. Excluding capital gain on the sale of land in Spain that took place in 2008, the increase in gross cash flows totals 1 %. Nevertheless, evolution varied considerably by business unit. Metal, aluminum and steel mill dust, recycling activities were markedly affected by the economic crisis in the construction, automobile and capital goods industries in Europe. In contrast, the performance of the water sector business was extremely positive as a result of the process of internationalization involving this activity in recent years. In 2009 we continued to execute four major desalination plants in Algeria and India, and we closed financing for our first desalination plant in China. As a result, revenues deriving from activity in the water sector rose 29 %, to €285 M.

- In 2009, revenues from our IT business totaled €759 M, up 9 %, and gross flows increased 113 % for a total figure of €173 M. These gross flows include the capital gain on the sale of Telvent shares that took place in 2009, which leaves Abengoa with a shareholding interest of 40 %. Through this partial divestiture, we attained additional resources for growth in other areas, while continuing in our commitment to Telvent’s progress by seizing synergies with the other businesses.

- In Industrial Engineering and Construction, revenues increased 29 %, to €2,576 M, and gross flows rose by 54 %, for a total of €363 M. The evolution of this business varied quite significantly by geographical area and sector. Renewable power plant construction, for Abengoa as well as for third parties, has continued to show a substantial growth rate. Electrical power line construction and operation in Latin America also showed a favorable evolution as the product of maintenance and growth in the line construction plans in various countries in this region. However, several of the industrial electrical installation construction businesses, particularly in Spain, were affected, just as we anticipated, by the downswing in industrial investment.

By geographical location, we saw tremendous growth of our business in regions such as the United States, Latin America and, with the exception of Spain, Europe, drastically mitigating the moderate drop in the Spanish market. Consequently, in consolidated terms, Spain now represents only 31 % of Abengoa’s revenue, whereas the remaining activity is divided among Latin America, 28 %; the United States, 14 %; Europe (excluding Spain), 15 %; and other countries, 12 %.

Attainment of these results, in a year as difficult as 2009, represents, undoubtedly, a tremendous achievement. However, fulfillment of the strategic objectives that had been set for the period was even more important for Abengoa, and this has us positioned to continue growing in a profitable manner in the future:

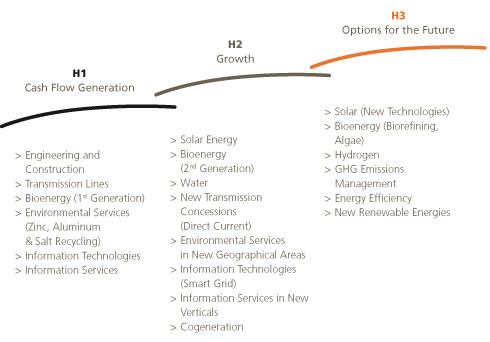

1. We drove down our costs as planned, especially in Horizon 1 (mature) businesses, some of which have decreased their activity. This has enabled us to improve operating margins in practically all of our businesses, and lower comparable overall expenditure by 3 %. This is what we call “earning the right to grow”, by making sure that mature businesses continue to generate cash flow and profits that we may reinvest in other growing businesses.

2. We invested more than €2,000 M in 2009, primarily in Horizon 2 (growing) businesses, utilizing €1,200 M of non-recourse project debt and €800 M in corporate assets. This investment will enable us to grow by starting up projects currently under construction in 2010 and 2011.

3. We stepped up our R&D&I investment with a total of €90 M, up 7 % on 2008. As a result of this investment, Abengoa has applied for 54 new patents in its different businesses, which is a reflection of the success and potential of our new technologies and the importance we attach to Horizon 3 (future) businesses. Specifically, we believe that our forward-looking businesses (new solar technologies, new biofuels, hydrogen, emission management, energy efficiency, and new renewables) will afford us long-term growth.

4. We optimized our cash-flow management, which has enabled us to keep net debt at what we consider to be a reasonable level. Net debt, excluding non-recourse financing, at year-end 2009 totaled €1,257 M, 1.8 times our EBITDA. Total net (recourse and non-recourse) debt, excluding that which is tied to projects that have yet to go operational and which therefore still do not generate EBITDA, totals €1,818 M, 2.4 times our EBITDA.

5. We maintained investment in developing and training our team of professionals through over a million hours of training for the more than 24,000 members of our organization, which represents 11 % more than in 2008.

6. We continued our international scholarship program. In 2009, 575 grant holders have had interships in Abengoa’s business groups, which represents 7 % more than in 2008.

7. Following successful completion of our first greenhouse gas inventory, we continue working in this direction, progressively improving the quantification of our emissions and the implementation of our product labeling.

In addition, with the aim of continued assurance of the reliability of the financial information prepared by the company, we have continued to reinforce our internal control structure, voluntarily adapting it to the requirements specified under the U.S. Sarbanes Oxley (SOX) Act, which is helping us to grow with solvency and security. Once again this year, we sought to submit the internal control system of our entire group on a voluntary basis for independent assessment conducted by external auditors in accordance with the PCAOB Auditing Standard.

We also moved forward in our commitment to transparency and good governance practices; our annual report now includes six independent verification reviews prepared by external auditors on the following: Annual Accounts, SOX Internal Control System, Corporate Social Responsibility Report, Greeenhouse Gas Emissions Inventory, Corporate Governance Report, and Design of the Corporate Governance Report, and Design of the Company’s Risk Management System.

Finally, we continued to strengthen our commitment to the social and cultural development of the communities where we operate, paying particular attention to people with disabilities and the underprivileged. All of this takes place through the program of Corporate Social Responsibility we conduct through the Focus-Abengoa Foundation, where investment in this area in 2009 totaled more than €8 M, in addition to a €23 M investment in the Velazquez Center.

Our desire to share Abengoa’s culture and values with our stakeholders in a receptive and transparent manner and to integrate stakeholder perspectives into the company, has compelled us to develop a procedure enabling us to report on the performance in the realm of corporate social responsibility of the more than one hundred and fifty companies which, through their activity in seventy seven countries, make up Abengoa. This system brings together the company’s social, environmental and economic information. Furthermore, all data have been reviewed externally by an independent verifier with a reasonable level of assurance, which thereby authenticates the reliability of the information we disclose.

Our forecasts for 2010 are favorable. We expect to show growth in revenue and profitability in line with the results obtained in recent years. This will be made possible through the optimization of existing businesses, the rollout of investments initiated in the last few years, and start-up of several new projects:

- Our Solar business will bring four power plants into operation in 2010, for a total of 300 MW – three 50-MW parabolic trough technology plants located in Spain, and a gas-solar hybrid plant in Algeria. We also hope to start building several of the ten new 50-MW solar plants that entered into the Compensation Preallocation Registry (solar tariff) in Spain and which, therefore, already have the required construction permits. Work on several of these plants will involve collaboration with business partners, including the multinational electric utility E.ON, with whom we are already building two solar power plants in Écija (Spain).

- Our Bioenergy business will operate the plants we started up in 2009, and the plant located in Holland, as well as the two in the United States, which were under construction until now, will all enter into operation. In addition, we will finalize several significant investments for improving our Brazilian plants. This will result in the culmination of our first-generation biofuel investment plan.

- We expect to see partial recovery in Environmental Services of the recycling businesses that were affected by the downslide in industrial activity in Europe, and we anticipate further growth in the Water sector. In 2010 we will begin operating the desalination plant in Chennai (India), start up the desalinating plant in Tenes (Algeria) and continue building the Qingdao (China) plant.

- In our IT business we anticipate a very favorable evolution in the electricity market, where the products associated with intelligent electrical power grids, or Smart Grids, are proving their tremendous potential. In other sectors investment evolution in major corporations and public administration will be a key factor.

- In Industrial Engineering and Construction we anticipate significant activity deriving from contract wins in 2009 for transmission lines in Latin America, generation plants, and new solar plants. Some of the smaller businesses dependent upon industrial activity in Spain will continue to obtain results falling below the historical trend.

Therefore, our biggest challenge in 2010 will not only be to maintain our activity and profitability, and to design projects geared towards growth, but also to finance the major projects Abengoa has generated. In markets with a tremendous potential, including solar power, biofuels, water and electrical infrastructure, each year we promote countless opportunities that have enabled us to invest billions in a profitable manner. Specifically, in 2009 we won tenders and culminated project promotion that will represent an investment of around €5,000 M, and most of this amount has not yet been reflected in the backlog figure. In 2010 we will thus continue to analyze and execute, assuming conditions are propitious, several financing options that will enable us to keep creating value through these new projects. As these projects are financed over 2010 and 2011, we shall secure profitable growth for the coming years.

For all of the reasons above, we recently issued two types of corporate bonds, thereby demonstrating that Abengoa can gain direct access to capital markets, and we signed partnership agreements to develop projects through joint initiatives undertaken with third parties. Fortunately, we have a considerable number of projects through which we may create value for our shareholders.

In conclusion, 2009 was a year of fulfilled objectives, and 2010 should be another year of profitable growth for Abengoa, even though the macroeconomic context and financial market situation have yet to add their contribution. Our objectives for the new year are straightforward: to continue optimizing mature Horizon 1 businesses (engineering and construction, recycling, information technologies, and first-generation biofuels), to implement new assets under construction, to finance some of the major new projects (primarily Horizon 2, including solar, water and second-generation biofuels), and to uphold our commitment to the future through R&D&I, the training and development of our people, and corporate social responsibility.

A balanced set of activities (2010 vision)